Market Brief

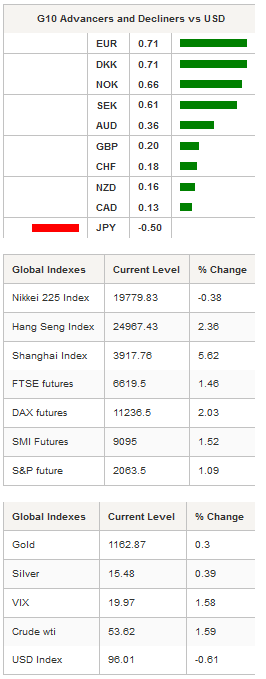

As expected, the BoE meeting was a non-event. The Central Bank held its key interest rates at 0.5% and kept unchanged its asset-purchase program at £375bn. As Fed members, UK policy makers voiced their concerns about the Greek situation and preferred to postpone the start of the tightening cycle. GBP crosses didn’t react much to the headline as the decision was broadly expected by market participants. GBP/USD is moving sideways for the last 2 days as Greek negotiation prevent traders to take substantial exposure on FX markets. EUR/GBP managed to stay above the 0.72 psychological threshold and will likely find resistance around 0.7250 (previous highs) while on the downside a strong support lies at 0.7055. We anticipate that FX markets will remain quiet today as traders are reluctant to take massive directional exposure given the highly uncertain outcome of Greek negotiations. However, in case of an agreement is reached between Greece and its creditors before the weekend, expect some major swings in both FX and equity markets.

In the US yesterday, initial jobless claims surprised to the upside with a reading of 297k versus 275k median forecast. Bloomberg consumer confidence eased to 43.5 from 44 a week earlier. EUR/USD reversed momentum in the Asian session and erased the losses incurred during the European and US session.

In Asia, equity returns are broadly mixed this morning, with the exception of Chinese stocks. South Korea’s KOSPI edged slightly higher by 0.17% while Thai shares shares added 0.42%. Australian equity market equity market added gains with the S&P/ASX up 0.38% despite home loans approvals dropped 6.1%m/m in May versus -3% consensus. AUD/USD is reversing momentum and is heading toward the next resistance standing at 0.7533 while on the downside a support can be found at 0.7372 (low from July 8).

In Japan, the Nikkei 225 retreated -0.38% after PPI plunged -2.4%y/y in June while analyst were looking for a reading of -2.2%. On a monthly basis, producer prices dropped -0.2% versus 0.1% median forecast. Over the last day, USD/JPY is down -0.50% versus the US dollar and is currently testing the 122 resistance level after having bounced strongly from the 120.50 support level.

In China, equity markets are back in positive territory after Beijing allowed funds from the PBoC to be used to support stock prices and banned major stockholders from selling stocks. The Shanghai Composite is up 5.62% while the Shenzhen Composite adds 4.14% while more than 1,400 shares remain suspended from trading. Hong Kong’s Hang Seng advanced 2.36%.

European future equity markets are more than upbeat this morning as a Greek deal seems more likely than ever. Xetra DAX is up 2.03%, CAC 40 gains 2.47, Euro Stoxx 50 is up 2.63%, FTSE 250 is up 1.46% while Swiss blue-chips are up 1.52%.

Today's CalendarEstimatesPreviousCountry / GMT TU May Current Account Balance -3.53B -3.41B TRY / 07:00 DE Jun CPI MoM -0.10% 0.00% DKK / 07:00 DE Jun CPI YoY 0.60% 0.60% DKK / 07:00 DE Jun CPI EU Harmonized MoM - 0.00% DKK / 07:00 DE Jun CPI EU Harmonized YoY - 0.40% DKK / 07:00 NO Jun CPI MoM -0.40% 0.20% NOK / 08:00 NO Jun CPI YoY 2.00% 2.10% NOK / 08:00 NO Jun CPI Underlying MoM -0.30% 0.50% NOK / 08:00 NO Jun CPI Underlying YoY 2.40% 2.40% NOK / 08:00 NO Jun PPI including Oil MoM - -0.10% NOK / 08:00 NO Jun PPI including Oil YoY - -4.80% NOK / 08:00 IT May Industrial Production MoM 0.30% -0.30% EUR / 08:00 IT May Industrial Production WDA YoY 1.20% 0.10% EUR / 08:00 IT May Industrial Production NSA YoY - 3.80% EUR / 08:00 UK May Construction Output SA MoM 0.80% -0.80% GBP / 08:30 UK May Construction Output SA YoY 3.10% 1.50% GBP / 08:30 UK May Visible Trade Balance GBP/Mn -£9700 -£8561 GBP / 08:30 UK May Trade Balance Non EU GBP/Mn -£2800 -£2094 GBP / 08:30 UK May Trade Balance -£2150 -£1202 GBP / 08:30 IN May Industrial Production YoY 4.00% 4.10% INR / 12:00 CA Jun Unemployment Rate 6.90% 6.80% CAD / 12:30 CA Jun Net Change in Employment -10.0K 58.9K CAD / 12:30 CA Jun Full Time Employment Change - 30.9 CAD / 12:30 CA Jun Part Time Employment Change - 27.9 CAD / 12:30 CA Jun Participation Rate - 65.9 CAD / 12:30 CA Bloomberg July Canada Economic Survey - - CAD / 13:00 US May Wholesale Inventories MoM 0.30% 0.40% USD / 14:00 US May Wholesale Trade Sales MoM 0.90% 1.60% USD / 14:00 BZ Central Bank Currency Swap Auction Results - - BRL / 14:50 US Fed's Rosengren to Speak at Rocky Mountain Economic Summit - - USD / 15:35 US Fed Chair Yellen Speaks on U.S. Economic Outlook in Cleveland - - USD / 16:30 CH Jun New Yuan Loans CNY 1050.0B 900.8B CNY / 22:00 CH Jun Money Supply M2 YoY 11.00% 10.80% CNY / 22:00 CH Jun Aggregate Financing CNY 1400.0B 1220.0B CNY / 22:00 CH Jun Money Supply M1 YoY 4.20% 4.70% CNY / 22:00 CH Jun Money Supply M0 YoY 2.80% 1.80% CNY / 22:00 SZ 2Q Real Estate Index Family Homes - 445.5 CHF / 22:00 IN Jun Exports YoY - -20.20% INR / 22:00 IN Jun Imports YoY - -16.50% INR / 22:00 IN Jun Trade Balance -$10500.0M -$10406.2M INR / 22:00 CH Jun Foreign Reserves $3702.5B $3730.0B CNY / 22:00

Currency Tech

EUR/USD

R 2: 1.1436

R 1: 1.1278

CURRENT: 1.1088

S 1: 1.0955

S 2: 1.0819

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5408

S 1: 1.5171

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 124.45

CURRENT: 121.86

S 1: 121.45

S 2: 120.64

USD/CHF

R 2: 0.9719

R 1: 0.9543

CURRENT: 0.9462

S 1: 0.9151

S 2: 0.9072