As Joe Wiesenthal recently noted, it's the moment of truth for the US recovery and expectations are rising for faster growth:

All the pieces are in place for the U.S. The fiscal drag is fading. Household balance sheets have improved. State and local bloodletting is coming to an end. If not now, when?

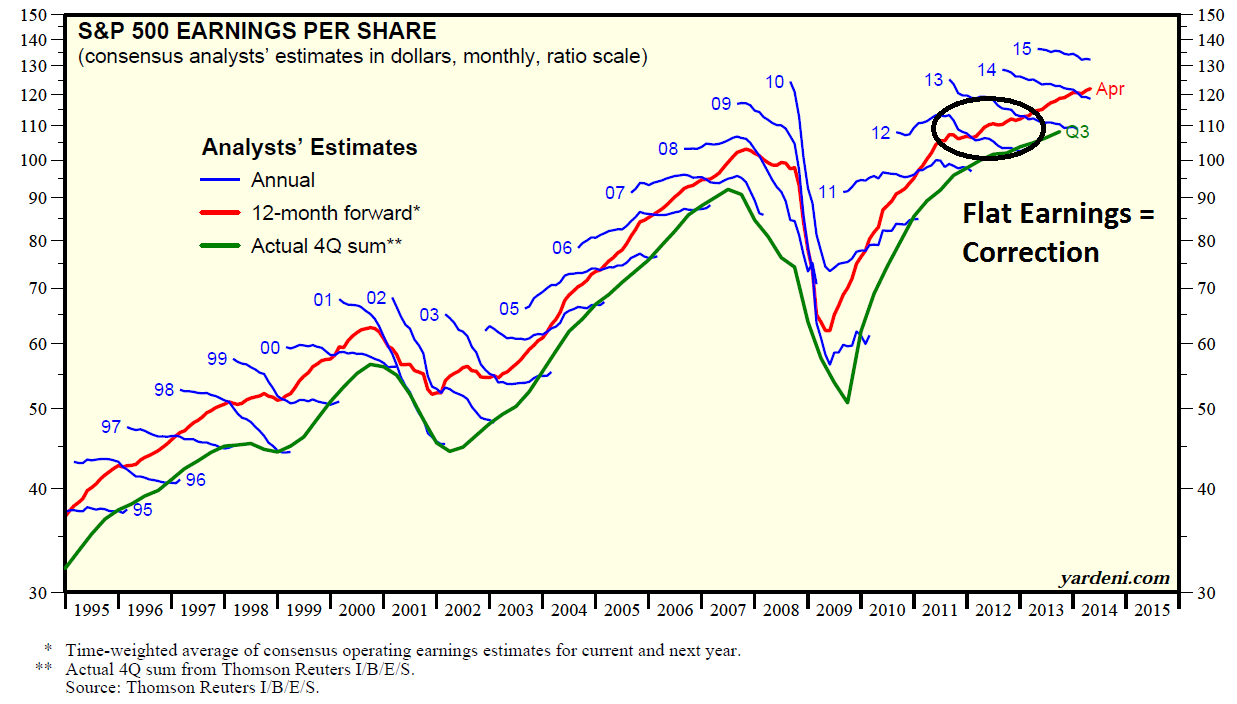

Indeed, the major US large cap equity averages pushed to new highs last week. The fundamentals appeared positive and supportive of the advance. Notwithstanding any unexpected shocks from the Fed, what really matters to stock prices are earnings. Ed Yardeni`s analysis shows that forward 12 month earnings continue to rise, while past periods of flat growth in 2011 and 2012 have been marked by market corrections.

Signs of weakness

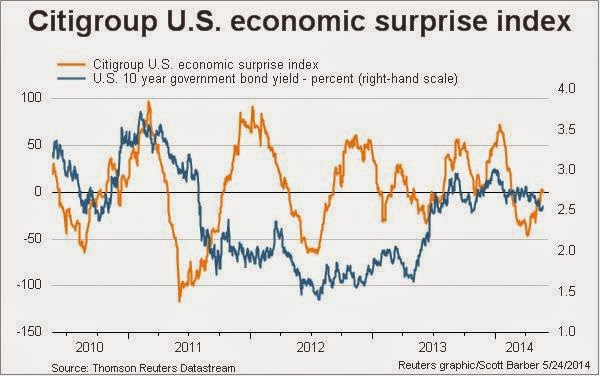

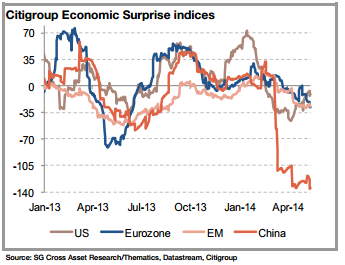

However, there are signs of weakness beneath the surface. Global growth is slowing. Societe Generale (via Pragmatic Capitalism) showed that the Citigroup Economic Surprise Index has been weak everywhere except for the US. Could a global macro growth slowdown be around the corner?

