Market Brief

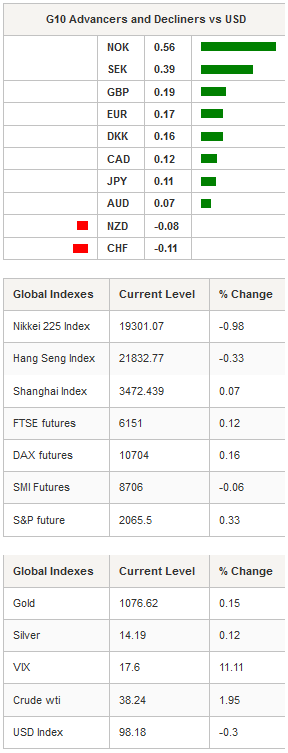

It was a relatively quiet session in Asia after the sharp movements on Tuesday as risk-off sentiment spread. The US dollar appreciated against EM and commodity currencies and lost ground against funding currencies such as the Japanese yen, the euro and the Swiss franc. Crude oil dominated the headlines yesterday as both WTI and Brent crude hit lows from 2009. West Texas Intermediate crude reached $36.64 and Brent crude fell to $39.81 a barrel. Obviously, equities across the globe buckled under heavy selling pressure with all indices heading deep into negative territory. European shares were roughly down 1.80% with the FTSE 100 falling 1.42%, the DAX -1.95% and the S&P 500 dropping 1.40%. In the US, the sell-off was less pronounced as the S&P 500 slumped 0.65%, the NASDAQ edged down 0.07%, while the Dow Jones erased 0.92%.

This morning, Asian markets are still catching up and are therefore blinking red on the screen. The Nikkei 225 was down 0.98%, while the broader TOPIX index dropped 0.84%. In mainland China, the Shanghai Composite edged up 0.07% and the Shenzhen Composite fell 0.32%. Hong Kong’s Hang Seng was down 0.33%, while in Taiwan, shares fell 1.37%. In Europe, futures are pointing to a higher open.

Released on Tuesday, the UK’s industrial and manufacturing productions painted a mixed picture with the former beating median forecast (1.7%y/y vs 1.2% expected) and the latter falling short of expectations, printing at -0.1%y/y versus 0.0% consensus. The cable continued to slide further - the pound lost as much as 0.70% against the greenback yesterday - and hit 1.4957 before recovering above the $1.50 mark.

In South Africa, bad news from the economy keeps piling up as the rand fell to all-time low yesterday. Current account deficit widened to 165bn in the third quarter, while economists were expecting a deficit of 152bn as domestic demand for foreign goods increased substantially. Separately, manufacturing production contracted 1.7%y/y (s.a.) versus -0.5% median forecast. On the bright side, the previous reading was revised higher from 2.2%m/m to 2.4%. USD/ZAR 14.7009 on Tuesday before stabilising around 14.50. We expect the rand to remain under pressure as the country has never been closer to losing its investment grade rating. Fitch downgraded South Africa’s debt to BBB-, while S&P switched the outlook from stable to negative.

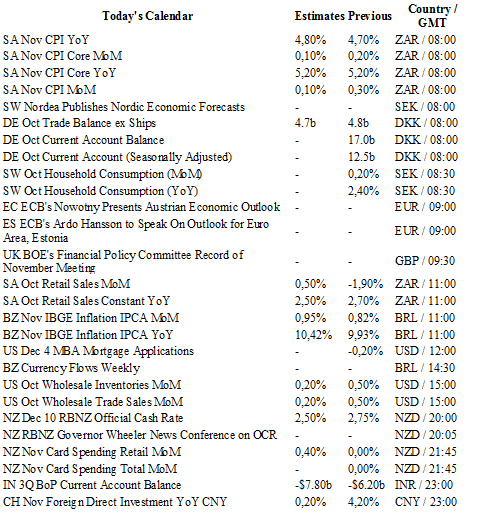

Today traders will be watching the inflation report and retail sales from South Africa; inflation report from Brazil; wholesale inventories and MBA mortgage applications from the US; RBNZ rate decision (OCR expected to be cut from 2.75% to 2.5%).

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0920

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5336

CURRENT: 1.5045

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.78

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 0.9931

S 1: 0.9739

S 2: 0.9476