It’s a nervy time for investors.

There are many factors that should be supporting riskier assets; improving economic outlooks in the U.S, Europe and China; U.S. corporate earnings and a gradual approach by the Fed to raise short-term interest rates and continued bond buying by the ECB and BoJ.

However, a lack of clarity on the timing and scope of promised pro-growth policies from Trumponomics, combined with uncertainty over whether the Fed will tighten rates at next months FOMC meeting has global equities losing momentum.

While in Europe, the Dutch parliamentary election on March 15 and the French first round presidential election on April 23 are also weighing on investor sentiment.

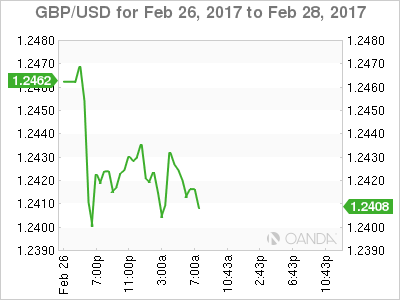

In the UK, whispers of a second Scottish Referendum in the works in the weeks around Prime Minister Theresa May’s triggering of the Brexit-inducing article 50 is battering GBP.

Note: The UK government is setting aside time for a Parliamentary battle to overturn changes May fears could be made to her draft Brexit law when it’s debated in the House of Lords this week.

In the U.S., fixed income is parting ways with the stock market; the divergence is a warning signal that the Trump “reflation” trade is in trouble.

Despite all the markets negative undertones, all of this could change this week with President Trump’s address to Congress Tuesday.

His speech will be scanned for guidance and insights on his proposed tax cuts and tax reform program, regulation, trade policy, and immigration.

1. Global equities see red

The rally in global equities that helped push their value above +$70T is losing momentum as investors grabble with political uncertainty and the Fed tightening timing.

In Japan, the Nikkei share average fell to 2-1/2 week low overnight as the yen strengthened (¥112.24) and as financial stocks dropped on lower U.S. yields.

In China, blue chips posted their biggest single-day loss in two-months after the securities regulator vowed to step up their campaign against speculation and hinted about loosening its grip on new IPO’s. The CSI 300 index fell -0.8%, its sharpest drop since Dec. 23, while the Shanghai Composite Index also weakened -0.8%.

In Hong Kong, stocks fell for the third consecutive session, as the market’s strong months-long rally showed signs of fatigue. The Hang Seng index dropped -0.2%, while the HK China Enterprises Index lost -0.8%.

In Europe, equity indices are trading mixed as the market await Trump’s address to Congress on spending and tax plans tomorrow. Insurers are weighing down the FTSE 100 after the Chancellor amended the discount rate for Personal Insurance claims resulting in financial impacts on 2016 profits. However, the major banking stocks are providing support across the indices, while energy stocks are trading notably higher.

U.S. equities are expected to open unchanged.

Indices: Stoxx50 +0.2% at 3,313, FTSE +0.2% at 7,260, DAX +0.1% at 11,819, CAC 40 -0.1% at 4,842, IBEX 35 +0.1% at 9,458, FTSE MIB +0.8% at 18,737, SMI -0.2% at 8,508, S&P 500 Futures flat

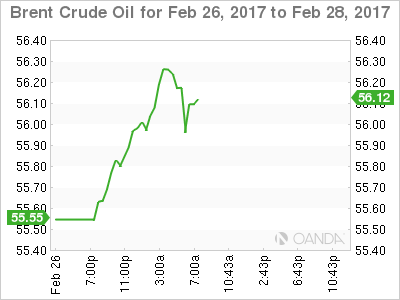

2. Oil prices confined to a tight range, gold up

Ahead of the U.S. open, oil prices remain better bid, as the global supply glut appears to be easing, however, rising U.S. production is expected to limit gains.

Brent crude oil has climbed +0.8% to +$56.44 per barrel, while U.S. West Texas Intermediate (WTI) added +0.7% to +$54.35 a barrel.

Note: Oil prices tumbled on Friday after data from the EIA showed U.S. crude inventories rose for a seventh straight week. Domestic stocks rose +564k barrels to +518.7m last week.

