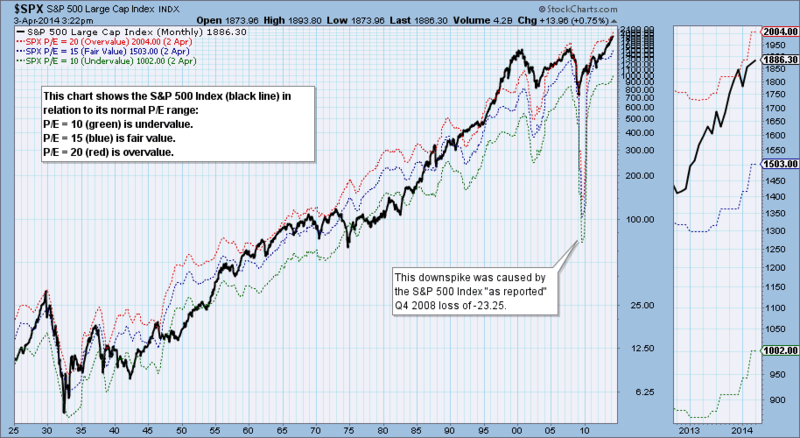

In a recent post, Carl Swenlin calculated the trailing GAAP P/E ratios of the S&P 500. He used a simple rule of thumb—the market is undervalued at a P/E of 10 and overvalued at 20. Based on that simple metric, he declared that the market is vulnerable to a pullback because valuations are nearing the top end of the historical range of a P/E ratio of 20, which would amount to an SPX level of about 2000.

Does that mean that stock prices are about to roll over and play dead? Not necessarily. What the bull market needs to keep going is the E in the P/E ratio to expand. The US is in the mid-cycle of an expansion and what typically happens mid-cycle is an acceleration in capital expenditures. Josh Brown eloquently summarized this point of view in a TV interview here.

To put Brown's comments into my own words, the economic doctors at the Fed have decided that the patient is stable and ready for the gradual withdrawal of the heavy cocktail of stimulus drugs being pumped into his system. Soon, he will be recovered enough to start walking on his own. One of the key signs of a true recovery is sufficient business confidence to start investing more into their own operations.

That's why, this Earnings Season, I will be carefully monitoring the tone of the guidance from capital goods giants such as General Electric (NYSE:GE), Caterpillar (NYSE:CAT) and so on.

Waiting for Godot?

Unfortunately, waiting for the capex cycle to revive itself during this economic recovery has been like watching Waiting for Godot. Larry Fink recently complained about the lack of capital expenditures among American companies:

Laurence Fink, chief executive officer of Blackrock Inc., the world’s largest money manager with more than $4 trillion in assets, recently issued a warning to U.S. companies: Stop focusing on short-term returns at the expense of longer-term investments.

“It concerns us that, in the wake of the financial crisis, many companies have shied away from investing in the future growth of their companies. Too many companies have cut capital expenditure and even increased debt to boost dividends and increase share buybacks.”

Fink complained that companies were overly focused on spending cash on buybacks and dividends rather than investing in their own businesses:

Companies only have a finite amount of cash to invest. Whatever gets spent on buybacks and dividends is that much less available to be spent on investments in employees, research and development, and capital expenditure. It's basic arithmetic.

When will the next round of capital investment begin in earnest? As soon as you figure out the answer to that question, you will have gained significant insight into the direction of the economy as well as the next phase of this stock-market rally.

