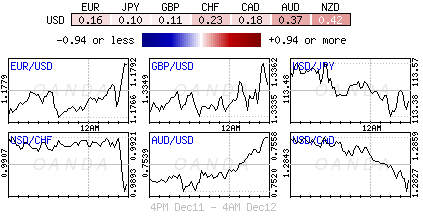

Global equities are struggling for traction, while the US dollar trades in a tight range as Treasury prices rally ahead of this week’s G10 central bank meetings.

Note: Federal Open Market Committee (FOMC) Wednesday, the ECB, BoE and SNB set monetary policy at their respective meetings on Thursday.

The Fed is the only central bank expected to raise rates at its meeting, while the ECB is anticipated to reveal details of its plans to taper asset purchases (QE) on Thursday. For the BoE and SNB, comments from officials on the outlook for 2018 should be the focus.

Elsewhere, aside from monetary policy decisions investors should also be casting a glance over this week’s U.S economic reports – consumer inflation on Wednesday and retail sales on Thursday.

On the political front, euro area and UK lawmakers continue to debate Brexit and weigh moves on the next step, while North America Free Trade Agreement negotiators meet again this week.

1. Stocks struggle ahead of U.S open

Yesterday, global stock prices pressed onward and upward despite a minor terror incident in midtown New York.

Overnight in Japan, the Nikkei slipped, reversing earlier gains as investors turned cautious ahead of this week’s rate announcements. The Nikkei share average fell -0.3% while the broader TOPIX eked out a marginal gain, rising +0.1%.

Down under, strong gains in energy stocks on the back of a surge in oil prices has allowed Aussie equity benchmarks to outperform in the region and notch a fourth consecutive modest gain. The S&P/ASX 200 posted its longest winning streak since mid-October to finish up +0.2%.

In Hong Kong, stocks dropped as the index heavyweight Tencent slumped over -3%. At close of trade, the Hang Seng index was down -0.59%. The Hang Seng China Enterprises index fell -1.04%.

In China, stocks also fell, erasing the bulk of the previous session gains, led lower by financial and transport firms. The Shanghai Composite index was down -1.24%, while the blue-chip CSI 300 index was down -1.32%.

Note: Investors are worried over whether the People’s Bank of China (PBoC) would follow the Fed, which is widely expected to raise interest rates tomorrow.

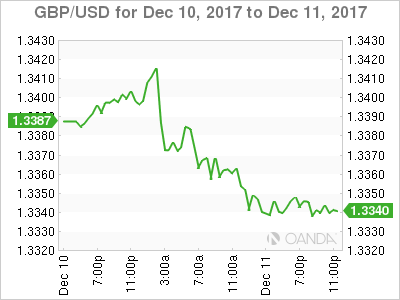

In Europe, regional indices trade mostly higher reversing earlier losses in relatively quiet trade. The FTSE continues to outperform once again on relative weakness in sterling (£1.3330) despite a slightly stronger headline U.K CPI print (see below).

U.S stocks are set to open little changed.

Indices: STOXX 600 0.2% at at 389.6, FTSE +0.2% at 7468, DAX +0.1% at 13141, CAC 40 +0.2% at 5399, IBEX 35 -0.2% at 10288, FTSE MIB flat at 22698, SMI -0.1% at 9305, S&P 500 Futures flat

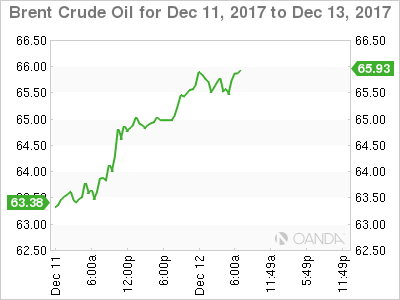

2. Oil prices jump on pipeline outage, gold higher

Oil prices have jumped this morning after the shutdown of a North Sea pipeline knocked out a significant supply from an already tightening market.

Brent crude futures has rallied above +$65 a barrel – their highest since mid-2015 – after Britain’s Forties pipeline was shut due to cracks as a cold snap sweeps the country. U.S crude oil futures (WTI) have rallied nearly +1% to $58.51 a barrel.

The jump in Brent prices has widened its premium to WTI prices to as much as over +$7 a barrel, the highest premium in over two-years, and up from around +$5 last week. This should make U.S oil exports more attractive.

Note: Production cuts by the OPEC and non-OPEC producers, including Russia, which have been in place since the start of 2017, have been supporting most of this years +35% ytd price gains.

