We thought we might recap for you what we have been sharing since the beginning of the year:

- We experienced a positive start to the stock market from the beginning of 2023.

- We saw a January Trifecta and that tends to forecast a positive year in the markets (As goes January, so goes the year).

- The Kansas City Chiefs won the Super Bowl. Historically when an original AFC team is the victor, the returns for the stock market are less than if an original NFC team were to win. Nonetheless, the average return after an AFC win was approximately 7.9%

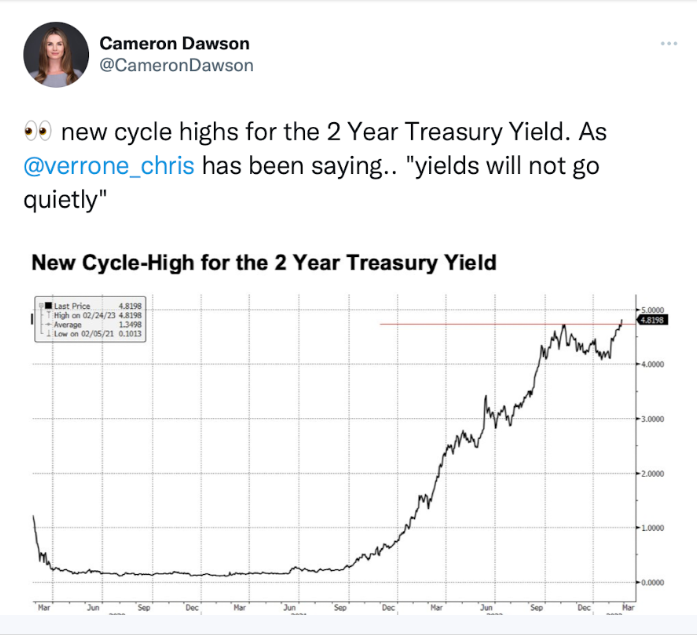

- The U.S. Dollar’s early-year decline, along with trending lower interest rates (on the United States 10-Year Treasury) provided a tailwind to the markets since October 2022.

- Chairman Powell’s comments that the Fed was seeing “disinflation” led to a continuation of the stock and bond market rally into early February.

- A small 25 basis point Fed rate hike in early February gave investors hope that there will be a pivot later in 2023 (we have continued to say “no way”).

- High-yield bonds were catching a bid and showing positive signs of resurgence until recently.

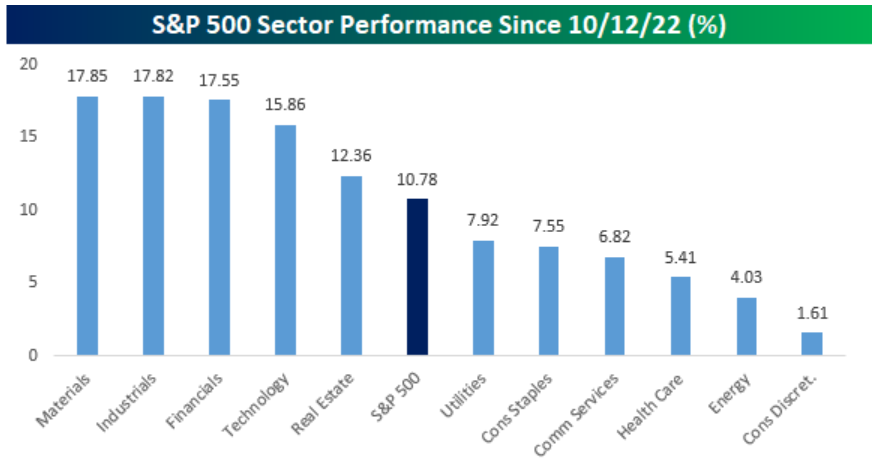

- Since last October (the 2022 market bottom), the sector leadership of the S&P 500 has been those sectors that were hurt the most during the first 9 months of 2022. See below:

- After hotter-than-expected CPI and PPI numbers two weeks ago, we cautioned you to watch interest rates closely (break out higher in the yield curve) and the U.S. Dollar (reversing trend).

