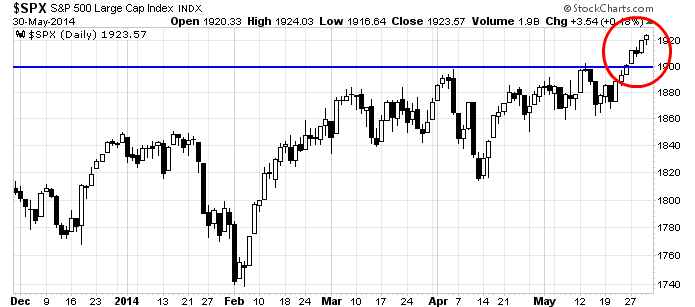

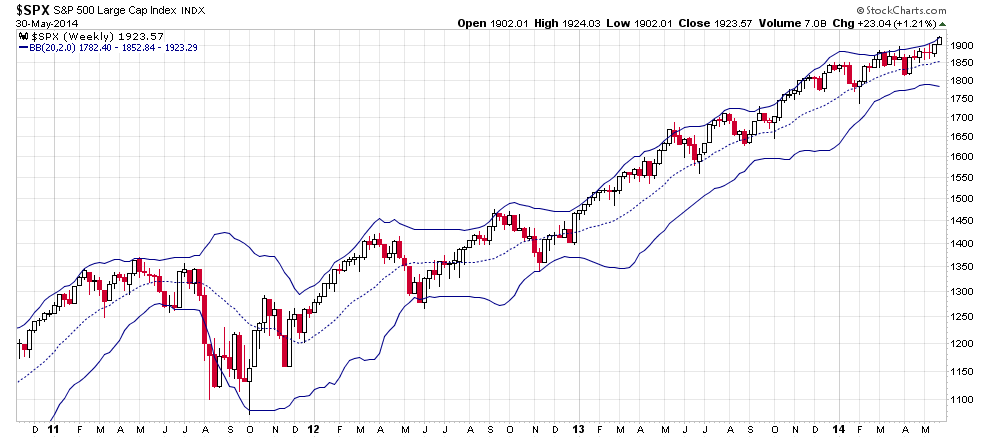

The analysis of financial markets has a low signal-to-noise ratio. Under those circumstances, good traders need to learn to admit when they were wrong and I am prepared to do that. Regular readers will know that I have been fairly cautious about the intermediate term outlook for US equities and I have been calling for a correction this summer. However, with the SPX pushing to new highs last week:

I have not moved to the bull camp, like BoAML which came out last week with a forecast of a market melt-up, followed by a nasty correction. However, I do believe that stock prices will remain range-bound in a choppy fashion until new developments cause the market to break up or down. That's because a number of forces are combining to either be supportive of stock prices or to put a lid on rallies.

Let's go through the bull and bear cases:

The bull case: Earnings outlook still positive

In a recent post (see Time for a growth scare?), I wrote that one of the critical drivers of stock prices is the earnings outlook. As Ed Yardeni pointed out, forward 12 month consensus EPS estimates continue to rise. In the current macro environment, rising EPS estimates are supportive of higher equity prices. Note how the red line in the chart below, which represents forward 12 month consensus EPS, is rising to new highs and past periods when the slope flattened out was associated with market corrections:

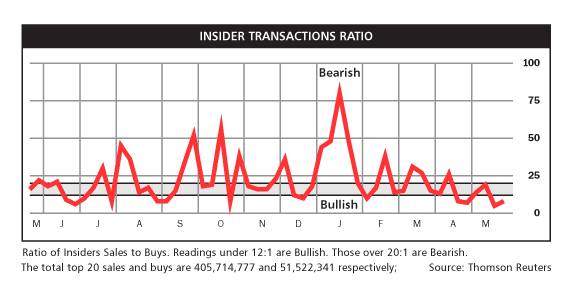

Bullish insiders

As optimism for earnings growth rises, insider activity has also flashed a big signal (via New Deal Democrat):

Hedge funds in a crowded short

As well, BoAML (link to article, above) pointed out that large speculators (read: hedge funds) are in a crowded short in SPX, Nasdaq 100 and Russell 2000 futures:

According to [Bank of America Merrill Lynch] Hedge Fund Monitor speculators have recently sold SPX to a net short position; Russell 2000 shorts are the highest they have been in 2-years, while Nasdaq longs are at a 1-year low.

