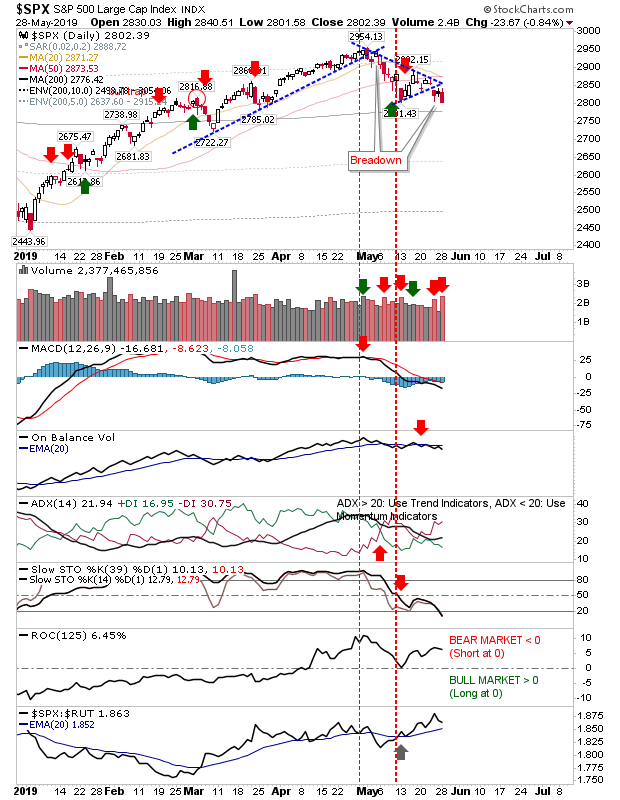

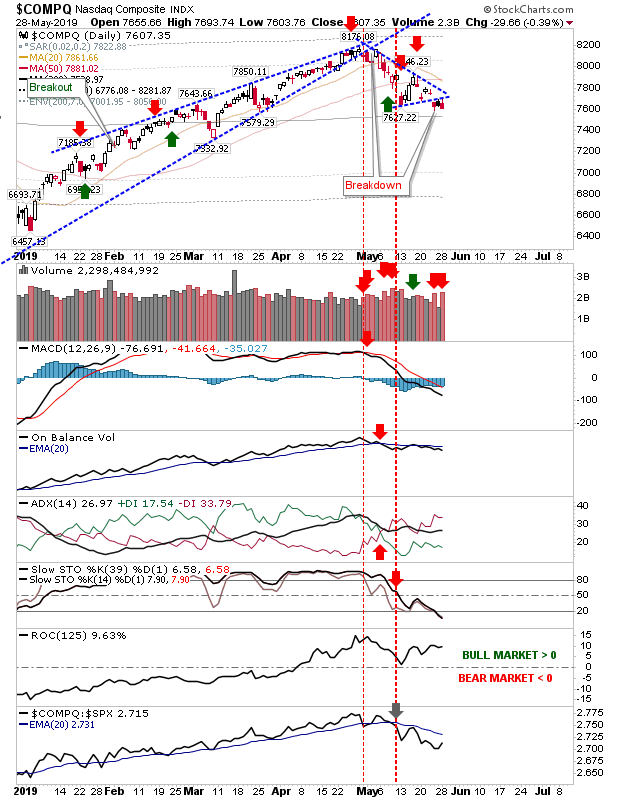

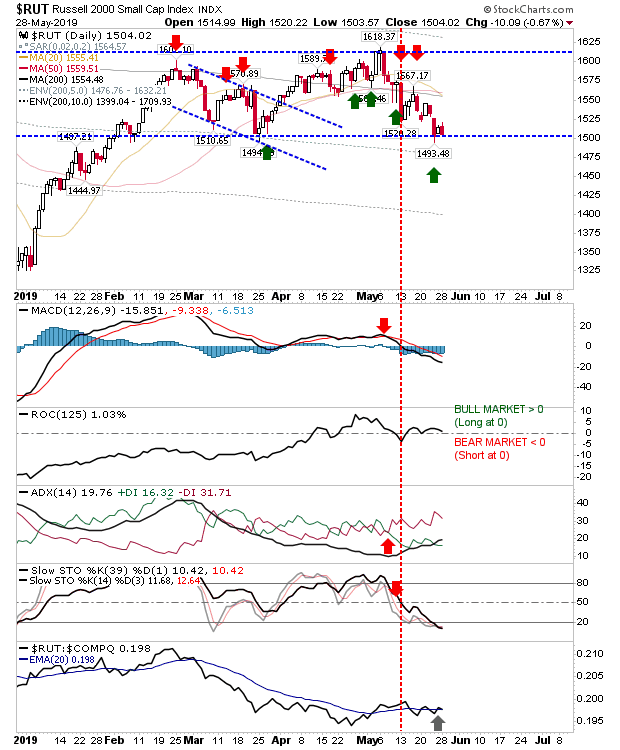

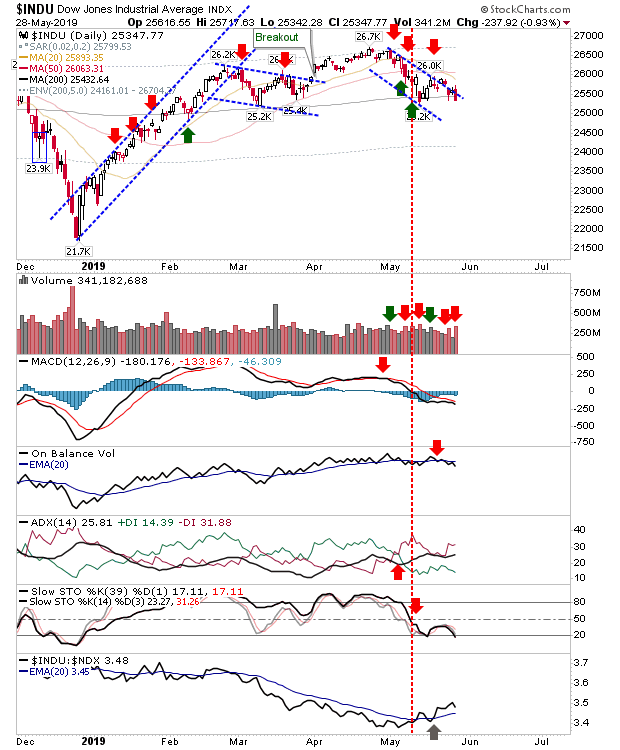

Traders returned from the Memorial weekend in a selling mood. Indices, already net bearish technically, suffered further losses on higher volume distribution.

The S&P is on course to test its 200-day MA, although relative performance continued to accelerate against the Russell 2000, which will be a cold comfort for current longs, but may be enough to prevent losses from getting too bad.

The NASDAQ experienced its second distribution in three days. Like the S&P it has the 200-day MA to lean on. Technicals are net bearish and relative performance has fallen off sharply against the S&P. Aside from the Russell 2000, Tech indices are looking particularly vulnerable.

The index which is looking likely to lose out first is the Russell 2000. Yesterday's action was anything but bullish and technicals aren't offering any comfort aside from an oversold condition - but market crashes come from oversold states (not overbought). Buyer beware.