We also suggested investors be prepared for a hotter release on forthcoming PCE inflation numbers. All of these, we cautioned, would be negative for the stock market. We were spot on.

- We mentioned that the S&P 500 was sitting in a precarious position and could go either way. This index is still perched right on the precipice of the 200-day moving average.

- Strength in the markets (as represented by the number of stocks above the 20-, 50- & 200-day moving averages) has begun to stagnate (Nasdaq 100, NYA, and Russell 2000), and it has already begun a decline in other markets (S&P 500 & Dow Jones Industrial Average). This is negative for the market in the near term.

- Inflation is persistent and is not likely to come down anytime soon.

The Fed’s Preferred Inflation Gauge - the PCE

On Friday, the much-anticipated report came out at 8:30, and like we said in last week’s Market Outlook… SURPRISE!!!

The PCE (Personal Consumption Expenditures) rose fastest since last June. This was an alarming sign that price pressures remain high in the U.S. economy and could lead the Federal Reserve to keep raising rates well into later this year.

This was not helped in the past two weeks by several Fed Governors indicating that they wished the committee had raised rates by 50 basis points instead of 25 basis points at the early February Fed meeting.

Friday’s report from the Commerce Department showed that consumer prices rose 0.6% from December to January, up sharply from a 0.2% increase from November to December. On a year-over-year basis, prices rose 5.4%, up from a 5.3% annual increase in December.

Excluding volatile food and energy prices, so-called core inflation rose 0.6% from December. This unexpected move was up from a 0.4% rise the previous month. And compared with a year earlier, core inflation was up 4.7% in January versus a 4.6% year-over-year uptick in December.

This was not what the Fed was hoping to see.

And it was certainly not what the stock and bond market expected. Friday, the S&P 500 sold off over 1%, and the tech-heavy NASDAQ was down over 1.7%.

Last week, both Mish and I commented (in our respective outlooks) that inflation can take a long time to decline. We are far from the Fed’s target of 2%.

We have had a consistent mantra since the end of 2021: that inflation can often take years to dissipate. What typically occurs is a lengthy period of stagflation.

Mish has repeatedly said to watch global food prices to identify the major shortages driving global inflation higher. You can see last week’s Market Outlook for a graph of the rising food costs.

Since last March, the Federal Reserve has attacked inflation by raising rates 8 times. 4 of these times were at an unprecedented 75 basis point level.

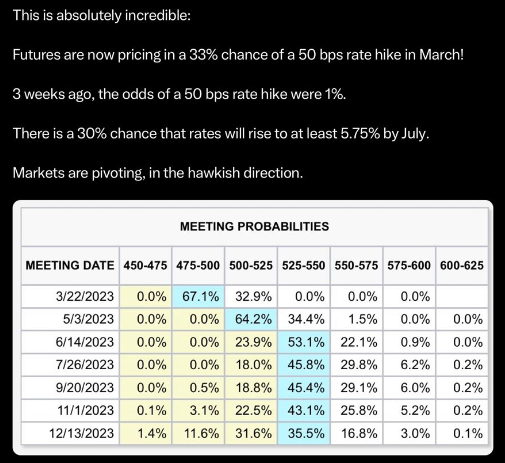

We believe the Fed is not done. In fact, it would not surprise us to see a 50 basis point rise at the next Fed meeting in March and possibly another 75-100 basis points before they stop raising rates. Effectively that would put Fed overnight rates at 5.5%-or even greater.

After Friday’s PCE came in “hotter” than expected, estimates for the next increase (and subsequent Fed potential rate hikes) were ratcheted up considerably. See the chart below:

This week, Jamie Dimon (CEO of JP Morgan) appeared on Mad Money with Jim Cramer. He suggested that we might see rates above 6%. Like us, Jamie described the insidious effect inflation has on all Americans. And, as we reported last week, 64% of Americans live paycheck to paycheck. If food and energy prices edge up even slightly more, many Americans will not be able to make ends meet.

