Market Brief

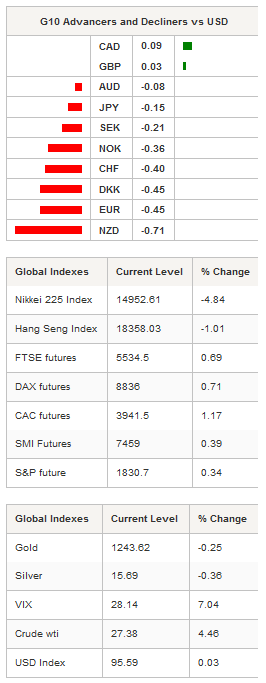

Crude oil printed a fresh 13-year low yesterday during the US session. The US crude benchmark, the West Texas Intermediate, fell another 3.70% on Thursday before bouncing back in overnight trading as fears of oversupply eased. WTI was up 4.46%, while its counterpart from the North Sea, the Brent crude, rose 4.69%.

On Thursday Japanese markets were closed for National Foundation Day and reopened in pain for the last trading session of the week. The Nikkei 225 closed significantly lower, down 4.84% as traders caught up with the rest of equity markets. In Hong Kong, the Hang Seng settled down 1.01%, which does not bode well for the Chinese re-open next Monday. Elsewhere, in Australia the S&P/ASX fell 1.16%, in New Zealand the NZX was down 0.89%, while in South Korea the KOSPI slid 1.41%. In the EM complex, Thai equities were down 0.38%, the Indian Sensex slip 0.71%, while Indonesian equities were down another 1.16%. European futures are blinking green across the screen.

In the FX market, rumours regarding a potential intervention from the BoJ to stop the yen's sharp appreciation are fading as the central bank did not provide any comment. In our opinion, it is very unlikely that the BoJ intervened as they cannot afford to take another half measure - like they did with the negative interest move a couple of weeks ago - as it would further damage the little credibility they have left. USD/JPY stabilised around 112 in Tokyo after reaching its lowest level since October 31, 2014. We believe there is still some downside potential for the pair; however traders are still trying to understand what happened yesterday - when USD/JPY spiked two figures in less than 5 minutes - and will likely remain sidelined before the weekend break.

The Swedish central bank surprised the market on Thursday by cutting its benchmark interest rate by 0.15% (versus 0.10% expected), pushing the repo rate further into negative territory, down to -0.50%. USD/SEK jumped 1.30% on the news, up to 8.4770, but returned quickly to its initial level at around 8.37. Over the last few months, the market reactions to interest rate cuts from central banks around the globe appear to have had a weaker impact on the market - USD/SEK needed just six hours to return to its pre-announcement level.

EUR/CHF consolidated yesterday’s gains and held ground above the 1.10 threshold. USD/CHF was moving sideways between 0.9715 and 0.9754 in Tokyo; however the pair is having a hard time breaking its 200dma (currently at 0.9731) to the downside. We therefore would not be surprised if USD/CHF recovers over the next few days.

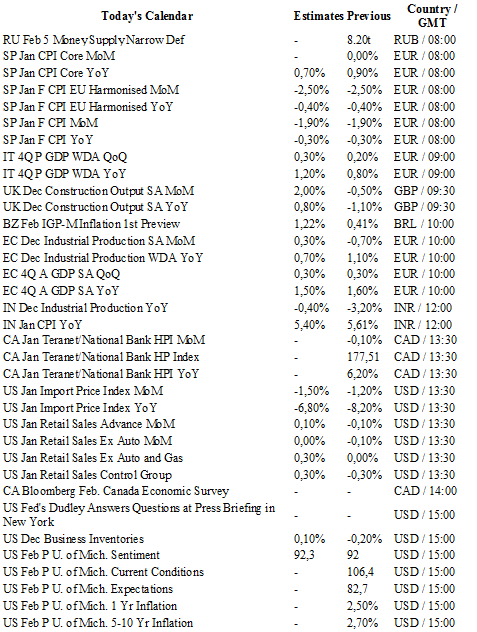

Today traders will be watching the inflation report from Spain; GDP from Italy; industrial production and GDP from the Eurozone; retail sales and Michigan sentiment index from the US.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1313

S 1: 1.0711

S 2: 1.0524

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4459

S 1: 1.4081

S 2: 1.3657

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 112.01

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9700

S 1: 0.9476

S 2: 0.9072