Market Brief

As expected, yesterday sharp sell-off that spread across all asset classes was short-lived. After opening in negative territory, US equities extended gains on Wednesday with the S&P 500 rising 1.11%, the Dow Jones Industrial Average surging 1.40%, while the NASDAQ was up 1.11%. European equities were no exception as the German DAX ended the session up 1.56% while the broad Euro Stoxx 600 surged 1.46%. Investors across the planet started wondering whether a Trump presidency would be positive for the US stock market. Indeed, during his campaign, Donald Trump promised he would cut corporate taxes and increase infrastructure spending.

In the FX market, EUR/USD moved ended the day in negative territory, moving to 1.0930 after hitting 1.13 in early European session on Wednesday. Implied volatility measures were also returning to their “normal” level with the 1-week measure easing to 8.72%, compared to 14% a few days ago. The market is a bit lost, especially since Trump’s victory has increased substantially the uncertainty regarding the Federal Reserve’s upcoming interest rate decision.

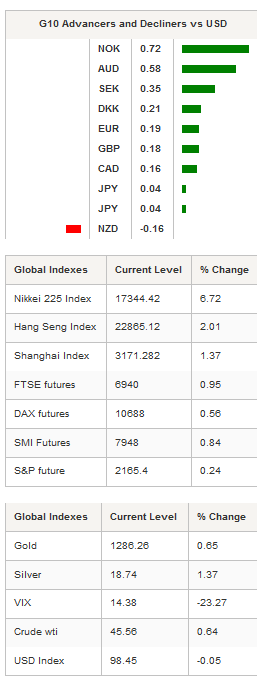

Elsewhere, most G10 currencies recovered against the US dollar. The Aussie rose 0.58% to $0.7680, the NOK was up 0.72% as USD/NOK slid to 8.2842. The New Zealand dollar was however under heavy fires on Thursday after the Reserve Bank of New Zealand cut the official cash rate target to record low 1.75%. Assistant Governor John McDermott said the central bank is worried about the consequence of the strong Kiwi on the economy. More specifically, he declared that “it [the Kiwi’s strength] is restraining important parts of the economy and it is also holding tradable inflation down to a point we think it is having a downward pressure on inflation expectations”. NZD/USD fell as low as 0.7236 in early European session before stabilising at around 0.7270. On the downside, the closest support can be found at 0.7110 (low from October 25th), while on the upside, yesterday high at 0.7403 will act as resistance.

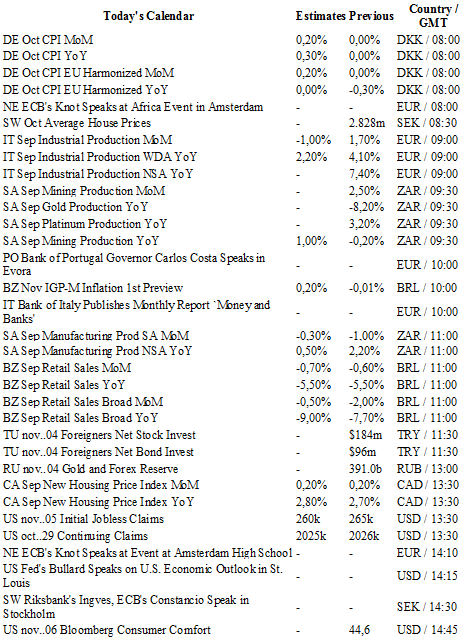

Today traders will be watching CPI from Germany; industrial production from Italy; manufacturing production from South Africa; retail sales from Brazil; gold and forex reserves from Russia; initial jobless claims and monthly budget statement from the US. Several central bankers will also deliver speeches today: Knot, Hansson, Mersch and Constancio from the ECB; Bullard and Lacker from the Fed; chief economist Andy Haldane from the BoE.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1210

CURRENT: 1.0929

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2557

CURRENT: 1.2446

S 1: 1.2083

S 2: 1.1841

USD/JPY

R 2: 111.45

R 1: 107.49

CURRENT: 105.56

S 1: 102.55

S 2: 100.09

USD/CHF

R 2: 1.0093

R 1: 0.9999

CURRENT: 0.9841

S 1: 0.9632

S 2: 0.9537