Friday January 18: Five things the markets are talking about

Improved market and investor optimism for Sino-U.S trade talks saw global equities and U.S stock futures climb in the overnight session. In commodities, crude oil prices are leading the rally, while sovereign yields back up and safe have currencies, like the yen, edge lower on suggestions that the U.S is considering reducing some tariffs on China during the negotiations as a way of getting more in return.

There were reports overnight suggesting that Treasury Secretary Steven Mnuchin was in favor to ease China tariffs. Even though the U.S Treasury denied the reports, the fact that the idea was floated has many believing that the Trump administration is keen for trade solution sooner rather than later to aid financial markets.

More Fed ‘dovish’ rhetoric mid-week from Chicago Fed Evans has also aided-risk on trading as we close out the week. His views about being patient on further interest-rate increases, resonates with messages from his colleagues and is helping equities to close out their fourth weekly consecutive gain.

On tap: Canadian CPI (08:30 am EDT).

1. Stocks get the green light

The Nikkei rallied +1.5% this week, nearly all of it in the overnight session (+1.3%), helped mostly by the currency markets (¥109.58) as capital markets take solace in Sion-U.S trade hopes. The broader TOPIX rose +0.9%, with all but two of the indexes 33 subsectors trading in the ‘black.’

Down-under, Aussie stocks maintained their steady gains throughout the overnight session, which allowed the index to record its first consecutive weekly gains in eight-weeks. The ASX 200 rallied +0.5% and +1.8% for the week. In South Korean, equities pushed to session highs at day’s close, capping its second consecutive week higher. The KOSPI climbed +0.8%, to trade atop of December’s high print. It rose +2.4% for the week.

In China and Hong Kong, the equity story was the same. Stocks got a boost on higher hopes for a resolution to the U.S-China trade war. In China, the Shanghai Composite Index rose +1.42%, while the CSI 300 of blue-chips closed up +1.8% – both benchmarks were up for their third straight week and saw their biggest weekly gains in two-months. In Hong Kong, the Hang Seng Index climbed +1.25%, to close the week at the highest level so far this year, and it’s up +5% in 2019.

In Europe, regional bourses trade higher across the board gains in Asia and strong U.S futures on positive trade sentiment.

U.S stocks are set to open in the ‘black’ (+0.29%).

Indices: STOXX 600 +1.0% at 354.2, FTSE +1.04% at 6,906.25, DAX +1.07% at 11,034.10, CAC 40 +1.18% at 4,850.74, IBEX 35 +1.01% at 8,998.60, FTSE MIB +0.65% at 19,596.50, SMI +0.62% at 8,968.70, S&P 500 Futures +0.29%

2. Oil climbs on OPEC output cut and easing trade tensions, gold lower

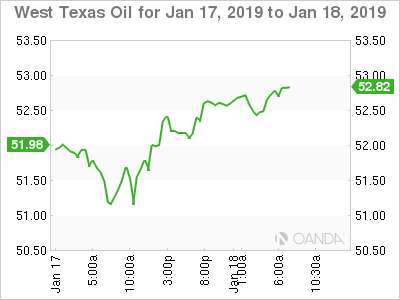

Oil prices have rallied over +1% overnight after an OPEC+ report showed its production levels fell sharply last month, easing fears about prolonged oversupply. Also aiding crude prices is trade related optimism.

Brent crude futures are up +62c, or +1.01% at +$61.80 per barrel – Brent has rallied +2% this week, its third consecutive week of gains, while U.S West Texas Intermediate (WTI) crude is at +$52.65 per barrel, up +58c, or +1.11% from Thursday’s close.

OPEC+ indicated yesterday that they had cut oil output sharply in December 2018 before a new accord to limit supply took effect on Jan. 1. This would suggest that the main producers have made a strong start to avoid creating a supply glut in 2019. In its monthly report, OPEC’s oil output fell by -751K bpd in December to +31.58M bpd, the biggest month-on-month drop in 24-months.

Note: The combination of production cuts by OPEC+, especially the Saudis, and tightening sanctions on Iranian oil exports is bringing the market close to equilibrium.

OPEC has cut its forecast for daily demand this year to +30.83M bpd, down -910K bpd from last year’s average.

Also, a surge in U.S crude output is undermining most of OPEC’s efforts – U.S output has increased by more than +2M bpd in the last 12-months to +11.9M bpd.

