Market Brief

Yesterday was a relatively quiet session in spite of Draghi’s quarterly testimony in front of the European parliament. The ECB president reassured market participants stating that “More time is needed to determine in particular whether the loss of growth momentum in emerging markets is of a temporary or permanent nature” adding that more time is also required to determine if more stimulus is necessary. On the data front, yesterday, the Eurozone Markit composite flash PMIs fell slightly to 53.9 from 54.3 in August and below market expectations of 54.2. Freshly released, German’s GfK consumer confidence came in on the soft side with a reading of 9.6 for October, down from 9.9 the previous month and below the median forecast of 9.8. Disinflationary fears are back under the spotlight as the downside risk on inflation builds up, increasing substantially the odds that the ECB will expand its asset purchase program before the end of the year.

In the US yesterday, better-than-expected September Markit flash manufacturing PMI failed to provide support to dollar bulls. The manufacturing purchasing managers’ index came in at 53, remaining unchanged from August, while analysts were expecting a reading of 52.8. EUR/USD is back above the 1.12 threshold this morning, up almost 1% since yesterday. An hourly support lies at 1.1087 (low from September 3rd) and a resistance can be found at 1.1330 (high from September 21st).

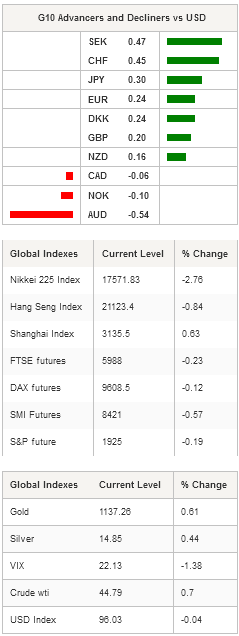

In the Asian session, Japanese equity index opened in negative territory after a 3-day holiday. The Nikkei 225 slid -2.76% as weak manufacturing PMI weighs. September’s flash PMI printed at 50.9 versus 51.2 median forecast and below previous month reading of 51.7. The broader TOPIX index fell 2.42%. USD/JPY is treading water between 119.70 and 120.70. The closest support can be found at 119.06 while on the upside, a resistance lies at 121.33. We remain bullish USD/JPY as disappointing economic data from Japan keep piling up.

Elsewhere in the region, equity returns are mixed with Chinese shares rebounding marginally, the Shanghai Composite and the SZSE Composite up 0.63% and 1.01% respectively. In South Korea, the KOSPI index edged higher 0.13%, while in Hong Kong the Hang Seng fell -0.84%.

As expected (see our Weekly Market Outlook from September 18th), New Zealand’s August trade deficit widened to NZD1,035mn from a revised deficit of NZD726mn in July, while economists were looking for a deficit of NZD850mn. However, NZD/USD moved higher as traders focused on better-than-expected exports (3.73bn versus 3.60bn expected) and an increase in the forecast of milk payout to New Zealand producers. The Kiwi edged slightly higher to $0.6280.

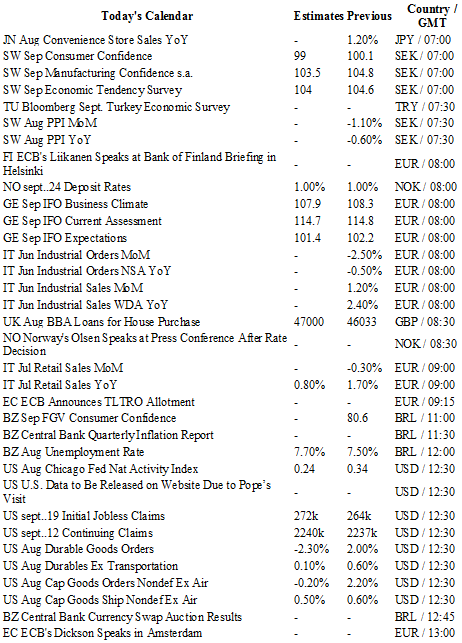

Today traders will be watching the interest rate decision from Norway; the IFO business climate from Germany; retail sales from Italy; unemployment rates from Brazil; Chicago Fed Nat activity index, initial jobless claims, durable goods orders, Bloomberg consumer comfort index, new homes sales and Janet Yellen’s lecture in Amherst.

Currency Tech

EUR/USD

R 2: 1.1561

R 1: 1.1330

CURRENT: 1.1215

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5276

S 1: 1.5165

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.95

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9750

S 1: 0.9513

S 2: 0.9259