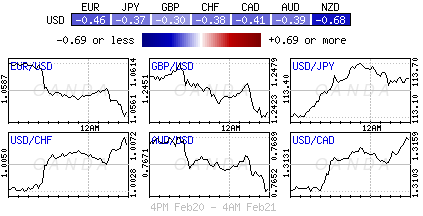

The ‘mighty’ dollar is trading firmer across the board following a hawkish set of comments from Fed voter Harker. The Fed member from Philadelphia reiterated that next months March 14/15 meeting should be on the table for the next rate hike, adding that the Fed is not behind the curve, that the U.S economy is healthy, and that jobs growth is steady.

Note: Later today Minneapolis Fed’s Kashkari and San Francisco Fed’s Williams are due to speak.

Earlier, Europe’s single unit came under pressure from concerns that France’s far-right candidate Marine Le Pen would the win upcoming French presidential elections, putting more pressure on eurozone solidarity.

1. Equities produce mixed results

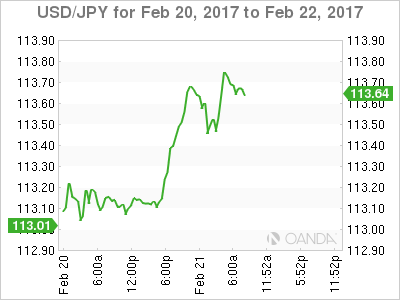

In Japan, stocks rallied overnight as a weaker yen (¥113.71) helped overall sentiment. The Nikkei climbed +0.7%, while the broader Topix rose +0.6%.

Note: Trading volumes were low as a holiday stateside left investors short of the usual leads.

Elsewhere, South Korea’s KOSPI index jumped +0.9% to the highest level since July 2015, while Hong Kong’s Hang Seng slipped -0.8%, the most in more than a month, while China’s Hang Seng China Enterprises Index lost -0.4% and the Shanghai Composite Index increased +0.4%.

In Europe, equity indices are trading mixed. The FTSE 100 is slightly underperforming, weighed down by shares of HSBC after the company released their FY16 results; major banking stocks trading generally lower across Europe. Elsewhere, commodity and mining stocks are trading mixed.

U.S equities are set to open in the black (+0.2%).

Indices: Stoxx50 +0.1% at 3,319, FTSE -0.3% at 7,279, DAX +0.4% at 11,879, CAC-40 +0.1% at 4,869, IBEX-35 flat at 9,523, FTSE MIB +0.5% at 19,068, SMI +0.4% at 8,548, S&P 500 Futures +0.2%.

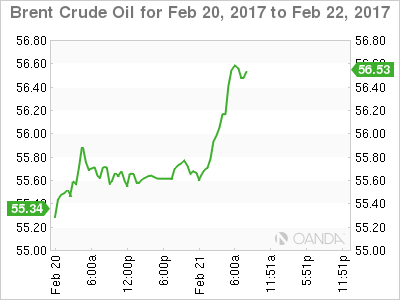

2. Oil rallies to top of range as OPEC cuts output, gold falls

Oil prices have rallied overnight as data showed that hedge funds placing record bets on North Sea and U.S. crude as OPEC production cuts tightened supply.

Brent futures are up +50c at +$56.58 a barrel, while U.S. light crude (WTI) is up +50c at +$53.90.

Note: OPEC has agreed to cut output by almost -1.8m bpd during the first half of 2017, with industry data showing that most producers are sticking to the deal (+93% compliance).

Despite this, inventories remain bloated and supplies high, especially in the U.S. Last week’s EIA report showed that crude and gasoline inventories soared to record highs as refineries cut output and gasoline demand softened. Crude inventories rose +9.5m barrels, while gasoline stocks rose by +2.8m barrels.

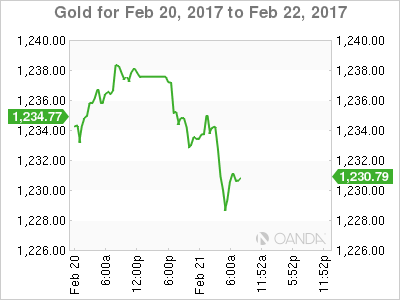

Gold (-0.2% to +$1,235.08 per ounce) prices eased slightly amid a firmer dollar as investors waited on clues on the timing of U.S. interest rate hikes in a host of speeches by Fed officials this week.

Note: The heads of five regional U.S. Federal Reserve banks are scheduled to speak this week

Elsewhere, iron ore futures have soared +3.2% after BHP Billiton (LON:BLT) warned that iron ore is at risk of declining in the near term after the component used to make steel jumped +34% this year.

3. French debt suffers Euro periphery spread problem

Investors are again selling the bonds of Europe’s peripheral economies amid political concerns. This time around, France has joined the club.

Investors are worried that France will elect Marine Le Pen as its president, a candidate that has promised to take the country out of the eurozone. A poll yesterday showed Ms. Le Pen comfortably in the lead for April’s first round of the presidential election – French 10-year bonds yields have jumped to +1.064%, while the spread with German bond yields have hit +0.84bps, the highest in more than four-years.

Note: In August, the gap was only +0.22bps.

Also rising are Italian and Portuguese 10-year yields, which are up by around +0.7% versus bunds in the last six-months.

In Greece, bond yields are lower this morning. Yesterday, the EU/ECB and IMF agreed to resume talks on the country’s second bailout review for its third program.

Greek 2-year yield were lower by over -100bps and the 10-year was lower by -20bps (+8.30% and +7.05% respectively).

In the U.S, the yield on 10-year Treasuries has advanced +3bps to +2.44%.

4. Dollar finally finds traction

The ‘mighty’ dollar starts this holiday-shortened week on firmer footing, supported mostly by ‘hawkish’ Fed comments yesterday (Philly’s Fed’s Harker).

The EUR (€1.0536) has not been able to benefit from better data in this morning’s euro session – major European PMI Manufacturing Survey (see below) confirmed that growth momentum in region with Germany handily beating expectations and printed a six-year high.

Also, Germany’s Bundesbank February Monthly Report yesterday noted that the domestic economy would stay on a strong footing in the coming months thanks to high industrial and construction activity. Nonetheless the ECB is seen to remain “accommodating” for this year.

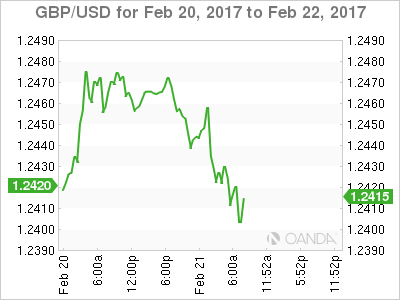

USD/JPY is up +0.1% at ¥113.47, while GBP/USD is down -0.3% at £1.2431. For the pound, much of the focus is likely to be on the large upward revisions to the BoE’s growth forecasts – well above the consensus – and is considered “unrealistically optimistic.”

5. Eurozone PMI’s stronger than expected

This morning, the composite PMIs for the eurozone in February came in much stronger than expected, jumping to 56.0 from 54.4 in January to reach its highest level in six-years.

Note: Consensus had expected a drop to 54.3.

The pickup seems set to continue over coming months, with new orders also at highs not seen in six years, while businesses hired workers at the fastest pace since August 2007, before the financial crisis.

Also, the ECB will be content that a rise in prices charged by businesses is at t the fastest rate since July 2011.