Market Brief

As expected, the Reserve Bank of New Zealand cut its official cash rate by 25bps to 2.50% and left the door open for further monetary easing. Despite the central bank’s stated dissatisfaction with the recent appreciation of the kiwi, we have the feeling that the RBNZ will be reluctant to act aggressively for the foreseeable future. The bank expects inflation to move within the 1 to 3 percent target range in early 2016 as the effects of low crude oil prices fade away. After dropping to 0.6582 on the headlines, NZD/USD bounced to 0.6782 and finally stabilised around 0.6740, as market participants were expecting a more dovish statement. The New Zealand dollar will be sensitive to any sign of weakness in the economy as this would ensure another easing move from Governor Wheeler.

In Australia, the unemployment rate surprised substantially to the downside in November, printing at 5.8% versus 6% expected (5.9% in the previous month) as the economy generated 71,400 jobs (economists expected a contraction of 10,000 jobs). The participation rate rose to 65.3% from 65% in October. AUD/USD jumped 1.55% on the news before stabilising slightly below $0.73.

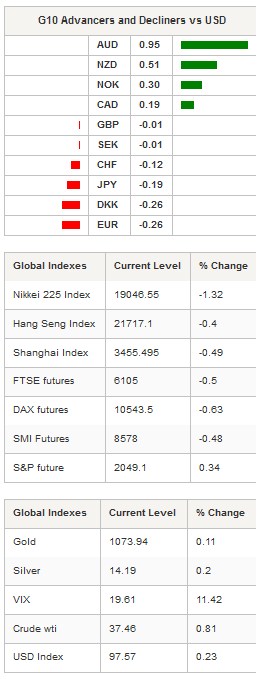

In the equity market, Asian stocks are trading in negative territory, following London and Wall Street's lead. The Nikkei and the Topix indexes were down 1.32% and 0.98% respectively, while in Hong Kong the Hang Seng fell 0.40%. In mainland China, the Shanghai Composite also paired losses, down 0.49%, while the tech-heavy Shenzhen Composite slid 0.11%. Only, South Korean and Indian shares managed to trade in positive ground with the Kospi index and the Sensex up 0.20% and 0.40% respectively. As expected, the BoK left its repo rates unchanged at 1.50%. European futures are wearing red this morning.

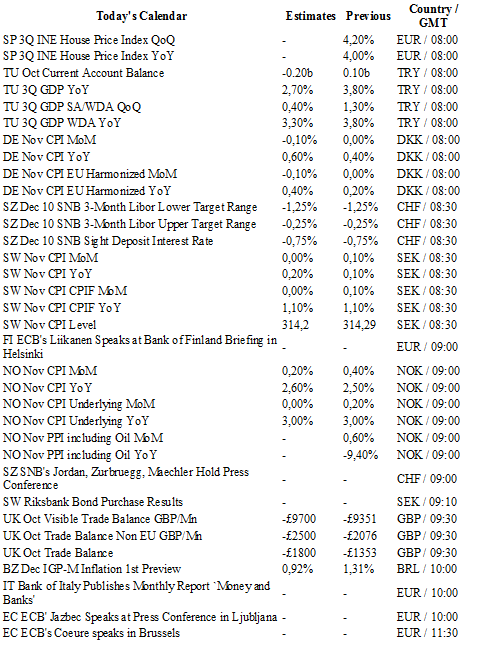

Today traders will be watching current account balance and GDP figures from Turkey; inflation report from Denmark, Sweden and Norway; interest rate decision from the SNB; BoE interest rate decision; new housing price index from Canada; import price index, monthly budget statement and initial jobless claims from the US; manufacturing PMI and food prices from New Zealand.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0920

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5529

R 1: 1.5336

CURRENT: 1.5045

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.78

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9931

S 1: 0.9476

S 2: 0.9259