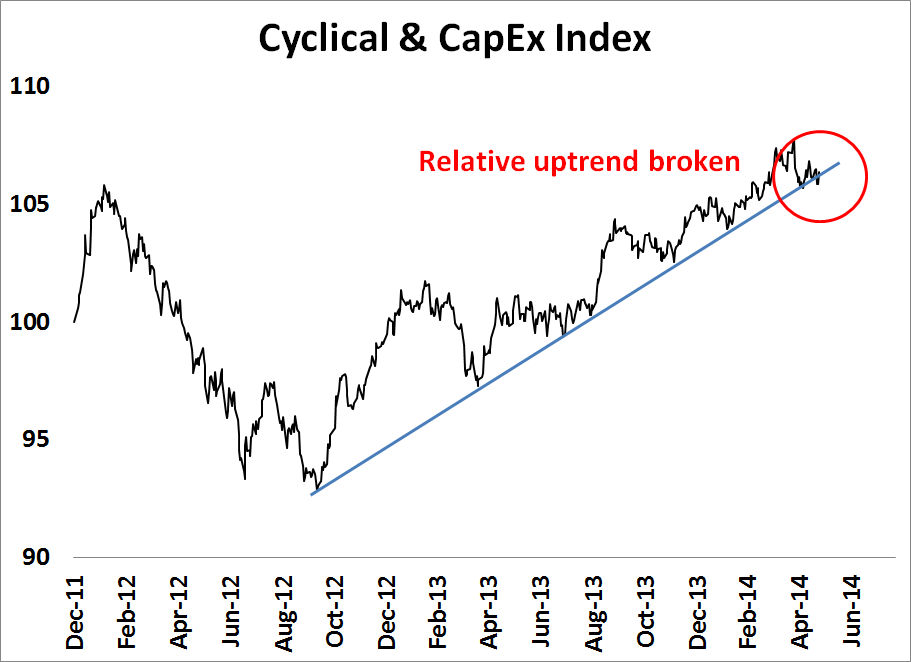

I have detailed in this blog over the last several weeks the technical concerns I have had about this stock market (see The bearish verdict from market cycle analysis and Market correction or consolidation?). I wrote that one of the key "tells" of the health of this latest bullish impulse is the performance of mid-cycle cyclical and capital equipment stocks.

The warning from cyclical stocks

Last week, they cracked, even as the major averages rallied to new all-time highs. The chart below of the relative performance of the Morgan Stanley Cyclical Index (CYC) show that cyclical stocks have definitively broken down out of a relative uptrend. Up until recently, it could be argued that the relative uptrend was a little wobbly but remained intact. The latest technical verdict from last week's market action was clear. No matter how you manipulate the trend line, the technical break was unmistakable.

Watch estimate revisions!

I have also thought of technical analysis as a branch of behavioral finance. In effect, the technical condition of the market tells me the state of market expectations. Right now, we have:

- Early cycle interest sensitive sectors rolling over after leading the market higher from the 2011 trough;

- Mid cycle sectors like Consumer Discretionary have weakened;

- Business-related mid cycle sectors like Cyclical and Industrial stocks are now starting to lose their leadership status;

- Late cycle sectors such as Materials and Energy are turning up on a relative basis; and

- Defensive bear market sectors such as Utilities and Consumer Staples have become the market leadership.

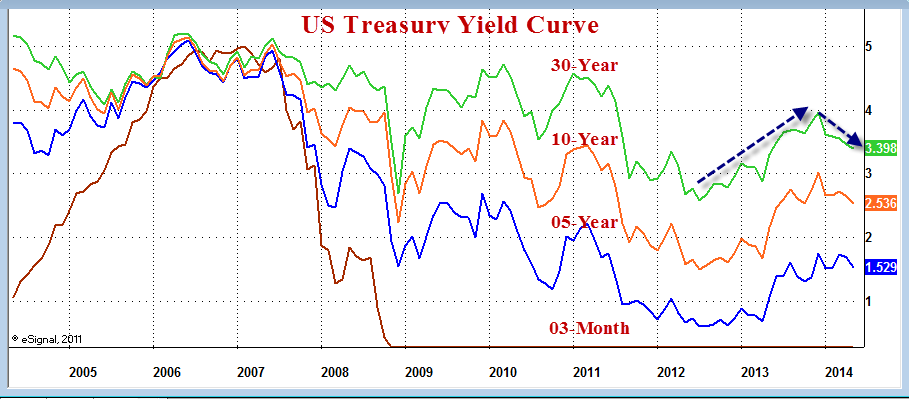

Barron’s interviewed Stephanie Pomboy of Macro Mavens this week and she presented an especially bearish view on the US economy. She argues that as the Federal Reserve stops buying Treasuries the economy will falter and the Fed might even taper the taper. She thinks there is little upside to Treasury yields and believes that the 10 year will be trapped between 2 percent and 3 percent for a long time.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (“Qwest”). The opinions and any recommendations expressed in the blog are those of the author and do not reflect the opinions and recommendations of Qwest. Qwest reviews Mr. Hui’s blog to ensure it is connected with Mr. Hui’s obligation to deal fairly, honestly and in good faith with the blog’s readers.”

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this blog constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or I may hold or control long or short positions in the securities or instruments mentioned.