Market Brief

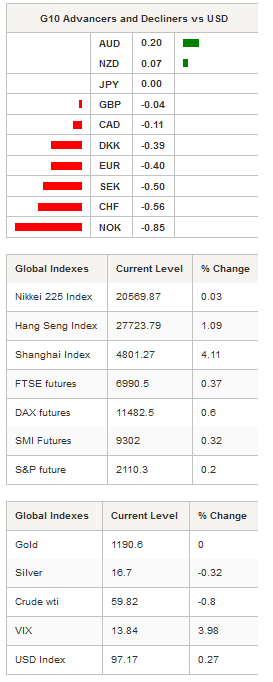

On Friday, the revisions to US Q1 GDP were released slightly above expectations. Data indicate that the US economy contracted -0.7% (quarter over quarter annualised) compared with -0.9% median forecast and +0.2% first read. We still expect growth for the second quarter but it is clear now that the recovery will be slower and that a replay of last year, with Q2 and Q3’s growth figures above 4%, is unlikely given the lacklustre economic data from the US. Equity markets reacted moderately with the S&P 500 down -0.63%, NASDAQ down -0.55% and the Dow Jones down -0.64%.

Across the Atlantic, European shares suffered the most as investors reiterated their concerns about the lack of significant progress in the Greek talks. Greece has to make several payments to the IMF in the coming weeks (€303mn next Friday, €341mn on June 12, €568mn on June 16, €341mn June 19) and it is unlikely that the Greek government has the money to meet the repayments without fresh bailout funds. European equities took the hit with most regional indices in negative territory. Euro Stoxx 50 lost -2.19%, FTSE -0.8%, DAX -2.26%, CAC -2.53%, Italian equities dropped -1.05% while Spanish ones were down -1.45%.

In the Asian session, EUR paired losses against the US dollar after having tested the 1.10 resistance level (Fib 50% on April-May rally), the pair is now sliding lower toward the closest support standing at 1.0882 (Fib 61.8%). Without significant breakthrough in the Greek situation, we do not expect majors FX moves today and this despite the fresh batch of EU economic data (Markit manufacturing PMI among others) due today.

In China, manufacturing PMI’s read suggests that recent monetary easing from the PBoC helped to cushion the slowdown of the economy. The official Manufacturing PMI improved from 50.1 to 50.2 in May (50.3 expected). As a result, Shanghai Composite climbed 4.11%, erasing partially last Thursday’s heavy losses. In Hong Kong, the Hang Seng participates partially to the rally and gained 1.09% while in Japan’s Nikkei is roughly flat, up 0.03%. USD/JPY is treading water and moved range-bound for the last couple of days between 123.50 and 124.50. Fresh boost will be needed to break the key resistance implied by the high of June 22 at 124.14. On the downside, the strongest support stands at 118.50 (multi low).

In Australia, equities suffered losses and are down -0.72% as April’s Building Approval printed way below consensus at -4.4%m/m versus -1.8%. AUD/USD consolidates around 0.7630 after the 2-week’s steady sell-off during which the Aussie lost 6.5% against the greenback. A strong support can be found around 0.7553/33 (previous lows).

USD/CHF seems to be unable to break the top of its declining channel (currently standing around 0.9450). Swiss’ PMI Manufacturing for May is due this afternoon and expected at 47.8 from 47.9 previous month. We expect a read below consensus as Swiss Q1 GDP was printed at -0.2%m/m on Friday versus 0% expected. April Retail Sales are also due this morning and are expected at 0.4%m/m, 0.7% prior read. EUR/CHF held steading, close to the bottom of its range at 1.03.

Currency Tech

EUR/USD

R 2: 1.1450

R 1: 1.1043

CURRENT: 1.0931

S 1: 1.0882

S 2: 1.0521

GBP/USD

R 2: 1.5879

R 1: 1.5800

CURRENT: 1.5273

S 1: 1.5191

S 2: 1.5090

USD/JPY

R 2: 125.64

R 1: 124.14

CURRENT: 124.13

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9463

S 1: 0.8936

S 2: 0.8823