Thursday October 25: Five things the markets are talking about

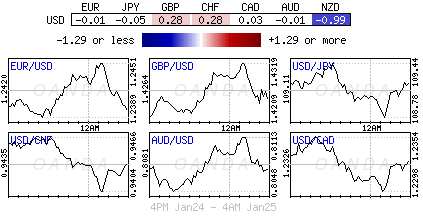

It was another mixed picture overnight, as capital markets digested the weakening US Dollar Index Futures and a protectionist push from the US. The greenback has slipped against most G20 currency pairs, while most commodity prices gained.

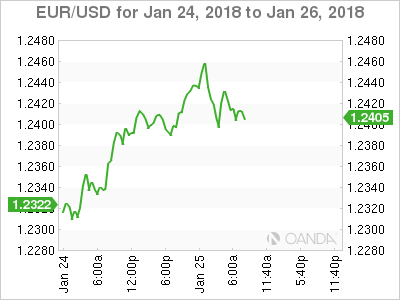

The EUR/USD has edged higher ahead of today’s European Central Bank (ECB) rate decision (07:45 am EDT) and Draghi’s highly anticipated press conference (08:30 am EDT). The market is looking for further clues on policy makers’ appetite for rolling back stimulus, and their thoughts on a strengthening EUR currency.

What to expect?

In order for traders to stop buying EURs (€1.2461), President Draghi needs to combine currency worries with downplaying the chance of a guidance change. If he does, the EUR could fall back below the psychological €1.2300 level if Draghi insists that rate increases won’t come until QE ends – basically diminishing the ‘hawkishness’ of the last ECB minutes.

Will the market buy Draghi’s downplaying early ECB exit speculation?

The bond market will find it difficult; yields in Germany and the rest of Europe are not expected to go that much lower now that the market is seriously talking about ‘rate normalization’ supported by the global growth story.

The ‘single’ unit should find a bid and rise through the €1.25 handle (three-year high) if Draghi focuses on the improvements in the eurozone economy and “acknowledges the possibility of early guidance changes,” even if he expresses concerns about EURs strength.

The eurozone growth story is already mostly priced into the EUR. Perhaps the next trigger for the common currency’s rally is likely to come from politics? Further hints on the progress of eurozone integration would likely give the market confidence to buy the EUR – remember, it was fears of eurozone disintegration that initially pressured the EUR years ago.

1. Stocks under pressure from currency strength

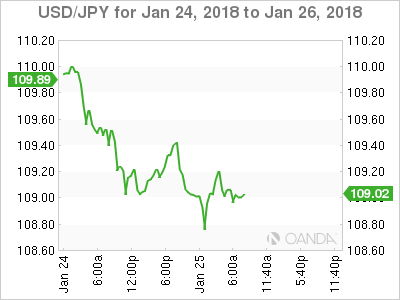

In Japan, the Nikkei share average dropped to a near two-week low overnight as a stronger yen (¥109.08) hurt exporters. The Nikkei ended -1.1% lower, the weakest closing level since Jan. 12. The broader Topix fell -0.9%.

Down-under, Aussie shares recouped some of their losses overnight to end the week in the black as a rally in top material firms partially offset falls in financials. The S&P/ASX 200 index closed lower than -0.1%.

In Hong Kong, stocks snapped a seven-day winning streak. The Hang Seng index ended down -0.9%, while the China Enterprises Index (CEI) fell -1.7%.

In China, stocks weakened from two-year highs, with the benchmark Shanghai Index snapping a seven-session winning streak, led down by property and healthcare firms. At the close, the Shanghai Composite index was down -0.31%, while the blue-chip CSI 300 was down -0.57%.

In Europe, regional indices trade mixed as the Euro Stoxx 600 trades fractionally lower, with strength in the CAC and IBEX offset by weakness in the DAX and Swiss SMI. Market is looking ahead to ECB’s press conference.

US stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 flat at 401.0, FTSE +0.1% at 7653, DAX -0.1% at 13395, CAC-40 +0.4% at 5515, IBEX-35 +0.5% at 10618, FTSE MIB +0.4% at 23714, SMI -0.1% at 9537, S&P 500 Futures +0.1%

2. Oil rallies on tighter supply and weaker dollar

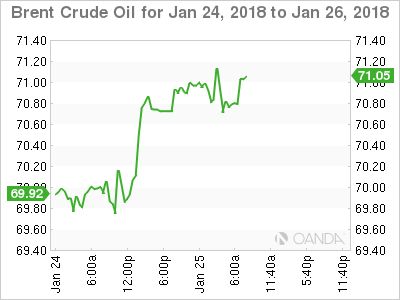

Brent crude oil hit +$71 a barrel overnight for the first time in three-years, supported by an OPEC-led supply curbs and a record-breaking run of declines in US crude inventories coupled with a weaker USD.