The Effect Rising Rates Have On The Stock Market

For over a year now, we have harped on the notion that investors should “not fight the Fed.” As I have recanted numerous times, I learned this in my first economics class in college back in the 70s. It still holds true today.

Recently, a subscriber asked me, “What are the biggest causes of market corrections or bear markets?”

In many of our Market Outlooks, we have discussed everything from appropriately valuing the markets to the negative impact higher interest rates and slower growth rates can have on market values.

Understand that short-term rallies and sell-offs often occur because of an “overbought or oversold” market where deviations are worked off. We want to spend some time describing the major causes for intermediate to long-term market pullbacks:

- The Federal Reserve is raising rates because of higher inflation. When interest rates rise, economists and analysts begin to revalue market multiples and company growth rates. Typically this leads to lower prices because higher interest rates ALWAYS purposely produce a slowdown in earnings and company growth rates.

When the Federal Reserve is rapidly raising rates as they have during 2022-2023, there is a much higher chance of a “hard landing” or recession (two consecutive quarters of negative GDP). We seem to be headed that way, but folks are hoping we get a soft landing due to the continuing robust employment market. We are not sure this is possible. Chances of a recession increase with every subsequent Fed rate hike.

- Raw materials, labor costs, and input costs for manufacturing are on the rise. Like #1 above, this typically happens because of inflation which is often a result of supply-demand disruptions. We had many of these during and after the Covid pandemic of 2020.

Raising prices (change at the margin) is healthy for companies. However, at some point, consumers either stop purchasing as much of the product, downgrade their quality to a less expensive product, or simply cannot afford it. This has a detrimental effect on stock prices as companies’ revenues begin to slide. We started seeing this in our current earnings season. Several big retailers report this week, and it will be interesting to see how their earnings fare. So far, consumers have held up this market.

- A major change in Economic policy. This can occur because of inflation, as mentioned above, or can be the result of a change in administration bias. Back in the 1970s, tax rates were unusually high (as much as 50% on a federal tax level), and with ongoing inflation, monetary policy became very hawkish. This had a double whammy effect of creating punishing stagflation. It was not until the early 1980s and a significant change in tax policy that real growth started to occur again in the U.S. economy.

- - Geopolitical strife. Sabre (NASDAQ:SABR) rattling between major countries can lead to dislocations in import-export and monetary policy. These hidden disruptors can create potential supply-demand issues and curtail the amount of potential product availability. In the U.S., we have relied heavily on cheap labor from Asian countries. This has helped positively contribute to keeping a cap on technology goods that are imported from these countries. What if this were to stop suddenly?

During Covid, many of these products were unavailable or became scarce (semiconductors as an example) and disrupted our markets to the point that many manufacturers were not able to deliver enough goods. Thus, their growth rates slowed dramatically.

- Resources are ultimately redirected to fighting, attacking, or defending countries. As referenced above under #4, geopolitical strife and the perception of the possibility of engaging in battle can cause a shortage of goods and services. This slows company growth rates and is usually an eventual hit to their stock prices.

Wars in other parts of the world are sometimes enough to cause shortages in the U.S. An investor only needs to look to the current Russia-Ukraine incursion to see the negative effect a war might have on world food prices. There has been a disruption of food staples, including wheat, soybean oil, and other products produced in that part of the world. We do not yet know what effect Russia’s planned pullback in oil production might mean for all important energy prices in the near future.

