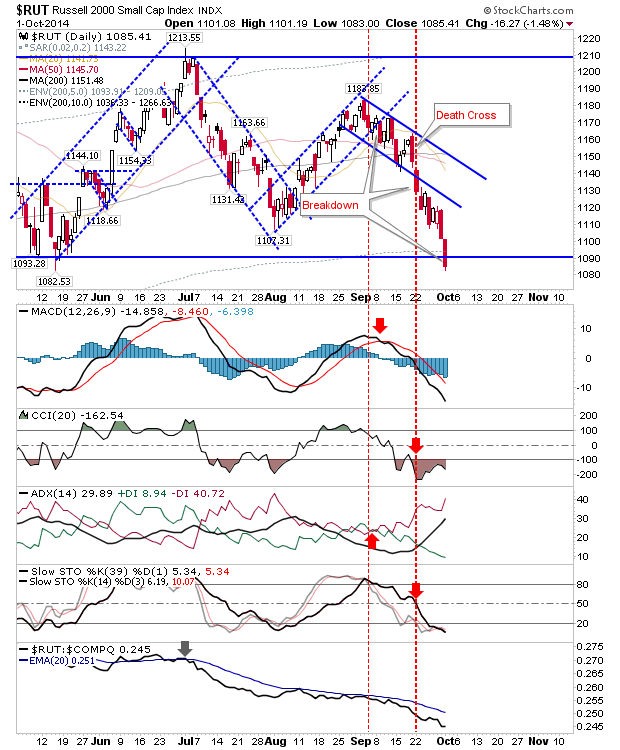

Bears haven't had too much to cheer about as every sell off has been quickly reversed, but yesterday they were given the run of the house. The Russell 2000 was the weakest index heading into the day, and it was slapped with another big hit yesterday. However, bulls probably have the best chance for a bounce trade in this index. The index saw a clear cut below the 200-day MA and 1,090, but a push above these levels today would set up a 'bear trap'.

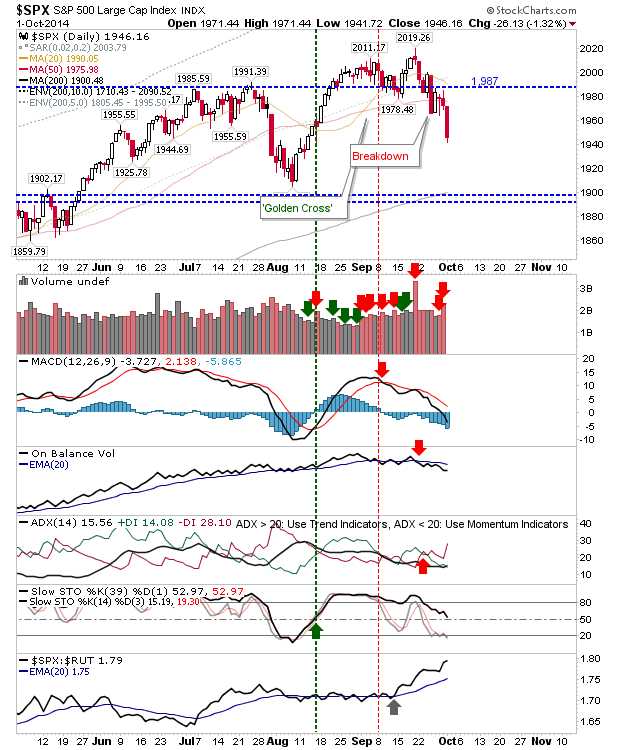

The S&P 500 was pushed into a no-mans land: it's no longer near support of its 50-day MA or 1,987, and it has room to fall before it reaches the August swing low and/or 200-day MA. Rallies from today will be sold into by shorts, with the 20-day MA likely to be the attack point. This will provide weak rally opportunities for traders, although the Russell 2000 is probably the more attractive index in this regard.

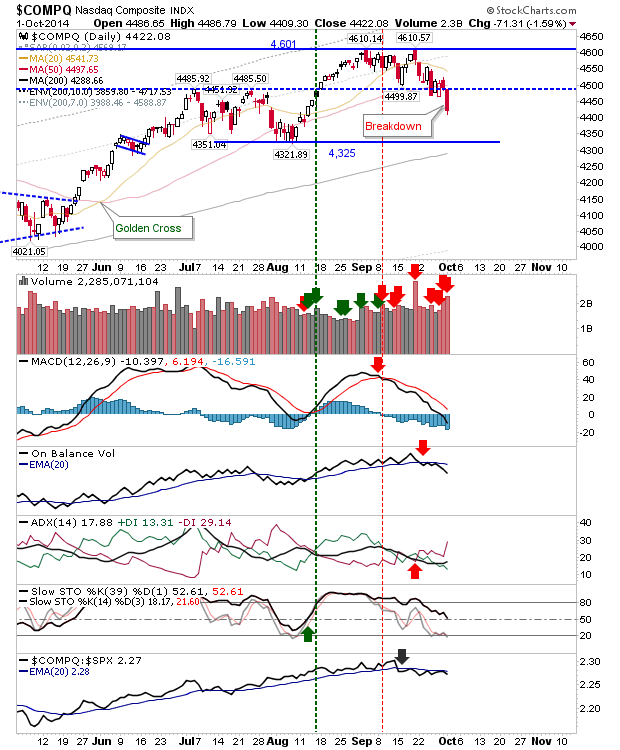

The NASDAQ was the last index to break support, but it perhaps has the best support opportunities to lean on. The swing low at 4,325 will soon converge with the 200-day MA, and if the NASDAQ makes it back to this point it will offer a cover/long opportunity.