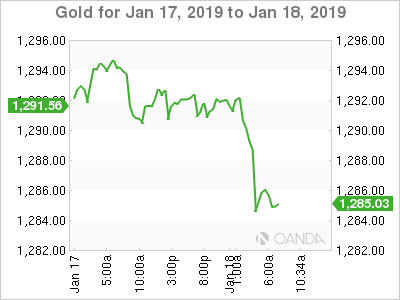

In commodities, palladium is holding above +$1,400 ($1,419) an ounce ahead of the U.S open after surging to record levels ($1,434.50) yesterday, amid tight supplies, while gold prices have eased as risk sentiment gets a leg-up from hopes of progress in U.S-China trade talks. Spot gold is down -0.1% at +$1,290.51 per ounce, while U.S gold futures are down -0.2% at +$1,290 per ounce.

3. Bund yields hit four-week high on “soft” Brexit hopes

In Friday’s Euro session, German Bund yields have backed up to a one-month high on renewed hopes that the U.K could avoid a messy divorce from the E.U, and perhaps hold a second referendum, raising the prospect of “no” Brexit at all. Also pushing yields higher are hopes of a more constructive stance in the Sino-U.S. trade talks.

German 10-year Bund yields have rallied to a near one-month high of +0.255%, up +3 bps on the day and nearly +9 bps this week; its first weekly rise since early November. Most of the other eurozone bond yields are also +2 to +3 bps higher ahead of the U.S open.

Elsewhere, the yield on 10-year Treasuries has gained less than +1 bps to +2.76%, reaching the highest in more than three-weeks on its fifth straight advance.

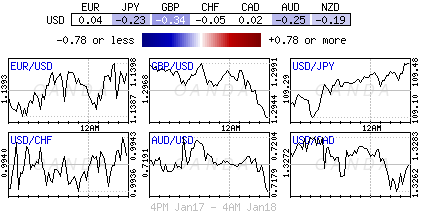

4. Big dollar supported by trade optimism

The Euro FX session has been very quiet with no new news out on Brexit and limited economic data releases.

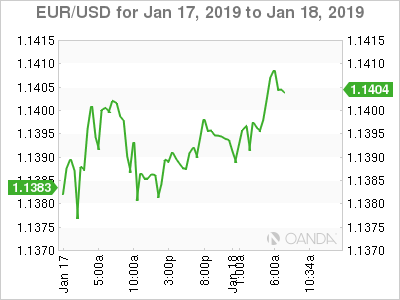

Improved risk sentiment, backed by positive Sino-U.S trade suggestions, has the USD poised for its first weekly gain in four-weeks, backed by rate differentials – Fixed income dealers have been pricing out the ability of other G7 central banks to start raising interest rates this year.

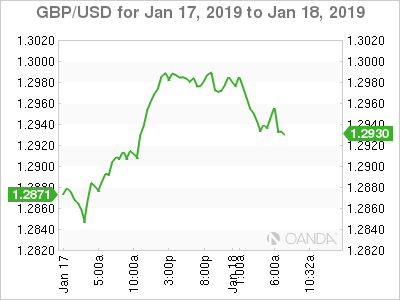

GBP/USD (£1.2944) heads into the U.S session giving up some of its late gains. Dealers believe that the Brexit process had pivoted toward a “softer” Brexit which has been supporting the pound over the past few sessions. Techies see £1.2800 level as strong support for the time being and £1.3000 as the psychological resistance.

EUR/USD (€1.1404) continues to be locked into its €1.13-1.15 range for the time being and caught between the Fed’s recent rhetoric of reaffirmed “patience” and concerns that the Eurozone might have slipped into a technical recession.

Optimism on the Sino-U.S trade front has helped to unwind a percentage of the safe-haven trades and put pressure on the Japanese Yen. USD/JPY higher by +0.3% at ¥109.55

5. U.K retail sales fall in December

Data this morning from the ONS shows that U.K retail sales declined last month, adding to signs the economy slowed in Q4, 2018.

U.K retail sales fell -0.9% in December m/m – the slide follows strong sales growth in November (+1.3%), suggesting that “Black Friday” sales encouraged consumers to bring forward their usual Christmas purchases.

Today’s print can be offered as the latest evidence that the British economy lost steam in the final three months of last year. Economists say tighter credit conditions and uncertainty over the U.K.’s future ties to the E.U are hurting both consumer and business confidence.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI