Market Brief

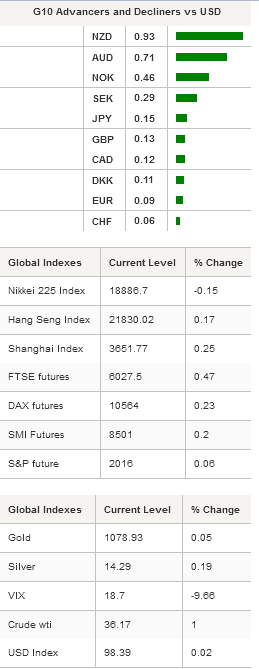

Asian equity markets were trading broadly higher overnight as crude oil prices recovered from yesterday’s record lows. Brent crude traded below $36.20 a barrel - the lowest mark since December 2008 – and reached $36.04, an 11-year low. The pressure on crude oil prices will therefore persist in 2016. It also means that we will have to wait longer before seeing CPI measures back to normal levels or at least without the print of oil. West Texas Intermediate managed to stay right above 2008’s low. The spread between Brent and WTI fell to $0.30, compared to an average spread of $3.

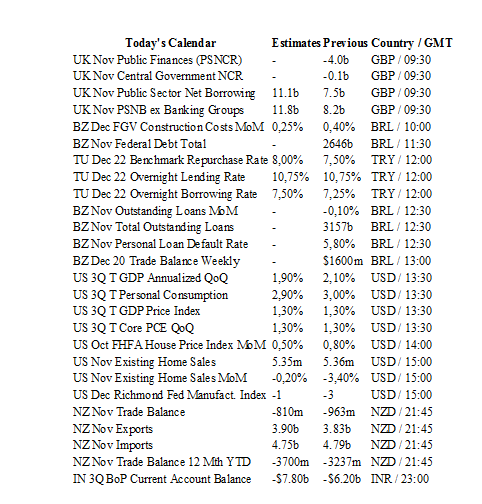

In the FX market, EUR/USD stabilised around 1.0920 after rising 0.80% in the European session yesterday. On the upside, the euro will need fresh boost to be able to break the strong resistance standing at 1.1050. Disappointing figures from the US, due this afternoon, could make the deal. Indeed, the third revision of US 3Q GDP, personal consumption and core PCE are due at GMT 13:30 today.

Over the last month, commodity currencies demonstrated an extreme sensitivity to variations in oil prices. With crude oil prices jumping higher in the Asian session, commodity currencies followed the lead and paired gains. The Kiwi appreciated the most against the greenback, climbing as much as 0.95% to $0.6826 before stabilising around 0.6810. The Aussie was not so far behind as it surged 0.62% in Sydney and consolidated its gains around 0.7225. The loonie and the NOK rose 0.17% and 0.15% respectively.

In the equity market, most of Asian regional markets were wearing green with the exception of the Japanese Nikkei, which edged down 0.16%. On the other hand, the broader TOPIX index edged up 0.15%. In Mainland China, tech stocks took over the lion’s share with the Shenzhen Composite up 0.92% while the Shanghai’s shares edged up 0.26%. Elsewhere, the S&P/ASX 200 climbed 0.15% while the S&P/NZX surged 0.44%. European futures are also blinking green on the screen with the CAC 40 up more than 1% and the German DAX up 0.70%. US futures are up 0.30% on average.

In Switzerland, the trade surplus contracted to 3.14bn in November compared to an downwardly revised figure of 4.09bn in October as exports contracted 2.1%m/m while import expanded slightly by 0.2%m/m. Swiss exports took another hit from a weaker demand from Asia, with exports to Hong Kong collapsing almost 30% compared to one year ago. One cannot only blame the strong Swissie for the fall of exports as the weakening demand from Asia has its share of responsibility. EUR/CHF climbed back above 1.08 while USD/CHF consolidated above 0.99 after being unable to break the parity to the upside.

Today traders will be watching Gfk consumer confidence from Germany; 3Q GDP and retail sales from Denmark; PPI and retail sales from Sweden; interest rate decision from Turkey (an increase of the repo and overnight borrowing rate are expected); 3Q GDP, personal consumption, core PCE, existing home sales and Richmond Fed Manufacturing index from the US; trade balance (exports & imports) from New Zealand.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0918

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5336

CURRENT: 1.4892

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 121.12

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9928

S 1: 0.9476

S 2: 0.9259