Tuesday October 25: Five things the markets are talking about

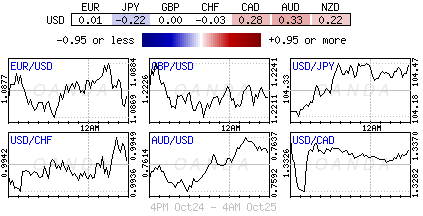

Rate differentials continue to support the “big” dollar, as it grinds higher across the board after a number of Fed speakers yesterday again lent their support for higher rates.

St. Louis Federal Reserve President James Bullard said December was “most likely” the best time for a tightening of borrowing costs, while Fed Bank of Chicago President Evans said it’s likely that interest rates will be hiked three times by the end of next year.

With U.S equities rallying Monday on the back of another upbeat round of corporate earnings, expectations are now high that U.S. economic data for Q3, released Friday, will paint a healthier picture of the world’s largest economy.

This has led to Fed fund futures pricing in a +74% chance for a December Fed hike. Will today’s U.S consumer confidence data and a speech by Fed Bank of Atlanta President Lockhart change those odds?

1. Asian stocks show mixed results, Euro and U.S futures trade higher

Asian equity markets traded mixed overnight, with some regional bourses dragged down by disappointing South Korean GDP data, which drove the country’s KOSPI index to edge down -0.5%.

In contrast, Japanese shares hit a six-month high as the yen (¥104.45) again underperformed against the USD, aiding export dominated companies. Japan’s Nikkei 225 rallied +0.8%.

European stock markets have opened a tad higher with the Stoxx Europe 600 rallying +0.3% in early trading, led by the basic resources and the telecommunications sectors and as German IFO comes in better than expected.

Commodity, mining and energy stocks are leading the gains seen in the FTSE 100. Investors are also waiting for Thursday’s U.K data to provide a first glimpse at post-Brexit Britain with the release of the Q3 GDP data (exp. +0.4% vs. +0.6% q/q). A strong report could convince the market to expect less monetary stimulus from the BoE?

In the U.S, futures markets currently point to a +0.2% opening gain for the S&P 500.

Indices: Stoxx50 +0.3% at 3,105, FTSE 100 +0.5% at 7,020, DAX +0.6% at 10,821, CAC 40 +0.4% at 4,569, IBEX 35 -0.1% at 9,209, FTSE MIB +0.6% at 17,402, SMI flat at 7,989, S&P 500 Futures +0.2%

2. Crude oil prices mixed as OPEC members argue

Getting a consensus from OPEC is like herding wild cats – it’s not going to happen.

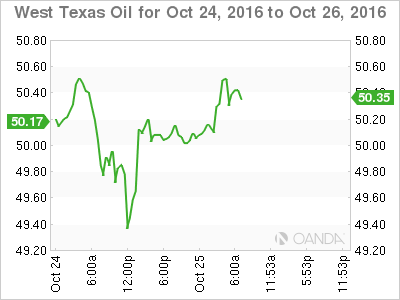

Oil prices continue to bounce about in choppy trade as disagreement persists on who should cut how much production in a planned coordinated reduction to support global prices.

In early trade, Brent crude oil futures have fallen -5c to +$51.41 per barrel, while U.S WTI crude futures have turned positive, gaining +5c to +$50.57 a barrel.

Not helping energy prices is the U.S dollar trading near new nine-month highs.

On the weekend Iraq’s oil minister said his country (OPEC’s second-largest producer) wanted to be exempt from output curbs, as they needed more money to fight ISIS.

For investors, until there is more clarity on “proposed” planned cuts between OPEC and non-members, crude prices are likely to remain range-bound, but volatile.

Speculators will look to today’s weekly API crude stocks estimates and tomorrow’s EIA data for direction.

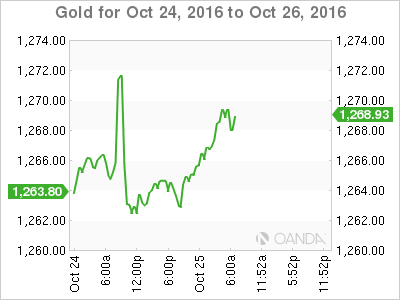

Gold prices have edged slightly lower (down -0.1% at +$1262.76) as the “big” dollar gains on increasing expectations of a December Fed hike. The precious metal’s price swings are expected to become more volatile in Q4 on the back of the U.S. presidential election as investors will look to gold as a hedge against financial uncertainty.

3. U.S yield curve little changed despite hawkish comments

U.S 10-year yields remain steady in early trade at +1.76% after climbing +3bps points in yesterday’s session.

With the market focusing on Fed speak; dealers will need to adjust their curves if Chicago’s Fed President Evans is proven correct with his prediction for three interest-rate increases by end of next-year.

With fed futures pricing in a +74% chance of a Dec. hike, analysts are predicting that the U.S benchmark will end 2017 backing up north of +2.20%.

Elsewhere, Japan’s 20-year JGB rose for a fourth consecutive day after demand picked up in today’s government auction – the yield fell -0.5bps to +0.37%, matching its lowest print for October.

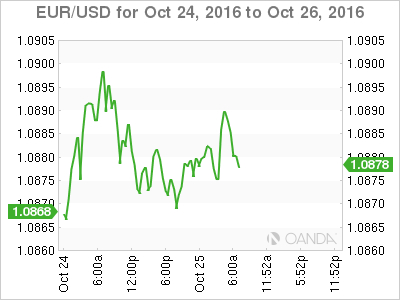

4. Is the dollar getting ahead of itself?

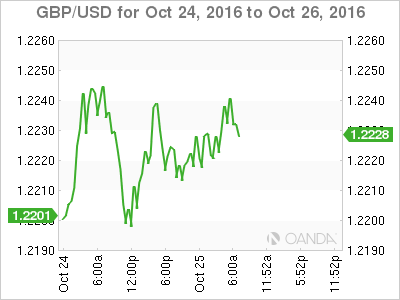

As capital markets heads into the home stretch of a contentious U.S Presidential election, the dollar continues to grind painfully higher across the board, egged on by a December Fed rate hike.

Is the world’s reserve currency of choice now running ahead of the rates markets even as expectations for the Fed to raise interest rates at year-end have topped +74%? The contrarian trader would probably agree, but bucking the trend can be expensive.

Some believe the dollar is trading stretched against the JPY (¥104.45) and CAD (C$1.3325) in particular, relative to short-term financial market drivers.

Looking at futures reports, the dollar exposure has built up quickly to levels last seen at the start of this year. With a number of USD bulls wary of geopolitical events over the next few weeks, don’t be surprised to see the “mighty” buck give up some of its recent gains for no reason aside form positioning.

5. German Ifo data rallies to a multi-year high

German business sentiment rose to a 2.5-year high this month, strong proof that Europe’s “engine” is picking up speed.

Germany’s Ifo’s institute business climate index rose to 110.5 points from 109.5 in September, reaching the highest level since April 2014. The market had been expecting a slight decline.

The report revealed that domestic companies were more satisfied with their current business situation and expressed “far greater optimism” about the months ahead.

Are things about to change? German companies are sitting on half-trillion dollars of cash, and reluctant to invest it in their own country because of weak economic outlook, regulatory uncertainties and geopolitical risks.