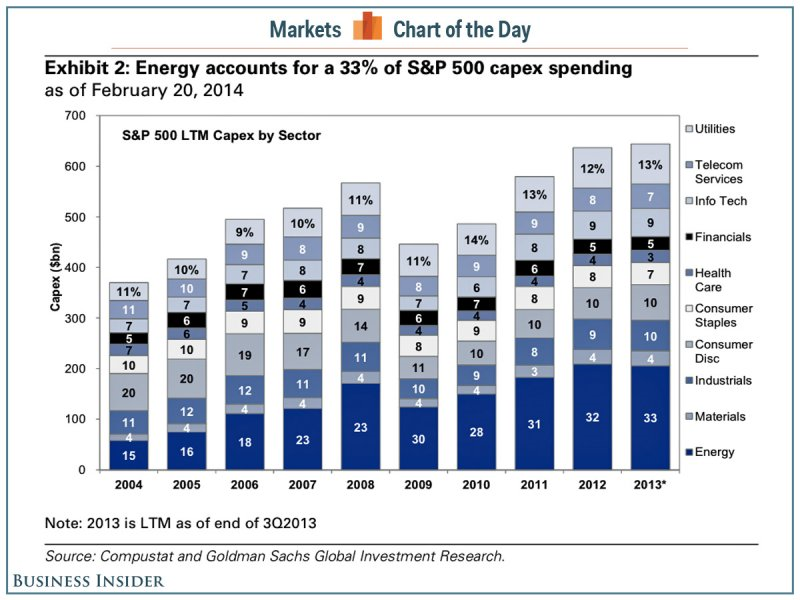

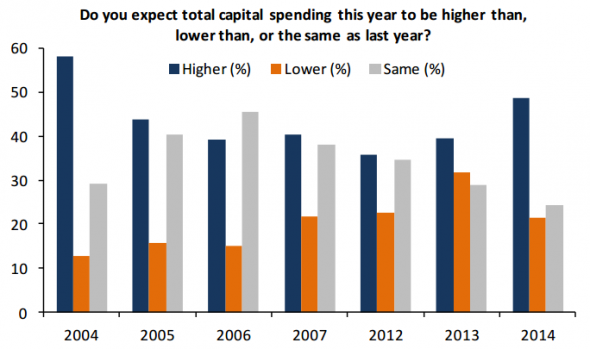

The following chart (via Business Insider) of capex by sector provides some perspective to the puzzle and also raises some interesting questions.

The key question is, "Why?" Unfortunately, the answer to this question is way above my pay grade (see my previous discussion here).

Capex bulls roam the Street

Cardiff Garcia of FT Alphaville pointed out that the Street remains optimistic that an upturn in capital expenditures is just around the corner. RBC noted that the corporate intentions are supportive of an upturn in investment spending:

