My recent post about risk appetite (see It's the risk appetite, stupid!) generated a number of thoughtful reader responses. They mostly went something like: "I have done similar forms of inter-market analysis as yours and my results show..."

The results were varied, but they were suggestive of a flat range-bound market rather than the correction that I have been looking for in the past several weeks. I am therefore contemplating an alternative scenario where stock prices stay flat in a choppy trading range and this post is mainly an exploration of that possibility.

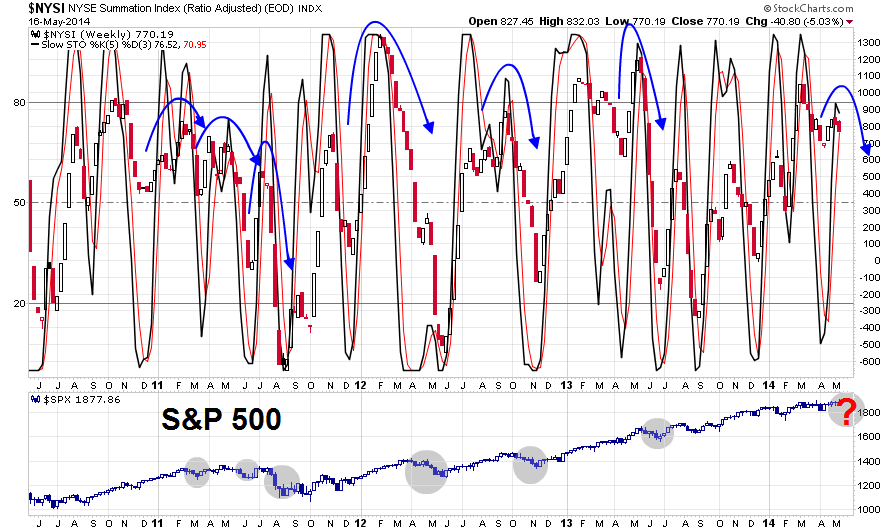

Indeed, the SPX has been trading in a relatively narrow range since early March and has frustrated both bulls and bears alike. Longer term, however, the index remains in an uptrend.

The market cycle framework

I decided to formalize my approach by using the technique used by New Deal Democrat at Bonddad Blog in his weekly reports on the economy. NDD separates his reports into different dimensions of short and long leading indicators and coincidental indicators indicators. My framework uses the market cycle technique that I described in my recent post The bearish verdict from market cycle analysis. I won`t repeat myself, but here is the basic framework of analysis:

Early cycle: The economy is in recession or on the edge of a recession. In response, the central bank stimulates the economy with low interest rates (or unconventional policy). As a result, stock begin to rise, led by interest sensitive sectors, such as Financial and housing related stocks.

Mid cycle: Some analysts split this part of the cycle into several pieces, but here is roughly how market expectations change. The economy gets better, or is perceived to get better. More jobs are created and consumers have more money to spend. Corporations find that they start to get capacity constrained. They respond by hiring more people, which leads to a virtuous cycle of more consumer spending, and buy more capital equipment. During this part of the market cycle, Consumer Discretionary, capital equipment sensitive sectors like Technology and Industrial stocks lead the market higher.

Late cycle: The economy starts to overheat and inflation starts to tick up. At this point, inflation sensitive commodity related sectors like Energy and Materials start to outperform. The central bank responds to rising inflationary pressures by raising interest rates, which leads to...

Bear phase: The stock market falls because of the expectations of higher interest rates and falling growth. Defensive sectors such as Consumer Staples, Utilities and Healthcare outperform during this phase.

Here is the most important caveat of this form of analysis:

I am describing a market cycle and not an economic cycle. Realize that this framework is based on technical analysis and not economic analysis. A market cycle behaves like an economic cycle, but it only describes the market response to expectations, not the actual economic result. As an example, the economic cycle started at the trough of the Lehman Crisis in 2008-09, but I believe that the market cycle actually began in late 2011, when the markets got over the trauma of the debt ceiling impasse in Washington and the ECB acted to relieve the pressures of the eurozone crisis with its LTRO program.

As the market cycle evolves, the leadership baton gets handed from one sector or group to another. I will not beat a dead horse and talk once more about why I think stocks are going to correct. Rather, I would like to focus mainly on what is going right.

To review what is happening, early cycle sectors like financials and homebuilding stocks have rallied but have faltered. Consumer oriented mid-cycle sectors like the Consumer Discretionary sector have also weakened, though the corporate mid-cycle names have wobbled and their leadership position is shaky. Meanwhile, late cycle (Materials and Energy) and defensive sectors (Utilities, Consumer Staples and Telecom) are all turning up.

