Thursday December 14: Five things the markets are talking about

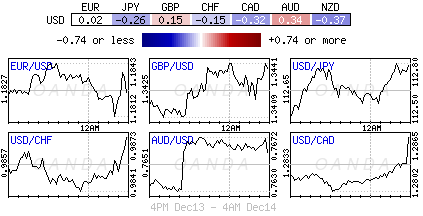

Global equities continue to drift as investors await the outcome of the last ECB meeting of the year (07:45 am EDT). Ahead of the U.S open, the ‘mighty’ dollar has temporary halted its decline sparked by the Fed’s unchanged outlook yesterday for rate increases in 2018.

Note: The Swiss National Bank (SNB) and Norges bank left rates unchanged as expected (see below), however, Norway seems to have brought forward its first planned rate hike. Turkey’s central bank said it will keep monetary policy tight until the inflation outlook displays a significant improvement and becomes consistent with targets – it raised its late liquidity window rate by +50 bps.

On Wednesday, the Fed raised interest rates another +25 bps and is expected to make three more such moves next year. In her final press conference at the helm, Chair Janet Yellen made it clear there is little to be concerned about in the U.S economy. Growth is strong, hiring is robust and there are no dangerous bubbles on the horizon.

Most Fed officials now expect some boost to economic growth from the tax package now working its way through Congress. Coming tax cuts likely would raise consumer and business spending, providing “some modest lift” to economic growth in coming years.

U.S officials expect unemployment to fall to +3.9% by the end of next year, down from their earlier estimate of +4.1%. And yet, despite those signs of a stronger economy, officials see no more inflation than they anticipated in September and no cause to raise interest rates more aggressively than they expected three-months ago.

Now it’s on to the ECB and BoE rate announcements this morning. Both central banks announced significant policy changes after their last meetings and the market now expect them to stand pat while officials assess developments. Investors should be looking President Draghi’s comments in his press conference (08:30 am EDT) for more clues about plans to start weaning investors off its monthly bond purchases next year.

1. Stocks struggle after new records

In Japan overnight, the Nikkei share average slipped as banks and insurer shares weakened in line with lower interest rates. The Nikkei ended down -0.3%, while the broader Topix was -0.2% lower.

Down-under, shares fell on Thursday and broke a five-session run of gains, with financials and real estate stocks accounting for most of the losses. The S&P/ASX 200 index declined -0.2%. In S. Korea the KOSPI closed out its session little changed.

In Hong Kong, equities were also little changed, as investors gave muted reaction to the Fed’s widely expected U.S rate hike. At close of trade, the Hang Seng index was down -0.19%, while the Hang Seng China Enterprises index rose +0.1%.

In China, stocks fell on Thursday, after the PBoC nudged up money market rate (see below) following the Fed’s rate hike. At the close, the Shanghai Composite index was down -0.29%, while the blue-chip CSI300 index was down -0.57%.

Note: China’s central bank lifted money market rates as authorities sought to defuse financial risks without imperilling the economy.

In Europe, regional indices trade mixed this morning with the DAX, CAC and the FTSE trading lower with Spanish and Italian markets trading slightly higher.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx 600 -0.1% at at 390.1, FTSE -0.2% at 7482, DAX -0.3% at 13088, CAC 40 -0.2% at 5388, IBEX 35 +0.1% at 10270, FTSE MIB +0.2% at 22442, SMI -0.1% at 9384, S&P 500 Futures +0.1%

2. Rising U.S output threatens global oil market balance, gold higher

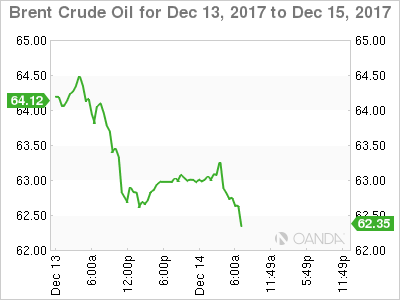

Oil prices remain better bid ahead of the U.S open as industry data this week revealed a larger-than-expected drawdown in U.S crude stockpiles. Also aiding prices is the markets expectation for an extended shutdown of a major North Sea crude pipeline.

Brent crude is up +19c, or +0.4% at +$64.03 a barrel, while U.S light crude (WTI) is up +15c, or +0.2%.

U.S API data on Tuesday indicated that domestic crude stocks fell by -7.4m barrels last week. That is almost twice the decline of market expectations for a drop of -3.8m barrels.

Also providing support is the news that Britain’s biggest pipeline from its North Sea oil and gas fields is likely to be shut for several weeks for repairs.