The Dow Jones is a little worse off than the S&P as it is in the process of giving up its 200-day MA support. Again, it has the benefit of a relative performance advantage (against the NASDAQ 100), but it's questionable whether this will be enough to save it.

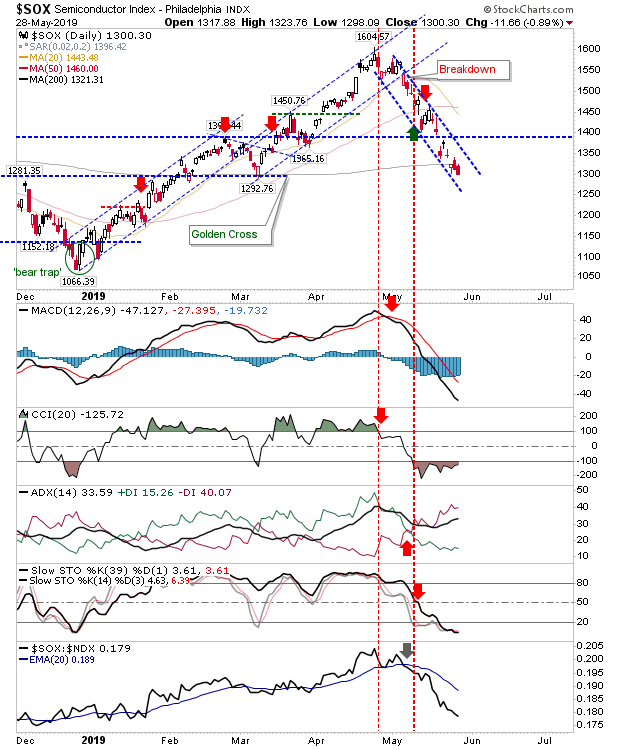

The Semiconductor Index undercut its 200-day MA as it remains on course to lose 20% from its highs. It's leaning on the last chance saloon of the March swing low, but should it give up this, only the December 2018 low remains.

For today, bears will be looking to lead out with further losses in the Dow Jones Industrial Average and a support break in the Russell 2000. Should this happen, then the S&P and NASDAQ will not be far behind. Longs could get very aggressive on the Russell 2000, running a tight stop, but the outlook is not looking particularly positive.