Market Brief

At the end of what was a particularly volatile week, equity returns are mixed in Asia as traders adjust their positions ahead of next week’s FOMC meeting. Chinese mainland shares are in red this morning. However, the Shanghai Composite is on the cusp of ending the week in positive territory after falling almost 5% between Monday and Tuesday. It is up 0.43% on Friday while the Shenzhen Composite edges lower by 1.06%. The People’s Bank of China lowered the USD/CNY fixing to 3.3719 from 6.3772 while, in the meantime, Huang Yiping, the China central bank’s member, declared at the WEF in Dalian that “There will be no excessive depreciation (of the yuan)” adding, “The most important thing is to stabilise the economy”. Further devaluation of the yuan is less likely as Beijing still has plenty of room for regular monetary easing, such as RRR adjustments and interest rate cuts.

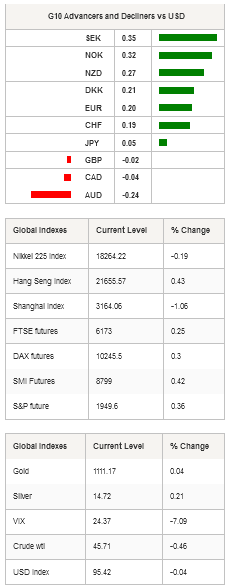

Elsewhere, the Japanese Nikkei 225 slid 0.19%, while the TOPIX index edged slightly higher by 0.05%. The South Korean KOSPI retreated 1.06% while in Hong Kong the Hang Seng gained 0.50%. Further south, Australian shares continue losing this week’s gains, retreating 0.47% while in Wellington shares are down 0.40%.

It was a quiet Asian session in the FX market. The US dollar weakened against most majors. In New Zealand, the kiwi is gaining ground against the greenback as traders digest the recent rate cut from the Reserve Bank of New Zealand. NZD/USD is up 0.93% since yesterday, back above $0.63, as business manufacturing PMI expanded to 55 in August from 53.7 a month earlier. Food prices contracted -0.5%m/m after increasing 0.6% in July.

Yesterday, the Brazilian real fell 1.80% against the US dollar and 2.35% against the euro as traders priced in Brazil’s downgrade to junk status by Standard & Poor’s. In addition, consumer prices rose 9.53%y/y in August, slightly short of the anticipated 9.54%. On a month-over-month basis, inflation rose only by 0.22% versus 0.23% median forecast and 0.62% in July.

In the US, the last batch of economic data indicates that import prices remained under pressure in August due to low commodity prices and a strong dollar. The import price index fell 1.8%m/m versus -1.06% consensus and -0.9% previous month. EUR/USD continues to move higher and validated a break of the resistance lying at 1.1262 (Fibonacci 50% on July-August debasement), maintaining a strong short-term bullish bias. On the upside, the closest resistances stand at 1.1368 (Fibo 38.2%) and then 1.1714 (high from August 24th), while on the downside, the previous resistance standing at 1.1155 (Fibo 61.8%) is now support.

In the equity market, futures are trading in positive territory prior to the European open. The Xetra DAX is up +0.30%, CAC 40 +0.54%, FTSE 250 +0.25% and SMI +0.42%. EUR/CHF is testing the strong resistance at 1.10 and will need a fresh boost to break through. USD/CHF is taking a breather and consolidates below 0.98. The dollar has risen more than 5% against the Swiss franc in 2 weeks.

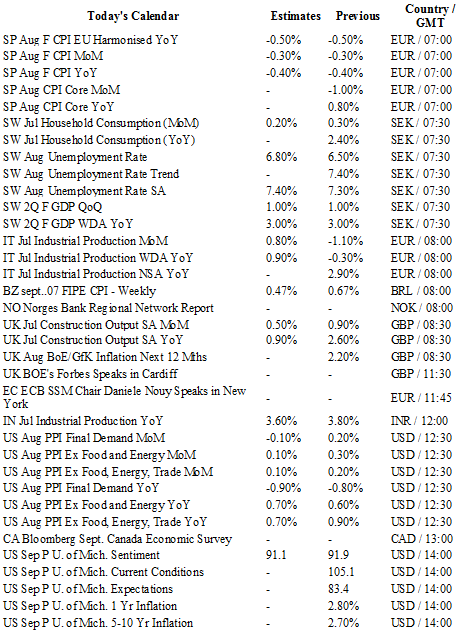

Today traders will be watching: Unemployment rates and Q2 GDP final estimate from Sweden; industrial production from Italy and India; PPI and Michigan sentiment index from the US.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1332

CURRENT: 1.1301

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5628

CURRENT: 1.5445

S 1: 1.5346

S 2: 1.5165

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.49

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9714

S 1: 0.9513

S 2: 0.9259