Indeed, the relative performance of equities (SPDR S&P 500 (ARCA:SPY)) to the US long bond (iShares Barclays 20+ Year Treasury (ARCA:TLT)) is suggestive that equity performance is losing steam.

Cyclical stocks are the key

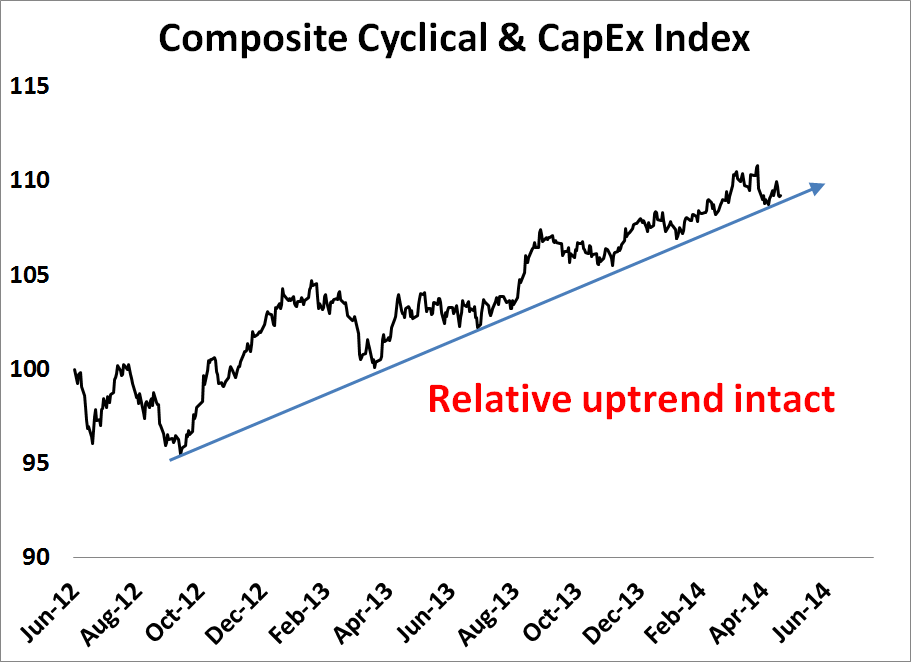

When I examined the bull case, I did find some pockets of strength. Notably, the mid-cycle cyclical and capital goods sectors of the market are still holding up relatively well. As an example, the Dow Jones Transportation Average made a new high last week, as did the Dow Jones Industrials Average - Dow big signal.

When I boil it all down, it comes down to the performance of the cyclical sectors. If I had to watch one chart as a key "tell" for the market, it would be the relative performance of the (Morgan Stanley Cyclical Index) against the market. As the chart below of the CYC/SPX ratio shows, cyclical stocks remain in a wobbly relative uptrend. Depending on how you draw the trend line, this ratio has either violated the relative uptrend or has experienced minor violations of the relative uptrend.

In short, the choppy range-bound market would be the result of a battle between the negative technical factors (see A case of risk exhaustion?, Interpreting a possible volatility regime change, Should you sell in May? and The bearish verdict from market cycle analysis) and optimism about the cyclical effects of CapEx spending, which provides the hope for the next round of earnings growth.

Risks skewed to the downside

In the meantime, many concerns have been expressed about the health of this equity bull. Josh Brown went to the SALT Conference and outlined the Things You Don’t Want To See about this market:

Lots of people are talking about the Things You Don’t Want To See if you’re very long risk assets like stocks and corporate bonds right now. They are all happening at once:

- Collapsing home builder stocks and fading real estate data.

- A US dollar on the verge of ripping to the upside.

- Treasury bonds refusing to back down, nudging their way higher daily.

- A deteriorating number of new highs for individual stocks as the indices flirt with record levels.

- Influential managers who’ve been bullish for most of the rally starting to turn cautious (Einhorn, Cooperman, Tepper, etc)

- Stalling earnings growth.

- Defensive stock leadership

- Huge divergence between small caps and large caps.

Veteran technical analyst Ralpha Acampora was reported to have a "sick feeling" about this stock market. He believed that the downside for the NASDAQ and Russell 2000 is 20-25%, though the projected downside for the S&P 500 between now and October is only 10%:

“The last time I saw anything like this was in 1994, when the Dow and the SP 500 were in a 10% trading range all year, and then under the surface they were just ripping them apart. I have a sick feeling that we might be doing that again,” he said.

In the end, I would tend to agree with the sentiment expressed by David Tepper in a recent interview:

I'm not saying go short. Just don't go too friggin long.

There are really two scenarios to consider for the summer months. Either stock prices correct or they remain in a choppy trading range.

In either case, the upside is limited and the risks are skewed to the downside. So just don`t go too friggin long.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.