I was the original author of the Hedge Fund Monitor and therefore I am very familiar with the data. I would discount the comment about SPX futures as I found that it had relatively low predictive value. However, extreme readings in large speculator futures positions in the NDX and Russell were good contrarian indicators of market direction for the next few weeks.

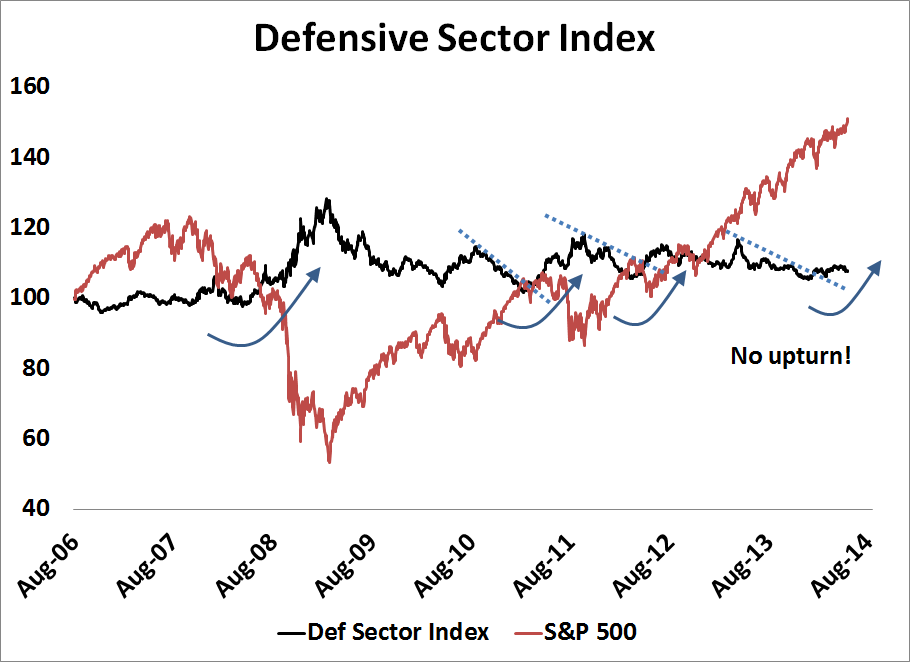

Late cycle and defensive sectors are faltering

In addition, a main reason for my cautiousness has been based on the signals from sector rotation as late cycle resource sectors and defensive sectors had been turning up to assume the mantle of market leadership. These were signs to be cautious about stock prices (see The bearish verdict from market cycle analysis). Since then, late market cycle leadership has stalled.

The chart below, of the relative performance of European Basic Materials against DJ Europe and Metals and Mining against the SPX both show a similar pattern of near-term relative weakness.

The bear case: Inflation ticks up = Rising short rates

While these factors are likely to put a floor on stock prices, there are a number of bearish factors that are likely to put a ceiling on any major advances by the stock market averages.

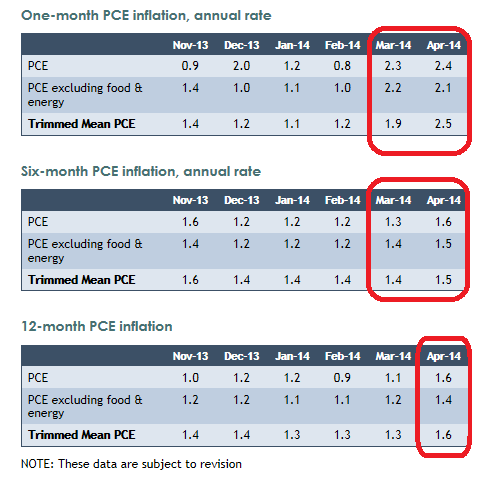

First of all, inflation is starting to tick up and that could cause an interest rate scare about the timing of tightening action at the Fed. This chart from Doug Short shows the Fed's favorite inflation metric, Personal Consumption Expenditures (PCE), is ticking up

