Global stocks remain on the back foot, pressured by crude oil tumbling into a ‘bear’ market on concern a global supply glut will persist.

The weakness in crude and other commodities is denting the Fed’s argument that weak inflation rates will be transitory, despite the domestic economy showing any signs of distress. Fixed income dealers are facing a ‘bull’ flattening U.S treasury yield curve.

The yen is heading for its longest winning streak in nine-weeks, while gold continues to climb from its one-month low.

In the U.K, investors are watching the divorce proceedings with the E.U. PM May heads to Europe for her first summit since the recent election and will outline her approach towards E.U nationals before publishing a detailed plan next Monday.

Note: Fed Governor Powell speaks at a hearing of the Senate Banking Committee in Washington.

1. Stocks under pressure from commodities

Battered oil prices hovering near seven-month lows on worries about a supply glut and falling demand is taking its toll on global equity indices.

In Japan, the Nikkei ended a tad lower as a stronger yen (¥111.12) took a toll on sentiment. The broader Topix fell -0.1% after fluctuating throughout the session.

Down-under, Australia’s S&P/ASX 200 Index jumped +0.7%, after tumbling -1.6% in the previous session to erase all of this years gains.

In Hong Kong, the Hang Seng was little changed as investors ponder the potential impact of MSCI’s decision to include more mainland China stocks in a key benchmark index.

In China, the Shanghai Composite Index slipped -0.3%, after climbing yesterday on MSCI Inc.’s decision to include mainland shares in its indexes. The CSI 300 Index has erased almost all of its +1.3% gain.

In Europe, regional indices have fallen for a third consecutive day as battered oil prices hover atop of its seven-month lows hit. The U.K’s FTSE 100, Germany’s DAX and France’s CAC 40 have all slipped -0.3-0.4%.

U.S stocks are set to open in the ‘red’ (-0.1%).

Indices: Stoxx600 -0.5% at 387, FTSE -0.6% at 7406, DAX -0.4% at 12729, CAC-40 -0.6% at 5241, IBEX 35 -0.8% at 10651, FTSE MIB -1.0% at 20867, SMI +0.3% at 9017, S&P 500 Futures -0.1%

2. Oil prices slip as physical excess overpowers OPEC

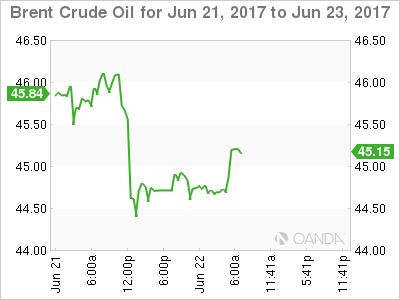

Oil dropped -2% yesterday and is little changed in the overnight session on continued negative sentiment about global market oversupply. Jawboning from Iranian oil officials has had little effect on price action.

Yesterday’s EIA data for crude oil stocks showed a drop last week of -2.5m barrels, coming in more than expected. However, concerns of continued increases in supply continue to outweigh any bullish data.

Brent crude futures are down -15c at +$44.67 a barrel –it fell -2.6% in the previous session to their lowest since November. U.S. crude futures (WTI) are down -14c at +$42.39 a barrel – yesterday, they touched their lowest intraday level since August 2016.

Since peaking in late February, crude has dropped around -20% in the wake of the initial OPEC-led production cut.

Note: OPEC and non-OPEC oil producers’ compliance with the output deal reached 106 percent in May. However, a number of producers – notably Iraq, Saudi Arabia and Russia – aggressively ramped up output in the run-up to the deal.

Ahead of the U.S. open, gold prices have rallied (+0.5% to +$1,252.41 per ounce) for a second consecutive session as risk averse sentiment amid weaker oil prices drives up the demand for the metal, with a softer USD and weakness in U.S. Treasury yields also lending support.

3. Yield’s ‘bull’ flattener

Subdued inflation and concerns about the outlook for global growth as the Fed raises rates has triggered a flattening in bond yield curves.

The gap between yields on U.S 5-Year notes and 30-Year long bond has flattened to +95 bps, holding atop its narrowest in a decade.

Note: A flatter curve suggests that both dealer and investor have concerns about the future pace of both growth and inflation.

Treasuries had a low impact session Wednesday, with little volatility in a choppy market. 10-Year yield are flat in the overnight session, just over +2.15%, while the 10-year/30-year spread curve continues to flatten reaching +56.7 bps, bringing the 30-year lower to 2.72%.

Yesterday, Philly Fed President Harker argued for a “pause in rate policy” in the months ahead as the Fed implements its balance sheet unwind. Harker believes a pause would be prudent, citing business owners telling him that they are “feeling real pressure for wage increases given the strong jobs market.” He expects inflation will eventually assert itself.

Note: In April, Fed’s Dudley (dove, FOMC voter) also made the case for a “little pause” in rate hikes when the Fed starts reducing bond holdings on the balance sheet, to avoid simultaneous policy moves.

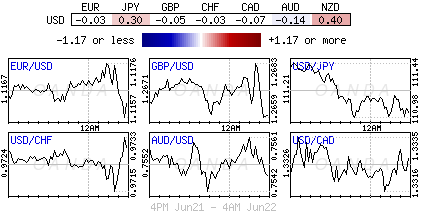

4. “Big’ dollar little changed

The USD remains steady against the major currencies (€1.1166, £1.2655 and ¥110.10) in relatively quiet trading.

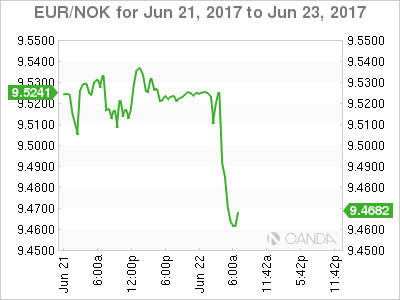

The NOK currency was the main focus after Norway’s Central Bank (Norges – see below) removed its “easing” bias. Norges now sees the Deposit Rate at current level going forward. EUR/NOK has fallen from €9.51 to test below €9.47 before consolidating.

Note: Policy officials had previously leaned towards more rate cuts if needed.

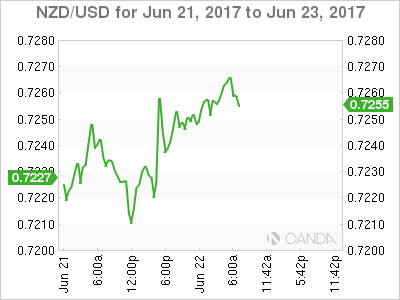

Elsewhere, the NZD has gained +0.5% to NZ$0.7257 after the Reserve Bank of New Zealand (RBNZ) yesterday held official cash rates at record lows, but sounded less ‘dovish’ than bears in the market had been banking on.

5. Reserve Bank of New Zealand (RBNZ) and Norges decisions

Yesterday’s RBNZ statement provided little foreign exchange rate jawboning and a positive growth outlook.

Kiwi officials left the overnight benchmark at +1.75% as expected. Governor Wheeler Graeme cited “numerous uncertainties” locally and globally that would keep the central bank cautious.

In Europe, Norway’s central bank (Norges) left its deposit rate unchanged at +0.5% as expected. The decision was unanimous and the rate is likely to be at current level in period ahead – removed the easing bias – and reiterated their view that forecasts are little changed from March.

Inflation is lower than expected and may continue to drift down in the months ahead as low domestic cost growth is weighing on inflation.