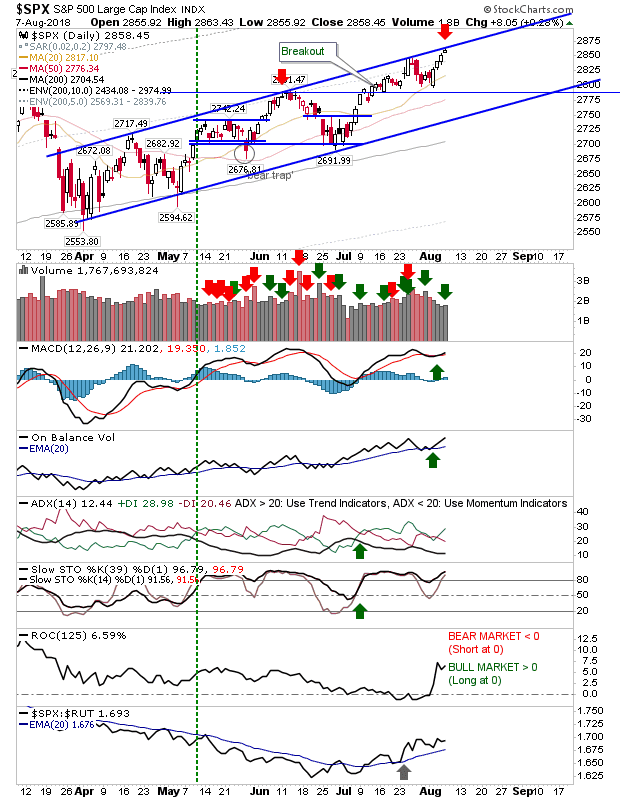

The rallies of last week continued with low volume gains. For those looking for new trade opportunities, there are potential near-term shorting trades available - or a chance to take profits for existing long trades.

The S&P 500 tagged channel resistance despite net bullish technicals. The gains were small but resistance has been tagged in what could mark a reversal play.

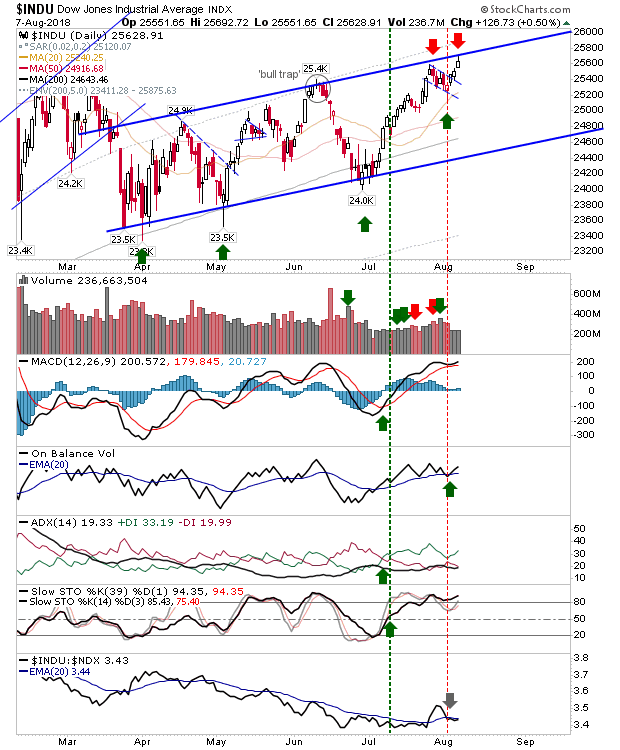

The Dow Jones Industrial Average tagged channel resistance but volume was light. Short stops go on a break of channel resistance.

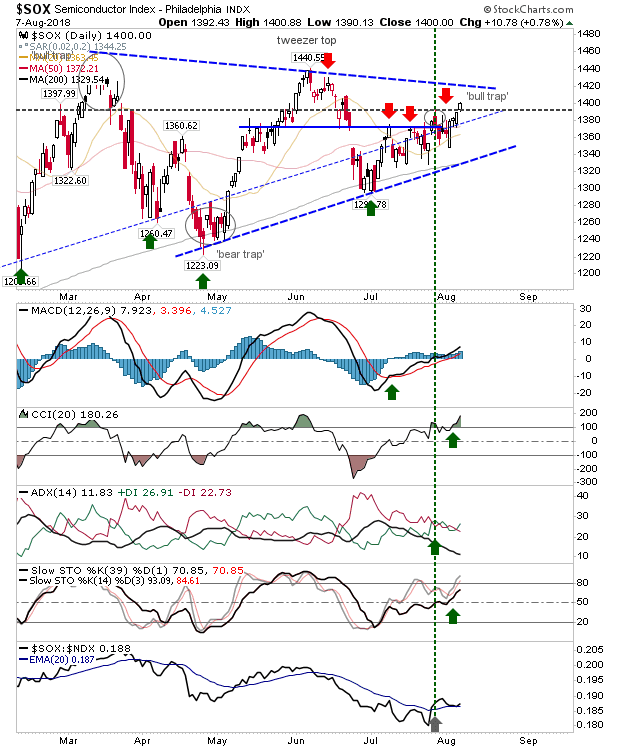

The Philadelphia Semiconductor Index continued its advance to triangle resistance, undoing past resistance. Technicals are all net bullish but not overbought. The 'bull trap' has been negated so this is one index where the shorting opportunity has again been negated - plenty of whipsaw going on here. The larger triangle looks to be defining the next big move; trading inside of this as it approaches the apex looks to be noise.