Cyclical stocks still weak

I would also reiterate my concern that the CapEx cycle has yet to kick in for this recovery. At this point of the expansion, companies should be hiring and buying capital equipment. As mentioned above, Ed Yardeni, along with many other analysts, have been expecting a CapEx rebound:

The profits outlook remains bright according to the S+P 500 forward earnings. This series has been highly correlated with capital spending in real GDP and with nondefense capital goods orders.

Comparing capital spending in real GDP during the current expansion to the previous six shows that it has also been growing at a subpar pace. Spending on structures, on information processing equipment, and on intellectual property products (including software and R+D) have been especially weak. On the strong side have been industrial and transportation equipment.

Yet CapEx is nowhere to be seen. While the last headline Durable Goods report beat expectations, core Durable Goods growth was only 0.1%, which missed expectations, and Durable Goods ex-defense and volatile aircraft orders growth came in at an abysmal -1.2%.

As a measure of the market expectations of the CapEx cycle and expectations of economic growth acceleration, the relative performance of the Morgan Stanley Cyclical Index against the SPX has been rolling over. Could a growth scare be around the corner?

What is comforting to the bull case is the expectation of a rebounding US economy, which is becoming the consensus view. In his latest weekly report on high frequency economic releases, New Deal Democrat reported:

We remain on track for a strong rebound in economic activity and the GDP in the second quarter, and the rest of 2014 remains intact as well. We did get a small decline in the long leading indicator of corporate profits adjusted by unit labor costs for the first quarter, but on top of the fact that it can easily be reversed this quarter, it isn't of significance until next year, if the negative trend were to continue.

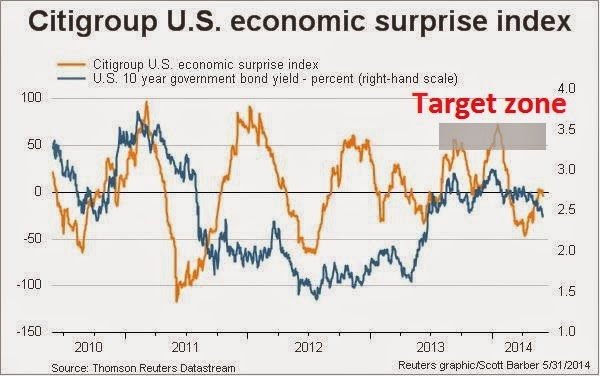

A glance at the Citigroup US Economic Surprise Index, which measures high frequency economic releases to see whether they are beating or missing consensus, shows it is rising and is now roughly at zero, indicating a rough balance between beats and misses after the spate of negative reports because of the bad winter. It may be that, with a rebounding growth outlook, we may need to see the Surprise Index rise to the grey target zone where there is an excess of positive surprises before the growth outlook and stock prices correct.

As the first-quarter earnings season wraps up, retailers in the consumer discretionary sector have been some of the last companies to report results. Throughout earnings season, consumer discretionary has been one of the stronger areas, with its 8.6% earnings growth rate outpacing the 5.5% growth of the S+P as a whole. But when it comes to looking ahead, the story has been less positive. Earnings growth for the second quarter is now estimated at 6.9%, just shy of the 7.1% growth anticipated for the index overall. The current 6.9% estimate is down from the 10.3% that was forecast on April 1. This 3.4 percentage point downward revision is the second steepest fall of any sector outside of materials over this time period.

