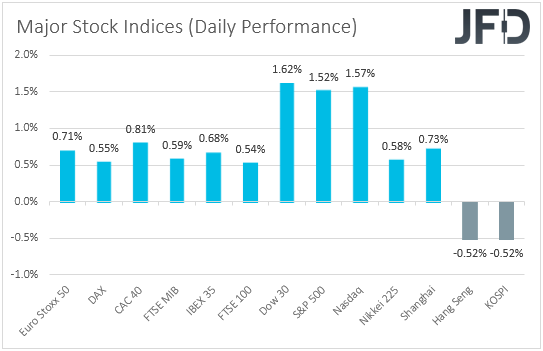

Major global indices rebounded yesterday, perhaps to correct Monday’s overstretched slide due to the renewed concerns that the fast-spreading Delta variant of the coronavirus could hamper the global economic recovery.

Market participants may have just had second thoughts over how restrictive any potential new measures could be. Any new measures could be softer, as vaccination rates limit the severity of symptoms of new cases.

Equities Rebound, USD Stays Elevated

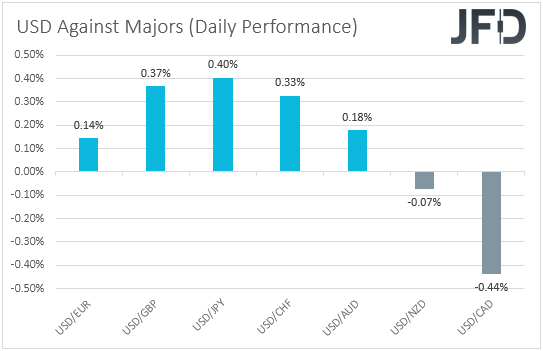

The US dollar kept outperforming all but two of the other major currencies on Tuesday and during the Asian session Wednesday. It gained the most versus JPY, GBP, and CHF, while it lost ground only versus CAD and NZD.

The weakening of the safe-haven yen, combined with the strengthening of the loonie and the kiwi, suggests that markets turned to risk-on yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major EU indices were a sea of green, with investor morale improving even more during the US session.

Appetite softened again in Asia, but still stayed relatively positive. Although Hong Kong’s Hang Seng and South Korea’s KOSPI slid, both Japan’s Nikkei 225 and China’s Shanghai Composite edged higher.

With the financial agenda relatively light yesterday, and nearly empty today, once again there was no clear catalyst behind the change in sentiment. In our view, the rebound may have just been a “correction of the correction.” In other words, equities may have rebounded to correct Monday’s overstretched slide, triggered by renewed concerns that the fast-spreading Delta variant of the coronavirus could hamper the global economic recovery.

Did the virus suddenly vanish? Of course not. Actually, it continues to spread fast, and, in our view, investors have not suddenly stopped worrying about a potential economic impact. This is evident by the fact that although equities rebounded, the safe-haven US dollar remained supported.

Market participants may have just had second thoughts over how restrictive any potential new measures could be. In our view, following the economic damages caused from the previous lockdowns, the world may not be able to handle another round of such kind of restrictions. Any new measures could be softer, as vaccination rates limit the severity of symptoms of new cases.

That’s why, even if we experience another round of selling in equities, we will not call for a reversal yet. We still see this as a strong downside correction of the prevailing positive trends.

Actually, we still expect any market effects due to COVID-related concerns to be more prominent in the FX world, as they already are. We believe that the risk-linked aussie, kiwi, and loonie may underperform more against the US dollar and the yen.

However, we prefer to avoid exploiting any potential losses in the kiwi, as it could suffer the least among the three, due to the RBNZ’s hawkish stance and elevated expectations for a rate hike, even as soon as at the Bank’s upcoming gathering.