OPEC and its allies, including Russia, began to curb supplies in 2017. An involuntary drop in Venezuela’s output in recent months has deepened the impact of the curbs.

Brent crude prices have hit +$71.20 a barrel, the highest since early December 2014, while US crude has climbed to +$66.44, also the highest since early December 2014, before dipping to +$66.05, up +44c.

Casting a shadow over the oil rally is the presence of growing output of US shale oil, as higher prices encourage more investment in expanding supplies.

Note: US crude oil production is expected to surpass +10m bpd next month, and on the way to a record ahead of previous forecasts according to the US government’s EIA.

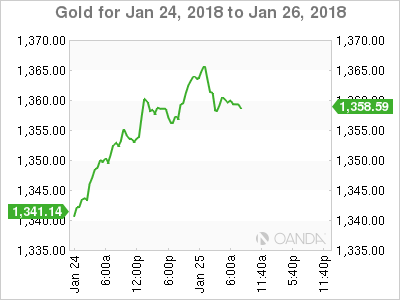

Ahead of the US open, Gold Futures prices have rallied to their 18-month high, buoyed as the US dollar hit three-year lows after ‘weaker currency’ comments from US Treasury secretary Mnuchin. Spot gold has rallied +0.2% to +$1,360.56 per ounce, after hitting its highest since Aug. 3, 2016 at +$1,366.07.

3. Sovereign yields wait for ECB press conference

Consensus expects ECB President Draghi will likely try to downplay all early ECB exit speculations in a few hours, but will the market buy it? With monetary policy normalization, a primary 2018 trading theme, lower sovereign yields are not expected to be the norm.

Elsewhere, Norway Central bank (Norges) policy statement this morning noted that the decision to keep policy steady was unanimous and that there were no substantial changes to outlook since December. Inflation is to remain below the +2.5% target in coming years – domestic inflation is low, but has moved up as expected.

Note: Previous comments from Norges Bank’s Governor Olsen in December indicated that policy makers might decide to follow in the footsteps of the fed and increase its key interest rates toward the end of 2018.

In Japan, JGB yields edged higher overnight, following US Treasury movements, even as a sharply stronger yen sends Japan equities lower. Yields on the benchmark 10-Year and newest 30-Year JGB’s are both higher by +0.05% each at +0.080% and +0.825%.

The yield on 10-Year Treasuries decreased -1 bps to +2.64%, while Germany’s 10-Year Bund yield declined -1 bps to +0.59%.

4. Dollars downfall remains intact

The mighty USD weakness continues to be the focus, but the dollar is off its worst levels heading into the N. America trading session. The latest US dollar weakness came amid Treasury secretary Mnuchin's ‘weaker’ comments and trade concerns – global leaders have asked the US to clarify weak dollar comments.

The EUR/USD has tested its three-year highs atop of €1.2459 and have since come off its best levels ahead of the ECB rate decision as participants moved to the sidelines from recent longs. Will Draghi continue to strike a dovish tone especially given the level of the EUR? Expect the ECB to show some concern on its inflation outlook if the EUR breaks above €1.26. A stronger currency would provide headwinds of achieving the ECB’s inflation target.

Elsewhere, sterling tested £1.4328 overnight for its best level in the aftermath of the Jun 2016 Brexit referendum, while USD/JPY is holding atop of ¥109 level after testing ¥108.74 earlier in the session.

5. German business sentiment ties record-high

Data this morning showed that German business sentiment in January tied November’s record high amid strong order books in the manufacturing sector.

The Ifo Institute for Economic Research said that its business climate index rose to 117.6 points in January from 117.2 points in December, beating economists’ expectations for a slight decline to 117.0.

“The German economy has had a dynamic start to the year,” said Ifo president Clemens Fuest.

Capacity utilization in the important manufacturing sector rose further from an already elevated level, bolstering businesses mood about their current business situation, which they assessed as “better than ever,” the Ifo said.

Yet despite the excellent current situation, the roughly 7,000 businesses polled by the Ifo in January trimmed their expectations for the next six months, the think tank said.