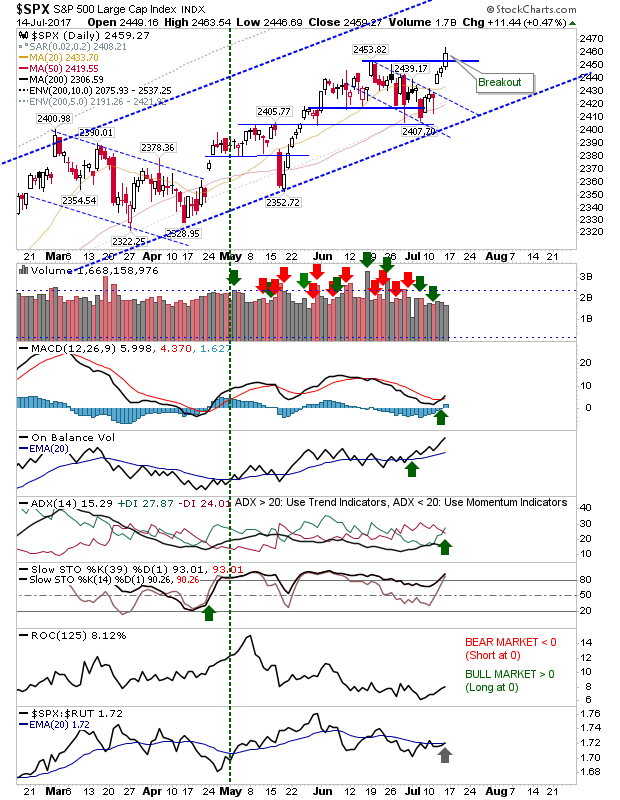

The week finished with some tasty looking breakouts in Large Cap and Tech Indices. Best of the action was given over to Large Caps with volume perhaps the most disappointing aspect of these breakouts.

The S&P closed the week out with a respectable breakout on a new ADX 'buy' trigger. This followed a MACD trigger 'buy' earlier in the week. Monday will be about defending 2,450 and staying above that mark at close of business. Long traders should play for a move to upper channel resistance.

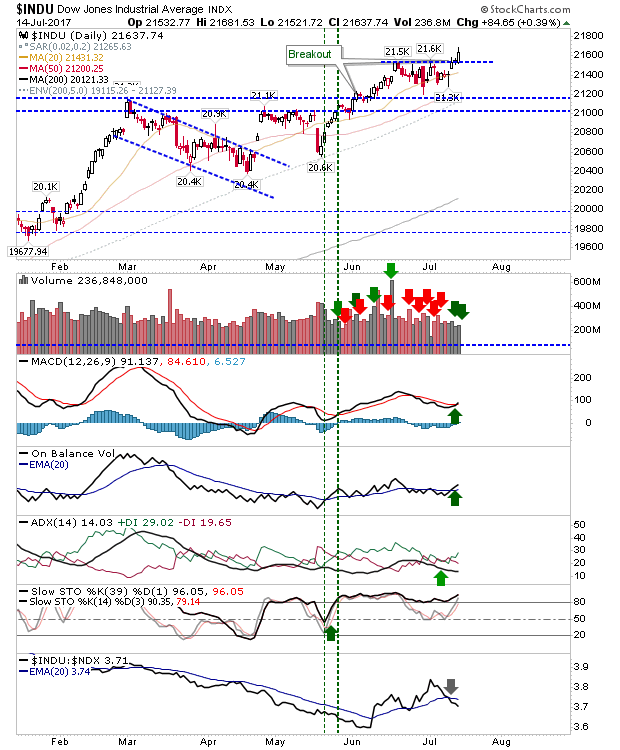

The Dow Jones Industrial Average also enjoyed a similar breakout, although this index has been underperforming relative to Tech averages. As for the S&P it will be important for the index to hold breakout support which in this case is 21,500.

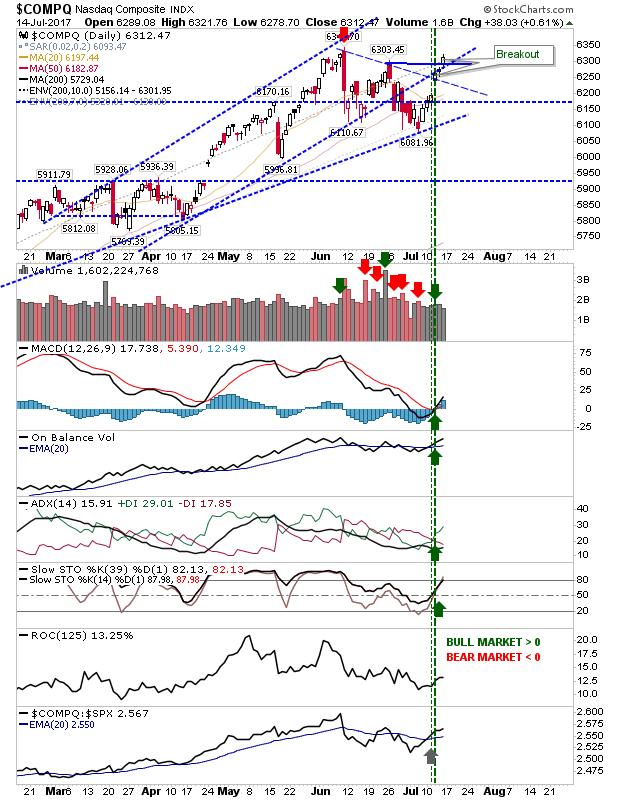

Tech was another set of indices to do well on Friday. The NASDAQ followed the resistance breakout with a new near term high style breakout. The early June bearish engulfing pattern remains dominant but each days worth of gains eats into this helped by net bullish technicals. Relative performance is also working in Tech's favour.