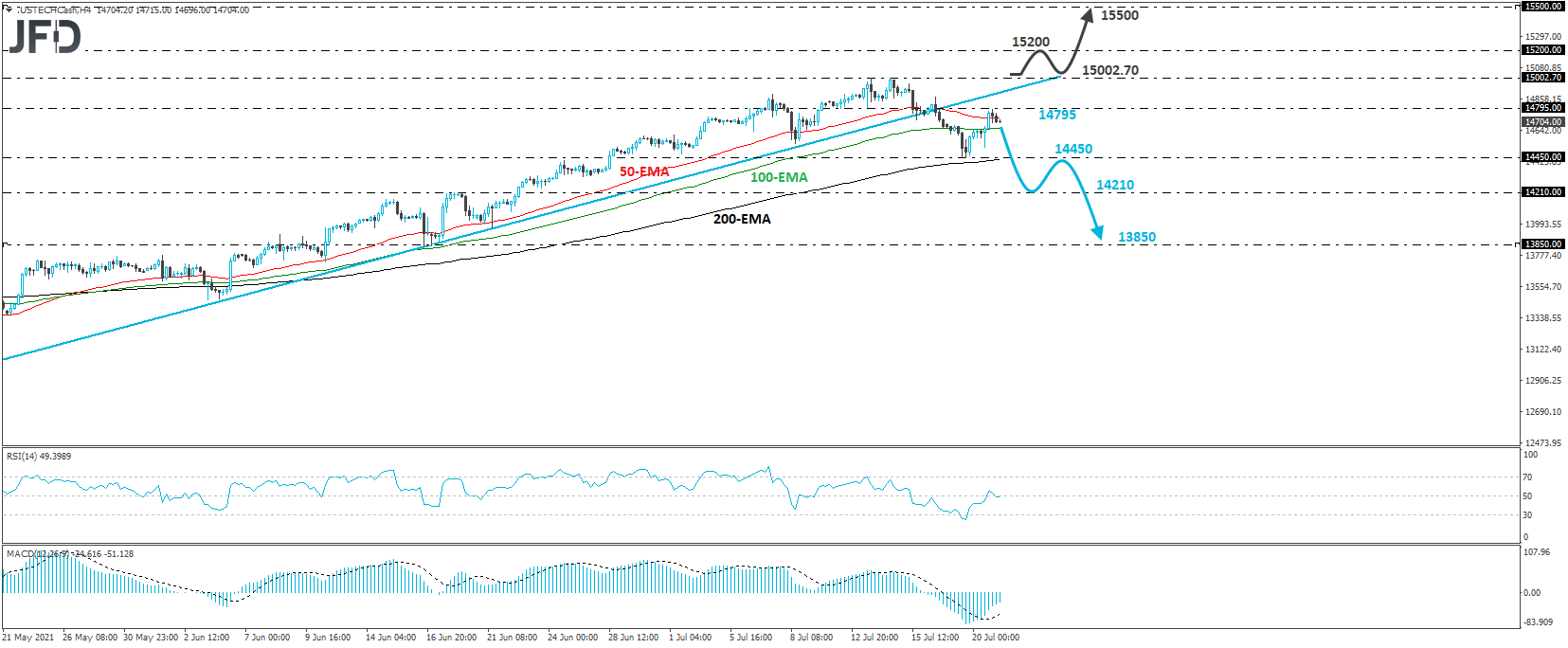

NASDAQ 100 – Technical Outlook

The NASDAQ 100 cash index traded higher yesterday, after hitting support at 14450. However, the recovery stayed limited near the 14795 territory, still below the prior upside support line drawn from the low of May 19. In our view, this keeps the door open for another potential round of selling.

If the bears take charge again from near that zone, we could see a slide and another test near 14450, the break of which could pave the way towards the 14210 barrier, marked as a support by the inside swing highs of June 17 and 18. Another dip, below 14210 could carry larger bearish implications, perhaps seeing scope for extensions towards the low of June 16, at 13850.

Now, in order to start examining the resumption of the prevailing long-term uptrend, we would like to see a break above the index’s record high of 15002.70. This would obviously confirm a forthcoming higher high, but with no prior highs and inside swing lows to mark new resistances, we will target the 15200 and 15500 zones.