Inter-market analysis still signaling caution

Despite the near-term failure of my market analysis, I continue to believe that inter-market analysis is still signaling caution for the stock market. To underline this point, my former Merrill colleague Walter Murphy wrote the following last week (emphasis added):

We have regularly pointed out that there has historically been an inter-market relationship between the S+P, yields, the euro, and select commodities. With that in mind, it seems important to note that 10-year yields, the euro, and gold have all recently broken down through important support trend lines. These breakdowns, along with price counts and weak momentum, suggest that lower lows are likely for these assets.

Nonetheless, and despite these inter-market pressures, the S+P has continued higher to all-time highs.

So the question is: Who missed the message? Was it the “500” or the other three asset classes? Given the equity market’s overbought momentum and sentiment indicators, as well as fragile seasonal considerations, it would seem that the S+P it the one listening to the wrong message.

Low volatility = Rising complacency

In addition, the fall in market volatility is fueling activity that might not be classified as "prudent". For example, the FT reports that investors have been reaching for yield by using the carry trade (borrow short-lend long) to enhance returns. These kinds of comments are signs of a maturing bull (emphasis added):

“The credit market is fully or fairly valued at the moment when we look at low default rates, strong company balance sheets and ease of debt financing,” says Edward Marrinan, head of credit strategy at RBS Securities.

He adds that an increase in the use of leverage, which is generally hard to measure, would definitely be a step towards pushing valuations in credit to an unsustainable level that would ultimately prompt a major correction.

Anecdotally, for instance, some investors are beginning to employ leverage to pump up returns on the senior slices of CLOs that currently offer the lowest yields.

“The carry demand is not just purely based on a reach for yield, it’s also based on low volatility,” says Marc Ostwald at Monument Securities. “The people who have been selling volatility have to get more and more aggressive about it. If they get more aggressive that means they have to get more leverage.”

FT editor Gillian Tett openly fretted about how this kinds of complacency might resolve itself:

For while ultra-low volatility might sound like good news in some respects (say, if you are a company trying to plan for the future), there is a stumbling block: as the economist Hyman Minksy observed, when conditions are calm, investors become complacent, assume too much leverage and create asset-price bubbles that eventually burst. Market tranquility tends to sow the seeds of its own demise and the longer the period of calm, the worse the eventual whiplash.

That pattern played out back in 2007. There are good reasons to suspect it will recur, if this pattern continues, particularly given the scale of bubbles now emerging in some asset classes. Unless you believe that western central banks will be able to bend the markets to their will indefinitely. And that would be a dangerous bet indeed.

So did Josh Brown:

Volatility is nowhere to be found – not in currencies, in fixed income or in equities. Complacency rules the day as investors and institutions gradually add more risk, using leverage and increasingly exotic vehicles to reach for diminishing returns in an aging bull market. This as economic growth – led by housing and consumer spending – stalls out and the Fed removes stimulus that never really worked in the first place.

And once again, the media is oblivious for the most part, fixated as it is on a French economist and the valuations of text messaging startups.

None of this has to mean disaster is imminent.

But man I wish it didn’t feel quite so much like de ja vu.

By deja vu, Brown was referring to two important blog posts about the dangers of complacency and the parallels with 2007. At this point, raising the ghosts of 2007 is a bit of an exaggeration as there is no recession on the horizon:

Charlie Bilello takes a time machine back to May of 2007 – the charts are all you need to see. (PensionPartners)

“The most notable thing in the financial markets today is the absence of anything notable: volatility has collapsed to near-historic lows.” (Economist)

In and of itself, low realized market volatility is not a concern. What is a concern is that it encourages undue risk taking and excessive leverage. Just as rising margin debt, by itself, is not a concern. However, if margin debt does get excessive and it starts rolling over, as it is doing now, that does become a cautionary signal.

Limited near-term upside

Though they warn of rising risk levels, none of the bearish factors that I mentioned are suggestive of an imminent crash in stock prices. In the near-term, however, the upside in stock prices are likely to be limited. Bespoke reports that 8 of 10 sectors in the SPX are overbought:

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.