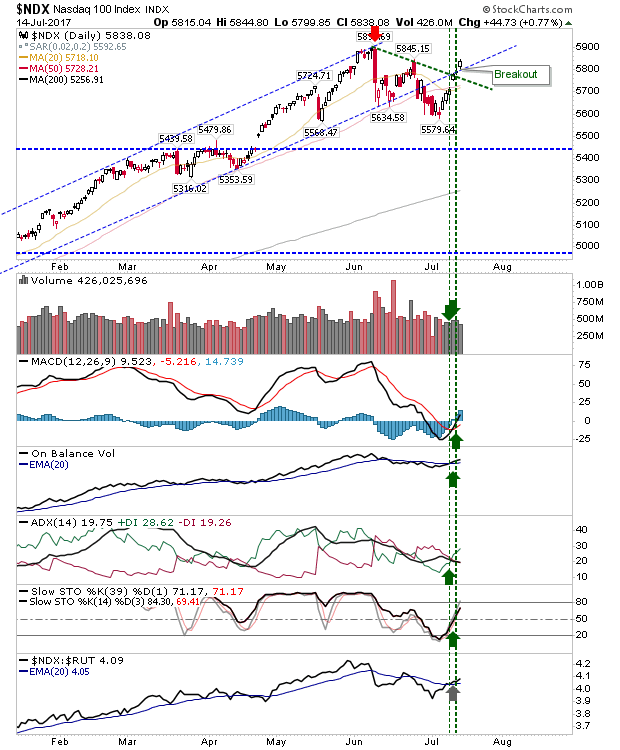

The NASDAQ 100 is not to be left out. Very similar performance to the NASDAQ with a relative advantage against the Russell 2000 (Small Caps).

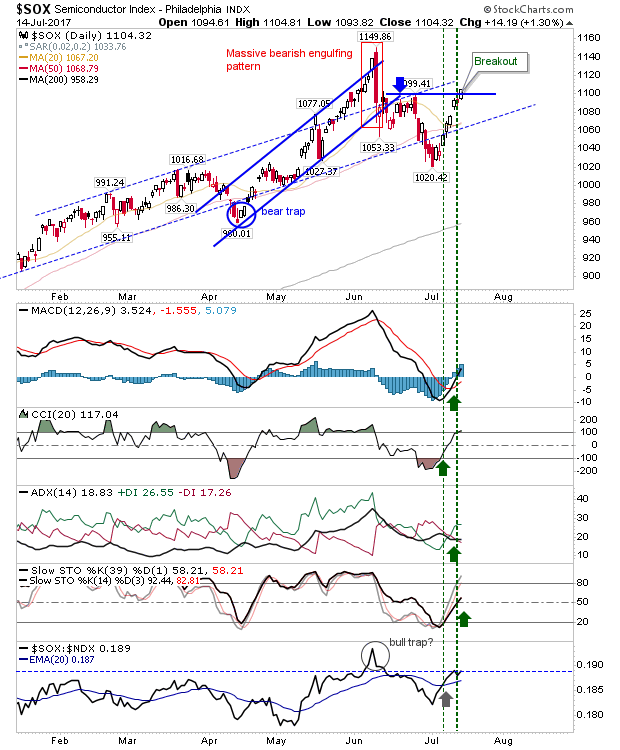

The Semiconductor Index has done well to recover from its June bearish engulfing pattern although I would like to see the relative performance 'bull trap' (against the NASDAQ 100) taken out before the bearish engulfing pattern is broken. Early week action will give an idea on this. Other technicals are all bullish.

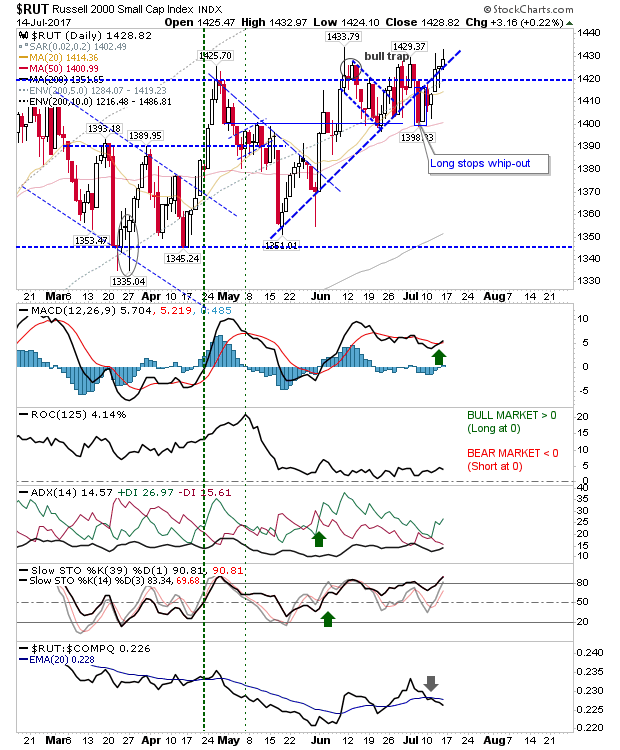

While Large Caps and Tech enjoyed their day in the sun, Small Caps continued to build pressure against resistance. Small Caps look like the index to lead into the second half of the year but bulls will have to wait for now.

This coming week will be about consolidating the breakouts and waiting for Small Caps to follow suit. Should the latter happen I would look for other breakouts to soften as money rotates out of these indices into Small Cap stocks.