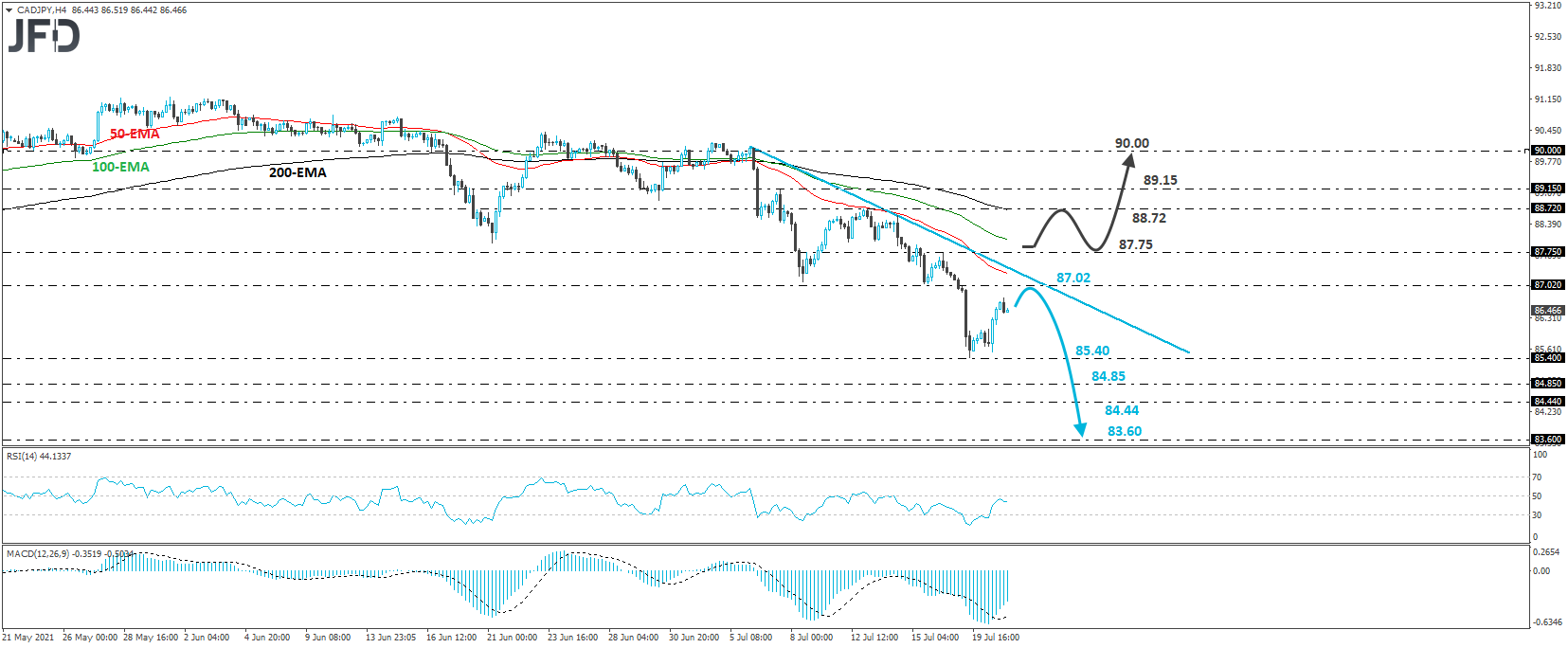

CAD/JPY – Technical Outlook

CAD/JPY traded higher yesterday as well, but stayed below the downside resistance line drawn from the high of July 6. Bearing in mind that the pair continues to print lower highs and lower lows below that line, we would still see a negative short-term picture.

We believe that the bears will regain control soon and perhaps aim for another test near 85.40, a support marked by the low of July 19 and Apr. 21, the break of which would confirm a forthcoming lower low and perhaps see scope for extensions towards the 84.85 or 84.44 levels, marked by the inside swing high of Mar. 3, and the low of the day after. If sellers are not willing to stop there, then the next stop may be at around 83.60, near the low of Feb. 26.

On the upside, we would like to see a recovery above 87.75 before we start assessing whether the bulls have stolen the bears’ swords. The rate would already be above the aforementioned downside line and we could see advances towards the 88.72 level, marked by the high of July 13, or the 89.15 barrier, marked by the peak of July 7. If neither territory is able to halt the rally, then we may see it climbing towards the psychological round figure of 90.00.

As For Today's Events

The economic agenda is nearly empty today, with the only release worth mentioning being the EIA (Energy Information Administration) report on crude oil inventories for last week. Expectations are for a 0.557mn barrels build following a 3.657mn the week before, but bearing in mind that the API report yesterday revealed a 0.806mn barrels build, we would see the risks of the EIA number as tilted slightly to the upside.