Friday June 8: Five things the markets are talking about

Global equities saw red overnight, as tech stocks continued their retreat in the Asian session, while in Europe, stocks has been hampered by disappointing industrial production data from Germany.

All market negativity is supporting investors’ risk-off mood ahead of today’s G7 summit beginning in Quebec, Canada.

The G6+1 meeting is expected to be an intense affair amidst heightened trade tensions between the US and some of its closest allies.

Naturally, the market is looking for further clues on trade after the Trump administration’s decision last week to impose tariffs on steel and aluminum imports from fellow G-7 countries. With President Trump already announcing that he is leaving early on Saturday don’t expect much to be achieved.

US Treasuries are steady after 10-year yields tumbled as much as -9 bps yesterday, and the dollar has edged higher.

On Tap: Canadian employment numbers are expected at 08:30 am EDT.

1. Stocks see red

In Japan, the Nikkei share average snapped a four-day winning streak overnight as investors stayed on the sidelines ahead of major economic events, while large-cap stocks weighed on the index. The Nikkei ended -0.6% lower, but is still up +2.4% for the week, its biggest gain in nearly three-months. The broader TOPIX fell -0.4%.

Down-under, Aussie shares ended lower in light trading as investors kept to the sidelines ahead of key central bank meetings next week with losses in industrial and material stocks outweighing gains in consumer and energy stocks. The S&P/ASX 200 was down -0.2%. It advanced nearly +1% this week, in its first weekly gain in four. In S. Korea, the Kospi was down -0.7%.

In China and Hong Kong stocks fell overnight, as investors were worried about the impact from the listings of big-caps, and amid uncertainty over trade relations. The CSI 300 was down -1.3%, while the Shanghai Composite Index also lost -1.3%. In Hong Kong, the Hang Seng index dropped -1.2%, while the Hong Kong China Enterprise (CEI) lost -1.3%.

In Europe, regional bourses trade lower as the risk-off trade intensifies, and is tracking US index futures lower. The tech sector in particular has been one of the hardest hit on rumours that Apple (NASDAQ:AAPL) has warned on a -20% decline in new iPhone parts orders.

US stocks are set to open deep in the ‘red’ (-0.6%).

Indices: STOXX 600 -0.6% at 383.7, FTSE 100 -0.7% at 7649, DAX -1.2% at 12656, CAC 40 -0.3% at 5432, IBEX 35 -0.9% at 9740, FTSE MIB -1.5% at 21433, SMI -0.8% at 8484, S&P 500 Futures -0.6%

2. Oil prices fall on dip in China demand, surging US output, and gold higher

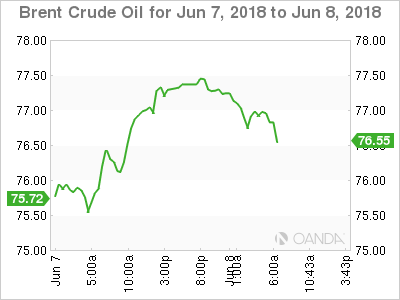

Oil prices are under pressure as signs of weakening demand in China and surging US output weighs on markets despite support from supply woes in Venezuela and OPEC’s production cuts.

Brent crude futures are at +$76.79 per barrel, down -53c, or -0.7%, from yesterday’s close. US West Texas Intermediate (WTI) crude futures are down -38c, or -0.6% at +$65.57 a barrel.

Customs data this morning showed that China’s May crude oil imports eased away from a record high hit the previous month, with state-run refineries entering planned maintenance.

May shipments were +39.05m tonnes, or +9.2m bpd vs. the +9.6m bpd in April.

Further weighing on prices has been surging US output. According to this week’s EIA report, it hit another record last week at +10.8m bpd.

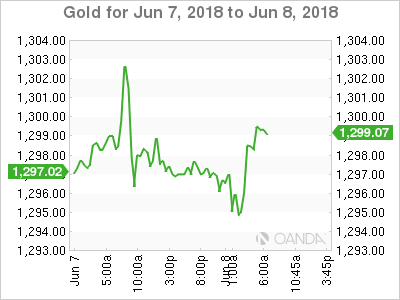

Ahead of the US open, gold prices have eased as the dollar has inched up, while investors’ remain cautious ahead of today’s G7 meeting and other key events next week such as a US Federal Reserve policy meeting and a US-North Korea summit (June 12).

3. Investor demand push sovereign yields lower

In Europe, the cost of insuring exposure to Italy’s sovereign debt has jumped this morning due to broad-based global risk aversion and unease about Rome’s spending plans, prompting a sell off in Italy’s government bonds.

Italian 2-yearBTP yields have rallied +20 bps to +1.775% percent, while a rise in 10-year BTP yields pushed the gap over benchmark German Bund yields to around +265 bps – the widest in around two-weeks. Under risk aversion, Germany’s 10-year Bund yield has fallen -5 bps to +0.43%.

Elsewhere, the yield on 10-year Treasuries fell -1 bps to +2.91%, the lowest in a week, while in the UK the 10-year Gilt yield sank -4 bps to +1.4%, the largest tumble in more than a week.

4. Dollar in demand ahead of G6+1

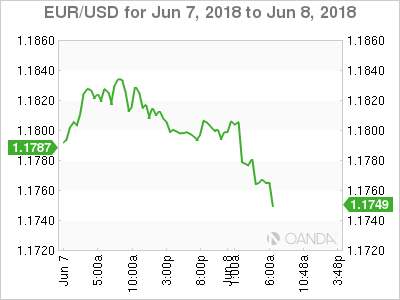

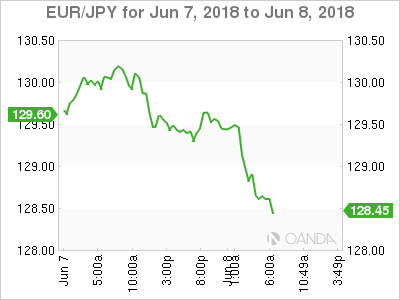

There are no surprises that risk-aversion dominates proceedings ahead of today’s G6+1 summit on concerns that the US trade row could deepen.

EUR/USD (€1.1770) is again trading below the psychological €1.18 level as Italian yields continued to edge higher and widen the spread to Bunds.

GBP/USD (£1.3412) is again being dominated by Brexit proceedings. The market does not seem to like the recent proposal on the ‘backstop’ from the UK.

Note: The UK would not leave the customs union until permanent arrangements could be put in place, possibly involving new technologies that avoid the emergence of a visible border between Northern Ireland and the Republic.

USD/JPY (¥109.38) testing lower, trading atop of its one-week lows due to safe-haven flows.

5. German industrial output, exports fell in April

Early morning data showed that German industrial production and exports declined in April compared with March. Again, this would suggest that Europe’s largest economy is struggling to gain momentum following a weak Q1.

According to the Federal Stats office, German industrial output dropped -1.0% from March while exports slipped -0.3%. Market consensus had expected a small increase in industrial production.

Data published Thursday showed that German manufacturing orders dropped for the fourth consecutive month in April, which suggest that the slowdown has indeed entered Q2.

Note: Germany’s annualized growth rate slowed to +1.2% in Q1 from +2.5% in Q4, 2017.