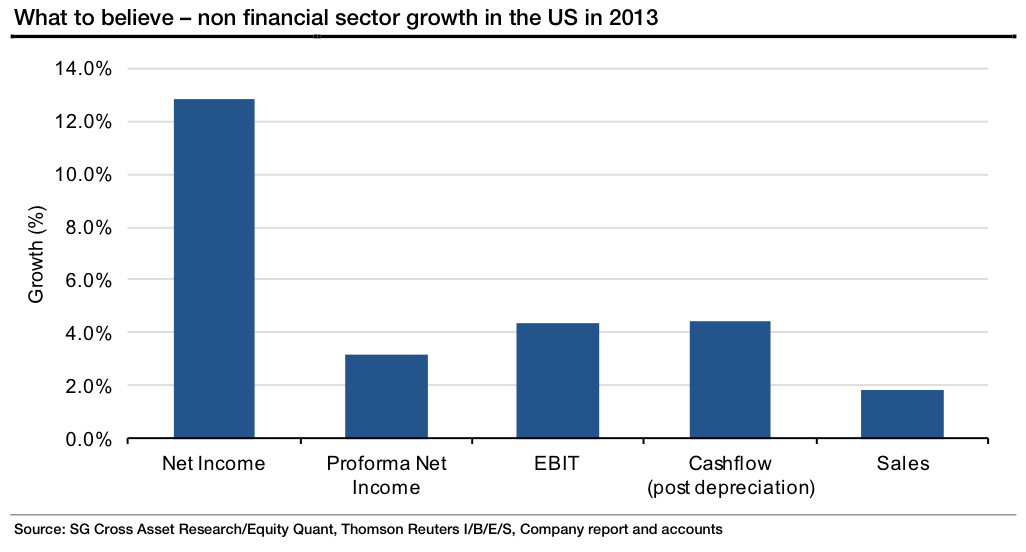

Andrew Lapthorne: Capex bear

"Looking behind these headline numbers we see that the biggest increase in reported net income in 2013 came from Hewlett Packard," noted Lapthorne. "This improvement was courtesy of the large 2012 $19bn goodwill write-down (from the EDS and Autonomy acquisitions) dropping out of the 2013 figures. Indeed if we compare the biggest positive contributors to reported net income the list is very much different to the pro-forma net income figures. The top 10 biggest positive net income contributions are dominated by companies affected by write-downs in 2012."

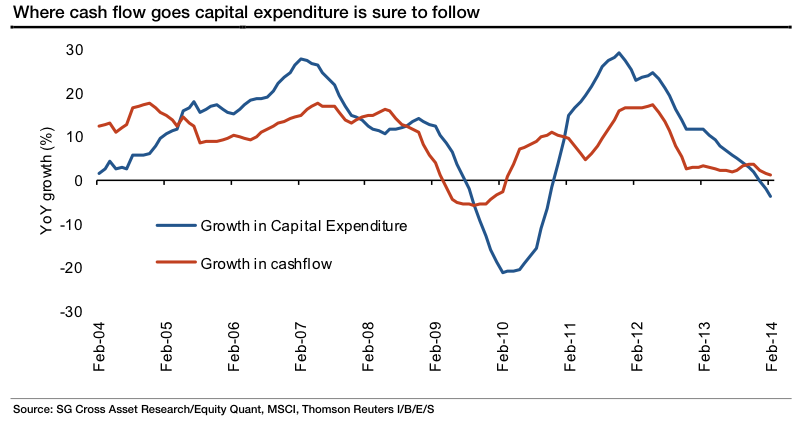

He concluded that cash flows may not be supportive of a capex expansion in the near term:

Capital-investment expectations held nearly steady from the prior quarter at a 6.5% gain, but were below year-earlier levels. Sales expectations for the next 12 months did advance to 4.6% in the first-quarter survey, from 4.1% the prior quarter.

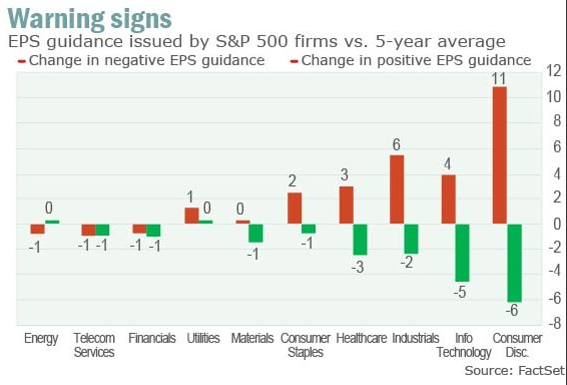

In addition, analysis from Brian Belski of BMO (via Marketwatch) shows that the Consumer Discretionary sector showed a high level of negative guidance, which creates capex headwinds for a sector that has lagged its historical pace of corporate investment. As well, capital goods sensitive market segments such as Industrials and Technology were the next two sectors that showed the highest levels of downward guidance.

What does Mr. Market think?

On the first score, Mr. Market is signaling asset inflation. The relative performance of the inflation-sensitive Energy sector (via the SPDR Energy Select Sector Fund (ARCA:XLE)) is starting to turn up:

At a crossroad

Who will win this argument?

I am not sure. That is why it is important to closely monitor the tone of the capital goods companies' upcoming earnings reports. Either capex intentions live up to expectations and the bull market continues to charge ahead to further new highs, or we see disappointment. In that case, the relative performance of XLI and CYC would roll over - which will be a signal that the bears have taken charge of the tape.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.