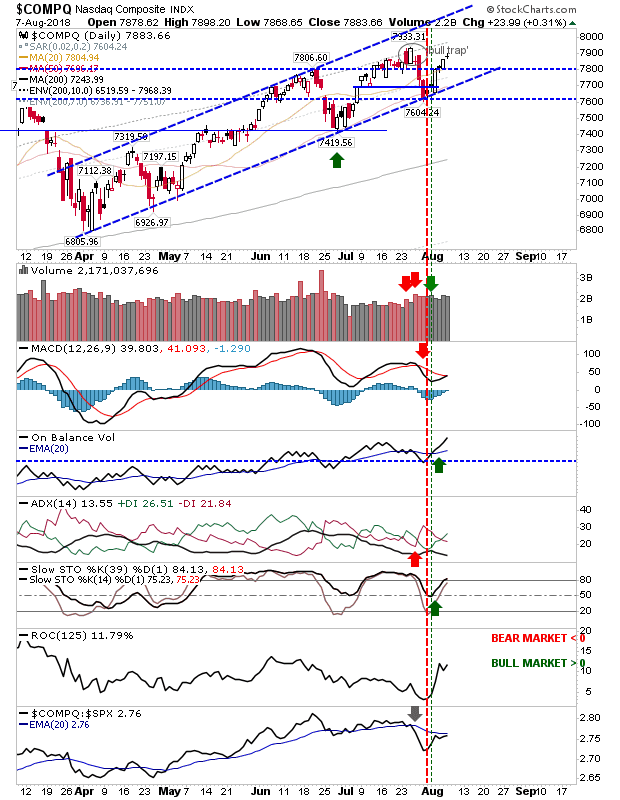

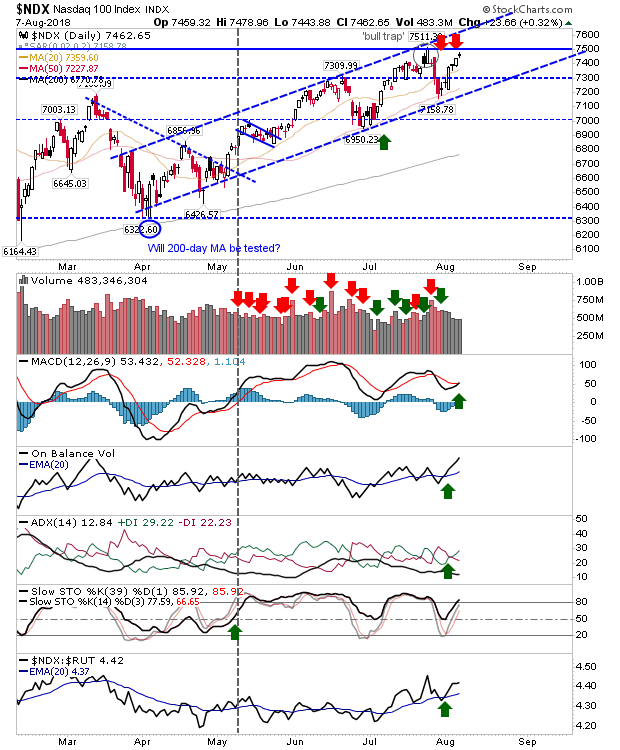

The Nasdaq had a quiet day. The doji was tight but there was no net change for the market.

t was the same for the Nasdaq 100; it tagged resistance creating a possible double top on light volume. Again, this is a shorting opportunity which would be negated on a move above 7,500.

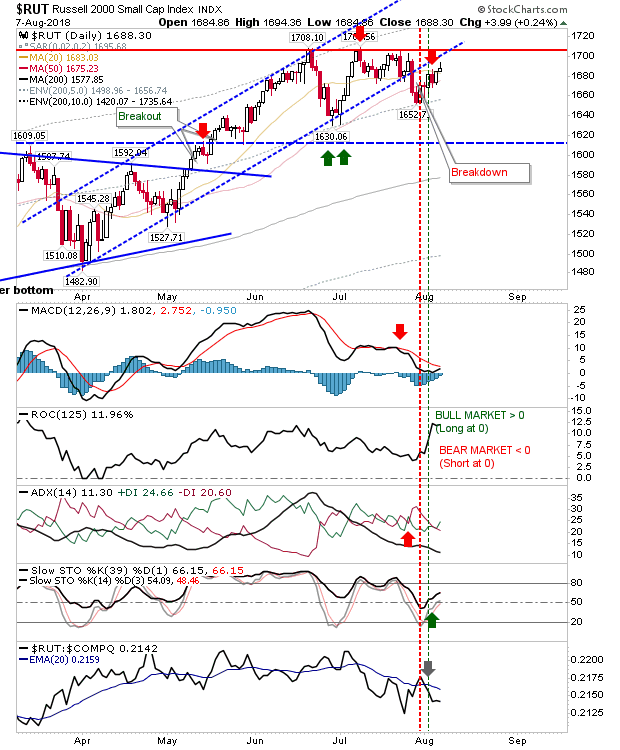

The Russell 2000 didn't quite tag resistance but is in the process of making a confirmation test of the channel breakdown. Today's small inverse hammer could be viewed as a new shorting opportunity although ideally, I would like to see a touch of the line.

For tomorrow, eager traders could use the various resistance tests as a chance to go short. The short-side of the market has not been a rewarding one with plenty of whipsaw risk to factor in - so don't look for these trades to last very long. Trail stops lower and look to take profits if they make it back to channel support or key moving averages (where available).