Nevertheless, prices are expected to be capped in the medium term as a report from the IEA this morning stating that the global oil market will likely show a surplus in H1 of 2018, as rising U.S. supply offsets OPEC’s discipline in maintaining its production cuts for the whole of next year

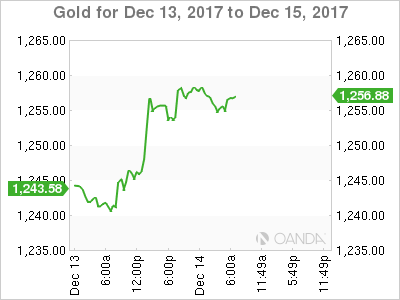

Gold prices hit it’s highest print in a week overnight, as the dollar remains somewhat on the defensive after tumbling in the previous session following the Fed’s decision on interest rates. Spot gold is up +0.1% at +$1,256.40 an ounce, after earlier touching its highest since Dec. 7 at $1,259.11 in the Euro session.

3. Central banks monetary policy decision

This morning’s Swiss National Bank (SNB) rate decision was as expected with the deposit rate unchanged at -0.75% and the SNB saying it is still willing to intervene in currency markets if the franc gets too strong. Officials also stuck with their assessment that the franc remains “highly valued” and that it’s too early to talk about ‘normalization’ of Swiss monetary policy.

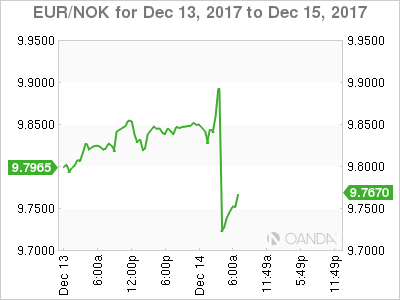

In Norway, government bonds remain stable after the Norges Bank (central bank) left its key rate unchanged at +0.50%, in line with expectations. The Norway 2-Year trades at a yield of +0.45%, while the 10-year bond trades at a yield of +1.49%. Officials say there is a continued need for expansionary monetary policy.

In China, the People’s Bank of China (PBoC) overnight raised two key short-term interest rates in tandem with the Fed’s hike. Officials raised the rates it charges commercial banks on seven-day and 28-day loans by +5 bps each. It also raised rates for a medium-term liquidity instrument. The increases were smaller than 0.10 percentage-point moves in the first quarter, and the bank left the benchmark policy rates unchanged.

Note: This surprise move suggests that China’s policy makers are trying to strike a balance between easing pressure on the yuan and reducing capital flight on one hand, and managing higher borrowing costs on the other.

4. Dollar under pressure from Fed hike

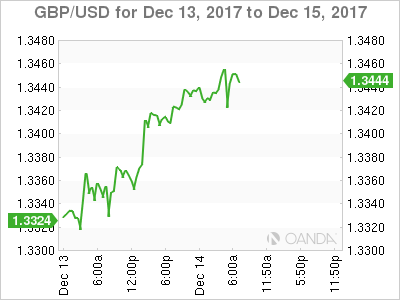

Heading into the U.S session, the USD (£1.3442, €1.1830 and ¥112.74) continues to maintain its softer tone in the aftermath of the yesterday’s FOMC rate decision, which is viewed as a “dovish” Fed hike.

The greenback has softened as the Fed ‘dots’ basically stuck to its rate projections. It would suggest that dealers and investors alike want to keep challenging the Fed’s ability and willingness to get inflation to +2%.

Elsewhere, the CHF (€1.1686) has fallen slightly after the SNB left interest rates on hold this morning, as expected, while it says the currency remains “highly valued” despite its recent depreciation. Officials indicated that while the CHF’s “overvaluation” has continued to decrease, “the negative interest rate and the SNB’s willingness to intervene in the FX market as necessary remain essential.”

The NOK (€9.7401) has rallied more than +1% after the Norges Bank kept interest rates steady, but says “changes in the outlook and the balance of risks imply a somewhat ‘earlier’ increase in the key policy rate than projected.”

The Turkish lira falls sharply after the Central Bank of the Republic of Turkey raised the late liquidity window lending rate by just +50 bps to +12.75% from +12.25%, at the lower end of markets expectations. Many had expected an increase of +100 bps. USD/TRY has jumped +2% on the day to reach a 10-day high of $3.8909.

5. U.K. retail sales accelerate last month on Black Friday deals

Data this morning shows U.K. retail sales accelerated last month as Britons flocked to shops to take advantage of Black Friday discounts.

Sales grew by +1.1% on the month in November, more than twice the pace of growth seen in the previous month, and significantly above the markets estimate of +0.5%m/m.

The figures indicated a pickup in consumer spending in Q4, a welcome sign for the largely domestic-driven economy.

Digging deeper, growth in retail was driven largely by strong sales of electrical household appliances.

Note: The U.K economy has slowed visibly this year, as accelerating inflation, spurred by the pound’s (£1.3442) steep depreciation after last year’s Brexit vote, squeezed consumer spending.