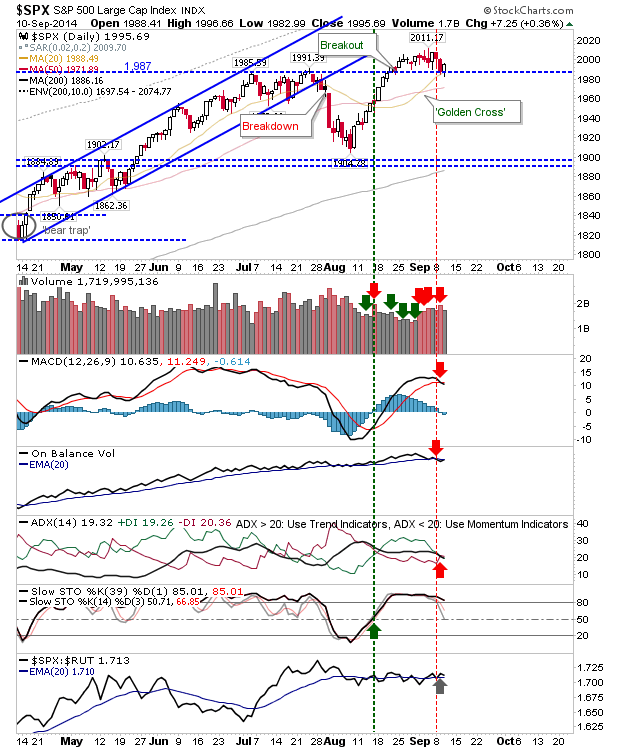

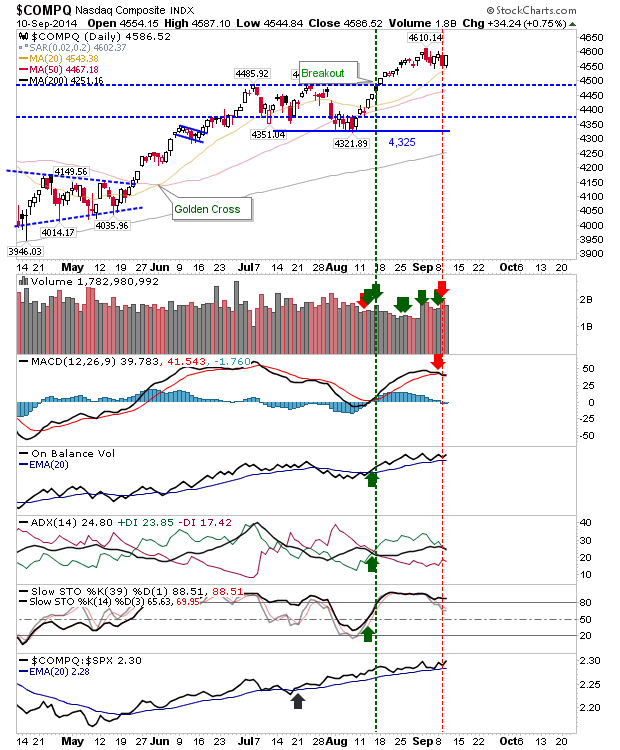

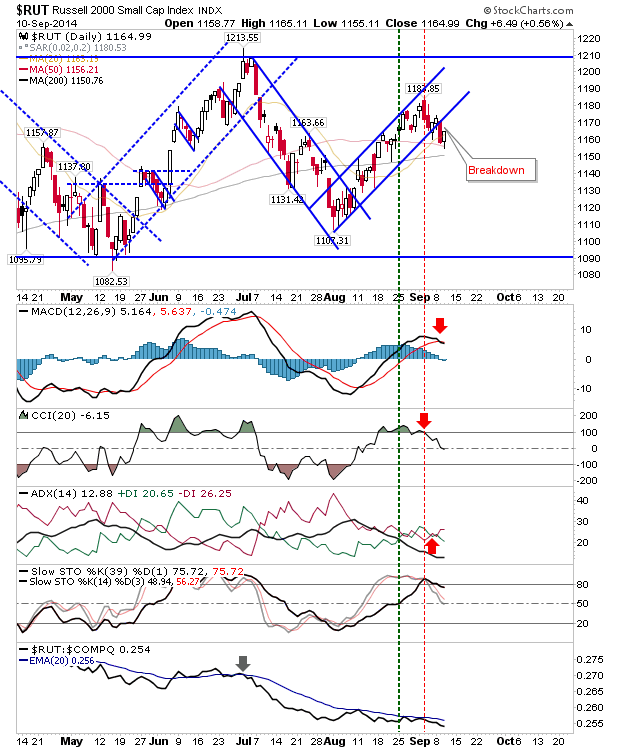

Yesterday, buyers made inroads into Tuesday's relatively mild losses. The point of defense were 20-day MAs of the S&P 500, Dow,NASDAQ and NASDAQ 100. The Russell 2000 found its love at the 50-day MA, although the 20-day MA is only a few points above it. While this offers near term upside opportunity, it has been rare for the 20-day MA to act as a launch point for a longer rally. Don't be surprised if this MA is again revisited next week.

The S&P has perhaps the most to gain given the significance of 1,987 support as it looks to push beyond the psychological 2,000 level. If there is a concern it's that technicals are favouring an expansion of the weakness: a move to the 50-day MA may be needed first.

The NASDAQ is also seeing the start of technical weakness, but Tech averages have had a good run since the start of August. It will take more than a nascent MACD trigger 'sell' to scare Tech shareholders out of their stocks.

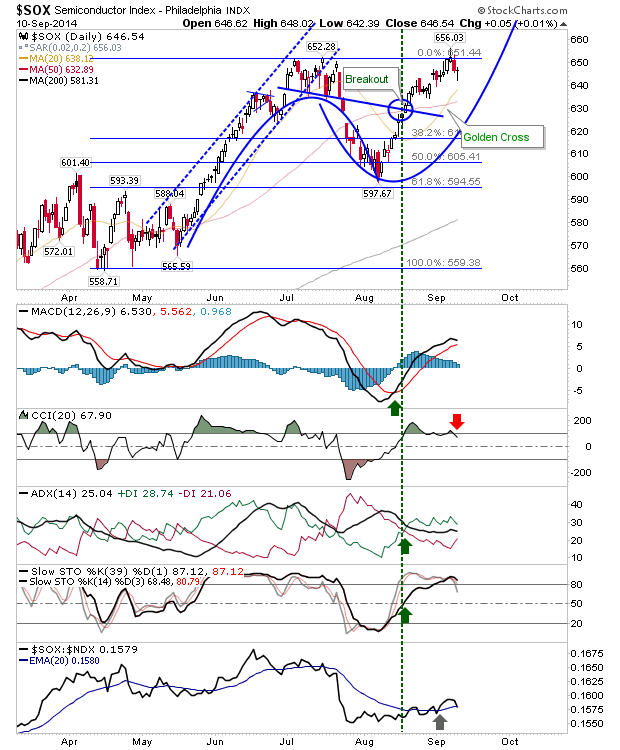

As a final mention, the Semiconductor index finished with a doji yesterday, close enough to resistance to suggest another challenge of this is on the way. Semiconductors look poised for a nice run. Probably from a rush to new iPhone 6s!