Market Brief

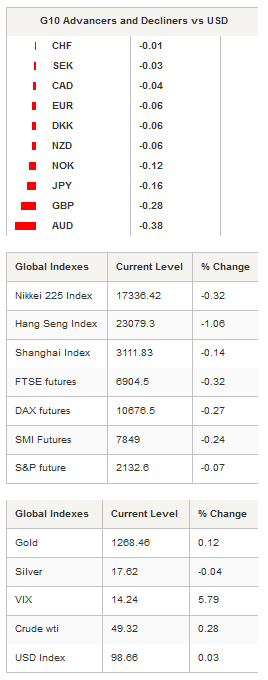

It was another quiet trading session in the FX market as investors seemed reluctant to take directional exposure ahead of this afternoon's key US data. Like other G10 currencies, the Japanese yen traded within a tight range on Thursday. USD/JPY moved within 104.30 and 104.70, stuck below the 105 resistance level. With an interest rate hike in the US now completely priced in, we believe that risk is to the downside in USD/JPY as yen bulls persist.

After falling as much as 3.55% since the beginning of the month, the euro treaded water at around 1.09 overnight. The strong support at 1.00822 (low from October 3rd) is still untouched, while on the upside the 1.12-1.13 area will act as resistance. Implied volatilities across various maturities remain very even though one-week implied vol ticked up slightly to 7.48%.

Looking at the 25 delta risk reversal measure, we notice that the market has become less pessimistic regarding the single futures as traders reduce their downside protection. However, as confirmed by the CFTC speculative positioning, last week traders continued to bet on further euro weakness.

After rallying at a modest pace in the first sessions of the week, EUR/CHF stabilised at around 1.0835 and seemed ready to start moving south again. The strength of the Swiss franc will continue to give a headache to the Swiss National Bank, especially as Brexit talks gear up. The “implicit floor” at 1.08 will remain the strongest support as the SNB systematically intervenes in the FX market when EUR/CHF gets too close.

Asian equities were under pressure on Thursday as investors could not justify pushing company valuations higher. In Japan, the Nikkei was off 0.32%, while the broader Topix index edged down 0.05%. In mainland China, the Shanghai Composite fell 0.14% and the Shenzhen edged down 0.06%. In Europe, equity futures followed the negative lead from Asia and slightly lower. The Footsie was down 0.32%, the DAX 0.27% and the SMI -0.63%.

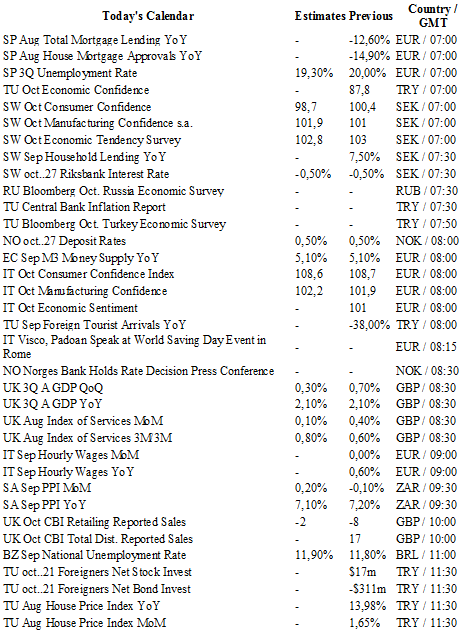

Today traders will be watching unemployment rate from Spain; interest rate decision from Sweden and Norway; manufacturing and consumer confidence from Italy; UK GDP; durable goods orders, initial jobless claims, pending home sales and Fed’s Mersch’s speech from the US.

Currency Tech

EUR/USD

R 2: 1.1352

R 1: 1.1058

CURRENT: 1.0908

S 1: 1.0822

S 2: 1.0711

GBP/USD

R 2: 1.2857

R 1: 1.2477

CURRENT: 1.2212

S 1: 1.2090

S 2: 1.1841

USD/JPY

R 2: 111.45

R 1: 107.49

CURRENT: 104.61

S 1: 102.80

S 2: 100.09

USD/CHF

R 2: 1.0328

R 1: 1.0093

CURRENT: 0.9933

S 1: 0.9632

S 2: 0.9522