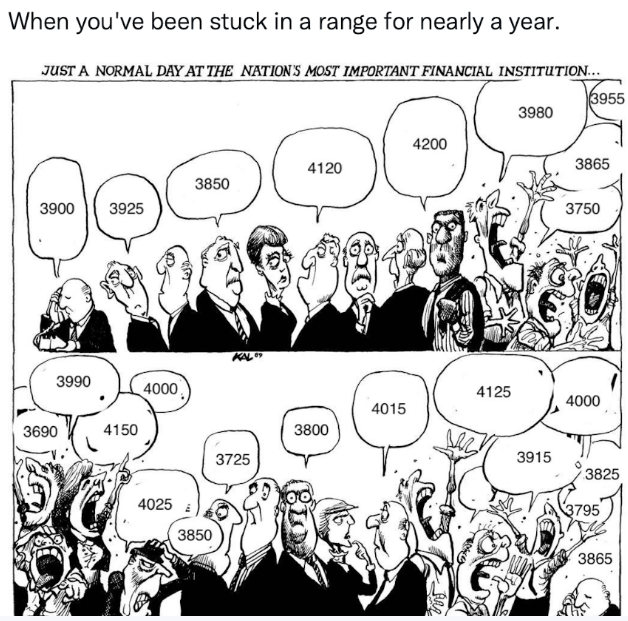

Currently, we are acutely aware that some or all of the above factors are negatively affecting our economy. It is a real possibility that the stock market is in for a range-bound sideways path while rates are still rising (both by the Fed and the bond market). This is something that Mish has written and spoken consistently on national T.V. See a range-bound chart and comic below:

Estimates on future earnings (and the market multiples analysts use) for market pricing are still coming down. It may be hard to get a “real” bull market until interest rates, input prices (food), and other pressures on our economy subside. This may be the only way inflation cools and gets closer to the Fed’s target rate

Risk-On

- Small Cap (IWM) and Mid Cap (MDY) are holding onto their bullish phases and are actually slightly oversold at the moment. (+)

- Even with the selloff this week, 4 of the 6 members of Mish’s Modern Family are still holding onto their Bullish phases for the time being. (+)

Neutral

- 3 of the 4 major indices show relatively neutral volume patterns with the exception of the S&P500 which has continued to weaken and has shown 5 distribution days compared to only 1 accumulation day over the past 2 weeks. (=)

- Risk Gauges remain unchanged week over week and are in Neutral territory. (=)

- Foreign Equities sold off hard across the board and gave up the support of key moving averages, although larger cap foreign equities (EFA) are still outperforming the U.S. market on a relative basis. (=)

Risk-Off

- It was a rough week for the market with all 4 major indices continuing to roll over and the S&P500 closing the week back below its 50-day moving average for the first time since January. (-) and now with a slightly negative TSI

- While the Russel 2000 (IWM) is currently holding support above its 50-day moving average, the other major indices have all fallen to support at their longer-term 200-day moving averages. (-)

- Real Motion shows that underlying momentum continues to break down across the indices on a weekly timeframe as they all show momentum failing its test of the 50-week moving average. (-)

- With the exception of Consumer Staples (XLP), every other sector closed this week in the red. (-)

- Market Internals remain in a weakened state for both the S&P500 and Nasdaq Composite, with the McClellan Oscillator as well as the New High / New Low ratios. (-)

- The short vs mid-term volatility ratio (VIX / VXV) finally broke out of its 3-month-long wedge pattern to the downside. (-)

- Cash Volatility ($VIX.X) has reclaimed its 50-day moving average for the first time since late October of last year. (-)

- The number of stocks above key moving averages has deteriorated across the board within the S&P500 and Russel 2000, however, it is worth watching this metric to see if there is potential for a bounce from oversold levels next week. (-)

- The 7-10 year treasury bond (IEF) is under pressure as it is closing with lower lows compared to its lows from December. (-)

- Value stocks (VTV) have officially taken the lead against Growth stocks (VUG) on a short-term basis, however, neither group looks all too strong given that VTV has lost its 50-day moving average and VUG has lost its own 200-day moving average which is showing pressure across the board. (-)

- Commodities all broke down hard this week, with Soft Commodities (DBA) losing their 200-day moving average and Copper (COPX) diving beneath its 50-day moving average. (-)

- The S. Dollar (UUP) is sitting on the precipice of its 200-day moving average, however, it has already begun to break above its longer-term 50-week moving average. (-)