Market Brief

USD/JPY took a breather after hitting 107.67 in the late European session on Thursday. The pair rapidly reversed momentum and returned to around 108.70 as traders wonder whether there is still downside potential after such a debasement. The BoP data showed that Japan’s current account surplus rose for 20 straight months in February, reaching 2.43 trillion yen (versus 2.3 trillion yen median forecast) from 520 billion yen in January due to sustainable improvements in the trade balance and solid income from tourists. However, the recent strengthening of the Japanese yen may eat into part of the extra made by Japanese exporters due to the weakness of the yen. Despite this morning’s consolidation, the bias remains on the downside in USD/JPY; however the yen will need a fresh boost to clear the 105-106 support area. If broken, the road towards 100 will be wide open.

In Switzerland, the unemployment rate fell to 3.6%, matching forecasts, down from 3.7% in February. However, the seasonally adjusted measure rose to 3.5% in March from 3.4% in the previous month, suggesting that the Swiss economy continues to suffer from franc strength. Indeed, the unemployment rate rose from 2.9% (s.a.) in 2012 to 3.5% in March 2016, while the unemployment rate in the eurozone fell to 10.3% from 11.4% over the same period. EUR/CHF stabilised at around 1.0875 after hitting 1.0843 yesterday, its lowest level since early March, as ECB members reiterated that the European Central Bank will do whatever is needed to return inflation to target. Upside pressure on the Swiss franc has increased substantially since the beginning of the year as markets wait for the ECB to pull out the bazooka again.

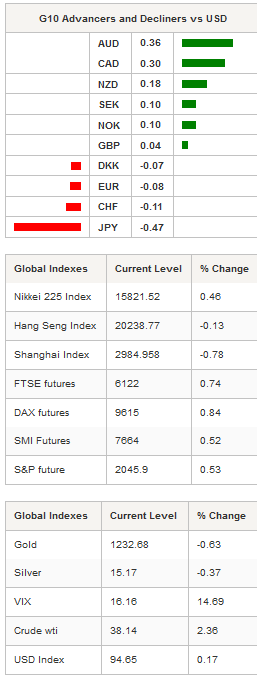

In the commodity complex, the recovery in crude oil prices helped the Aussie, the loonie, the kiwi and the NOK to reduce yesterday’s sharp losses. AUD/USD hit 0.7550 in Sydney after failing to break the 0.75 support area. However, we believe it is just a matter of time before the pair tests the 0.7477 support (low from March 24th) once again and break to the downside. USD/CAD is also erasing yesterday’s gains as the CAD gained 0.30% against the USD dollar with the pair down to 1.31 after hitting 1.3181. Overall, the market has not switched to risk-on but is rather consolidating after yesterday’s sharp moves.

Equity returns are mixed this morning with most of Asian regional markets blinking red across the board, with the exception of Japanese markets. The Nikkei and the Topix indices were up 0.46% and 1.18% respectively. Mainland Chinese shares moved lower with the CSI 300 index down 0.73%. In Hong Kong the Hang Seng slipped 0.13%. Finally, in Europe, futures are pointing towards a higher open with futures on the Euro Stoxx 600 up 0.60%.

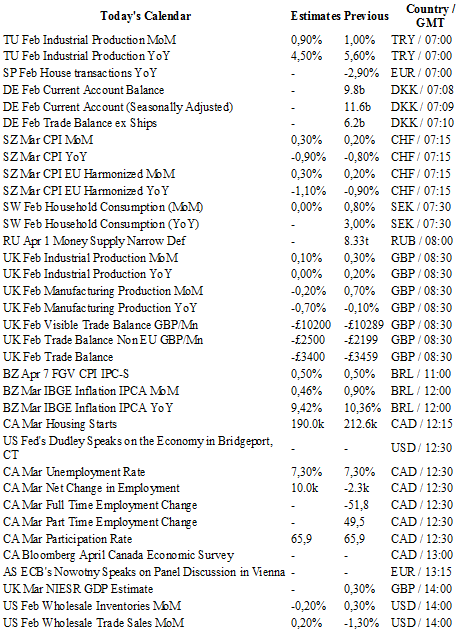

Today traders will be watching the CPI report from Switzerland; industrial production, manufacturing production and trade balance from the UK; IBGE inflation from Brazil; housing starts, unemployment rate and participation rate from Canada; wholesale inventories and Fed Dudley’s speech from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1495

CURRENT: 1.1361

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4591

R 1: 1.4459

CURRENT: 1.4073

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 113.80

R 1: 112.68

CURRENT: 108.87

S 1: 107.61

S 2: 105.23

USD/CHF

R 2: 0.9913

R 1: 0.9788

CURRENT: 0.9572

S 1: 0.9476

S 2: 0.9259