The market has been supported within a tight +$4 – $5 range since November, when OPEC agreed to cut production. Currently, the IEA puts OPEC’s average compliance at a record +90% in January for the six-month deal.

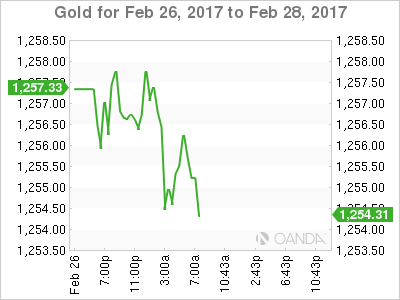

Gold prices are holding firm this Monday, trading atop of its four-month highs hit in the previous session (+$1,260.10) as investors await more clarity on President Trump’s economic policy. The metal jumped +1.8% last week for its fourth straight weekly advanced.

Note: Hedge funds have raised their net ‘long’ position in COMEX gold to the highest in nearly three-months during the week to Feb. 21 – by +14,482 to 82,464 lots.

3. FI trading diverged from equities

Last week’s February FOMC minutes appeared to pull forward hopes for the next rate hike, but the market is not yet behind a rate move in March.

Current futures prices seems to suggest that most believe the best bet could be May or more likely June rate hike, when the Fed is currently scheduled to hold a post-meeting press conference.

On Friday, U.S. Treasury yields were further pressured by a decline in German bunds. Political concerns and talk of an ECB-induced short squeeze sent the German 2-year yield towards -1%, while the U.S benchmark 10-year yield, which peaked at +2.43%, slid to a week close out of + 2.32%.

In France, 10-year bond yields hit a one-month low this morning (-2.5 bps to +0.90%), pushing other euro zone sovereign yields lower (Spanish, Italian and Portuguese yields all fell between -3 and -5 bps) as polls show centrist Macron would easily beat far-right candidate Le Pen in May’s presidential election runoff.

In Germany, the Treasury department set a 0% coupon on the new March 2019 Schatz – all recent Schatz series carry a similar coupon to reflect the low yield environment. The 10-year bund trades atop its historic lows (-0.19%).

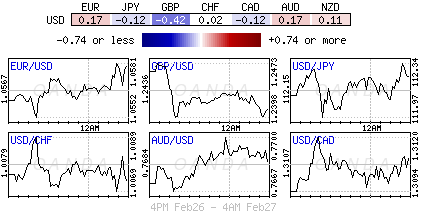

4. Dollar in consolidation mood

Ahead of the U.S. open, the ‘mighty’ USD is consolidating its recent losses before President Trump’s first major policy address to Congress on Tuesday. Trump is expected to include some details of his infrastructure spending and tax plans, but any lack of fresh direction would disappoint capital markets and weigh again on the USD.

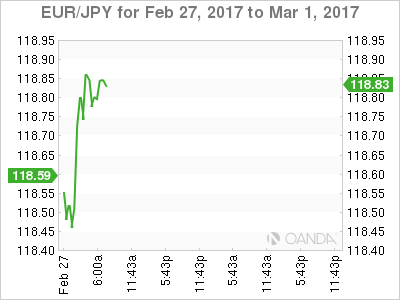

The pound (£1.2412) is again starting the week on the back foot, pressured by reports that the Scottish government could possibly be seeking another independence referendum next year. Europe’s single unit, the EUR (higher by +0.3% to trade at €1.0590), despite regionalist “populist” threats (Netherland and France) remains confined to its recent tight trading range.

Elsewhere, USD/JPY has moved off its two-week lows from Asia (¥111.98) and is trading atop minor resistance ¥112.25 just ahead of the N.Y open.

5. Eurozone confidence in line with expectations

Data this morning showed that Eurozone economic sentiment was in line with expectations in February. The headline print edged up to 108.0 from 107.9 and printed its highest level since March 2011.

Analysts note, that since consumer sentiment was “in-line” with the flash estimate, would suggest that business confidence rose significantly. This is consistent with the results of other recent surveys, which suggest the eurozone economy has gained some fresh momentum in Q1, despite heightened uncertainty about future policies ahead of a series of key elections across the currency region.

However, consumer inflation expectations were unchanged, despite the January jump in inflation, which supports ECB caution in the face of an otherwise encouraging data flow.