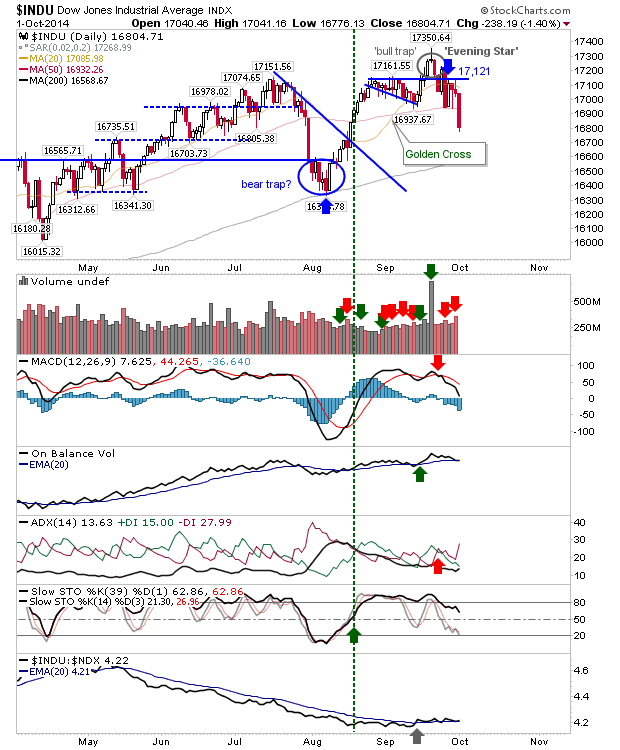

The Dow also took a big hit with a break of the 50-day MA, ending the consolidation trade between 50-day MA and 17,121. It's downward target is the 200-day MA, which is above the August swing low.

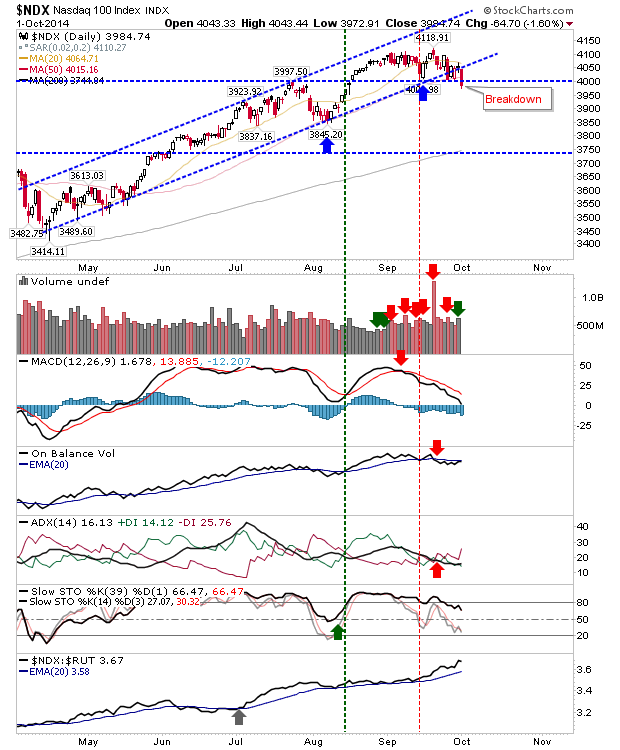

A short opportunity may be available in the NASDAQ 100. Here, the August swing low was part of the April-September channel, which was breached on yesterday's action. The next target down, after the August swing low, is the 200-day MA.

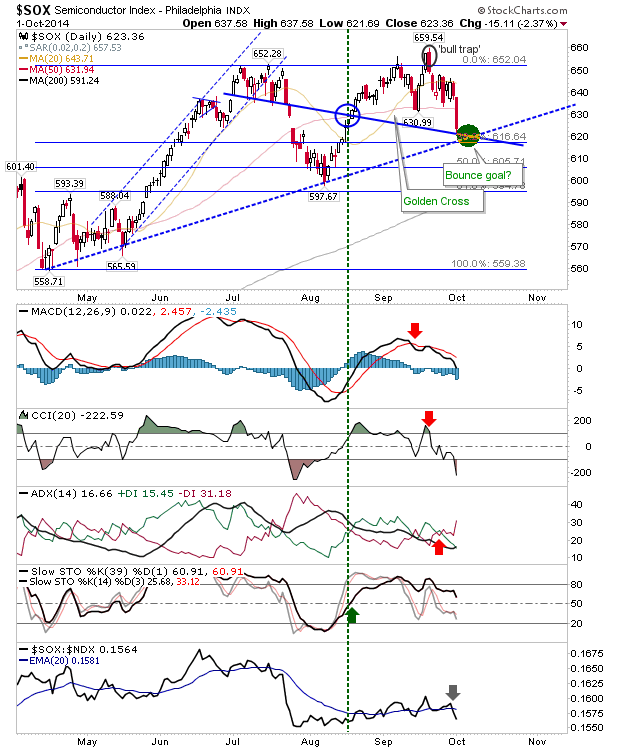

The best long standing short move has come from the Semiconductor Index. Those who caught the 'bull trap' have been rewarded nicely. However, it will soon be dealing with converged support marked on the chart.

For today, shorts can look to the NASDAQ 100 for potential opportunities, particularly on any counter move back to channel support - turned resistance. Longs can look for the 'bear trap' in the Russell 2000: if today produces a rally there is a good chance the Russell 2000 will deliver on the 'bear trap'.