Market Brief

Once again, data from the US was broadly mixed yesterday as investors impatiently await the Federal Reserve to start tightening at its December meeting. Looking at the implied probabilities of a rate change, it seems that the market is increasingly confident about a December delivery. Probabilities extracted from the OIS showed that odds of a rate hike have reached 76% compared to only 45% a month ago. We have the feeling that the economic data does not matter anymore as market participants focus solely on the wording used by Fed members. In our opinion, the economic data is in fact not supportive of a rate hike this month. However, the Fed had cornered itself and is getting beaten at his own game with Yellen claiming for months that everything is just fine. The Fed is now doomed to raise rates even though the economy is faltering and will sound dovish with or without a rate hike. This morning, EUR/USD is stabilising around 1.06 as traders await tomorrow’s ECB meeting, during which Draghi is expected to announce an extension and/or an increase of its asset purchase programme, but also Friday’s NFP. We’ll get a preview of the job market today the release of the ADP employment change, which are expected to increase to 190k from 182k in October.

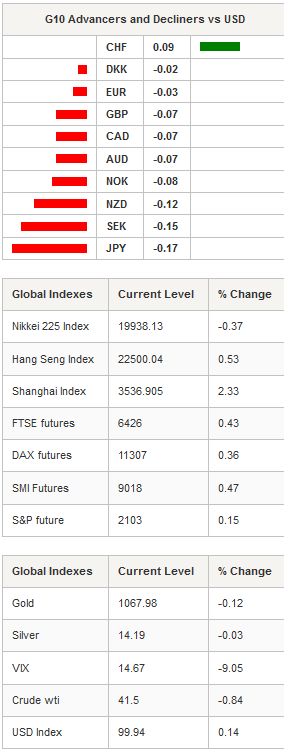

On the equity market, Wall Street closed in positive territory yesterday with the S&P 500, the Nasdaq and the Dow Jones up 1.07%, 0.93% and 0.95% respectively. However, Asian equity markets failed to follow this positive lead and are trading mostly in negative territory. In Japan, the Nikkei was down 0.37%, while the Topix index edged up 0.02%. In mainland China, the two equity gauges moved in opposite direction as the Shanghai Composite surged 2.33%, while the Shenzhen Composite fell 0.41%. In Hong Kong the Hang Seng was up 0.53%.

In Brazil, the economy contracted more than expected in the third quarter (GDP contracted 1.7%q/q versus -1.2% consensus and a downwardly revision of -2.1% in the Q2) as the spillover effect from the Petrobras corruption scandal has brushed aside the country's economic woes. Even though household consumption fell less than expected (-1.5% vs -2.5% expected), the political gridlock hurts fixed investments, which contracted 4%q/q. USD/BRL tested 3.90 in early session yesterday before stabilising at around 3.85. We expect the Brazilian real to remain under pressure due to the grim outlook.

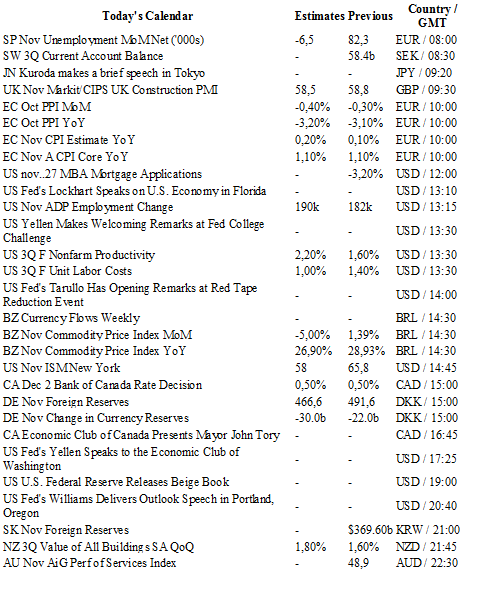

Today traders will be watching construction PMI from UK; CPI and PPI from the eurozone; MBA mortgage application, ADP employment change, Beige Book, Yellen, William, Lockhart and Tarullo’s speeches; BoC interest rate decision.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0624

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5066

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 123.10

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0250

S 1: 0.9739

S 2: 0.9476