However, the effect of these cuts are being undermined by rising output from the U.S, which is not participating in the deal to voluntarily withhold production.

Gold is trading slightly higher ahead of the open, just a tad up from yesterday’s five-month low ahead of the FOMC’s two-day meeting. Spot gold has rallied +0.2% to +$1,244.74 an ounce. Yesterday, it hit its lowest print since July 20 at +$1240.10.

3. Sovereign yields diverge

The gap between the benchmark German Bund and the U.S 10-year Treasury yield are close to it’s widest in seven-months ahead of the U.S open as the fiscal and policy paths diverge. The U.S/ German 10-year yield gap reached +208 bps yesterday, just shy of the +209 bps eight-month high hit earlier in December.

The paths are expected to deviate even further as President Trump pushes a tax overhaul that could put the U.S economy at risk of overheating and reason why fixed income traders are starting to price in multiple rate hikes from the Fed in 2018, after an almost-certain hike this week.

Note: Despite pressure from the divergence being most pronounced in the short end of the yield curve, the U.S Treasury curve is close to its flattest in a decade. However, the long-end is being impacted particularly after the risk of a U.S government shutdown last weekend was averted.

The yield on U.S 10’s is unchanged at +2.38%, the highest in more than a week. While in Germany, 10-year Bund yield has fallen -1 bps to +0.30%, while in the U.K the 10-year Gilt yield decreased -2 bps to +1.257%.

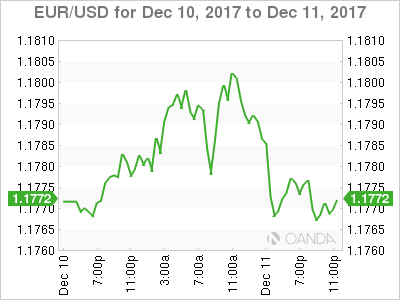

4. Dollar’s hands are tied until Fed announcement

The dollar has edged a tad lower (€1.1780, and ¥113.44), but remains within recent ranges, as the market waits for the conclusion of the Fed’s two-day monetary policy meeting beginning today. With many expecting the Fed to hike interest rates +25 bps tomorrow, the market focus will shift to the Fed’s economic and rates projections for next-year.

Sterling (£1.3313) remains a G7 outlier as the pound remains soft just ahead of the New York open despite the slightly higher November CPI data (see below) ahead of Thursday BoE’s rate decision.

Note: In Q4, the dollar has appreciated just under +3% against G10 currency pairs. If tomorrow’s Fed statement does not come with a ‘hawkish’ tinge, then investors should expect the dollar to come under renewed pressure to close out this year.

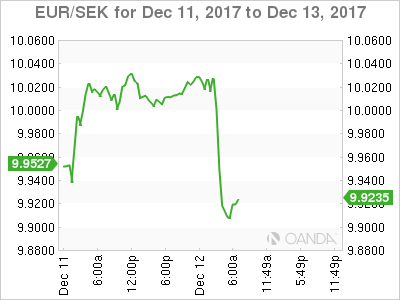

SEK (+1.1% to €9.9025) has aggressively rallied in the European session after this morning’s November annual CPI inflation data came in above the expectations of the market and Sweden’s Riksbank projection at +1.9% vs. +1.6% y/y. Data like this may convince the Riksbank to adopt a less ‘expansionary’ monetary policy.

Note: The next Riksbank meeting is due on Dec. 20.

Bitcoin ($16,776 +0.5%), the cryptocurrency, made it through its first full day of futures trading unharmed yesterday. Contracts rose as much as +26% on the CBOE’s exchange, triggering two temporary trading halts designed to calm the market.

Note: Initial volumes in Asia exceeded dealers’ expectations, though trading thinned significantly into the U.S session.

5. U.K prices grow at the fastest rate in six-years

Data this morning showed that U.K. consumer inflation ticked up unexpectedly to +3.1% last month (vs. +3% expected). It’s the fastest pace of price growth in six-years, with prices of raw materials and goods leaving factories also accelerating. This should be interpreted that inflationary consumer squeeze is evident since last year’s Brexit vote may not be over yet.

Digging deeper, the headline inflation was driven by rising prices of computer games as well as airfares, which fell more slowly than last year. A pickup in manufacturers’ input and output prices meanwhile was driven by rising costs of oil and petrol.

In Germany, December ZEW German sentiment fell marginally to 17.4 vs. its November 18.7 print. Nevertheless, the headline print remains at a high level and suggests that investors do not see political uncertainty as a major threat to the economic outlook any time soon.