Market Brief

AUD crosses rallied strongly in overnight trading as China’s manufacturing PMI rose to 50.4 in August from 49.9 in the previous month. The stabilisation of the Chinese manufacturing sector suggests that more stimulus is not required for the moment, which will allow the government to focus on eliminating overcapacity and containing financial risk. The non-manufacturing PMI eased slightly to 53.5 from 53.9. AUD/USD surged as high as 0.7548 in Sydney before easing to 0.7535 after data showed private capital expenditure fell another 5.4% in the second quarter (compared to -4% expected and -5.4% in the first quarter). However, CAPEX on equipment, plant and machinery increased by 2.8%q/q. All in all, it seems that the weak CAPEX figures will weigh on GDP growth for the second quarter. AUD/USD is still trading with a negative bias as market participants await Friday’s NFP report from the US. On the downside, a support can be found at around 0.75 (psychological level), while on the upside a resistance can be found at 0.7582 (high from August 29th).

In South Korea, August’s consumer price index came in well below market expectations as it contracted by 0.1%m/m versus an expected increase of 0.2% and a previous reading of 0.1%. On a year-over-year basis, headline CPI came in at 0.4% versus 0.7% median forecast. Separately, exports rebounded in August, rising by 2.6%y/y (versus -0.5% median forecast), while imports edged up 0.1%y/y (versus -2.2% expected). However, this positive surprise is mainly due to the two extra working days rather than an actual pickup in trading activity. South Korea is greatly exposed to the health of the Chinese economy and the latest data from the latter does not suggest a strong rebound in imports from South Korea. USD/KRW rose 0.60% to 1,122.05 during the Asian session.

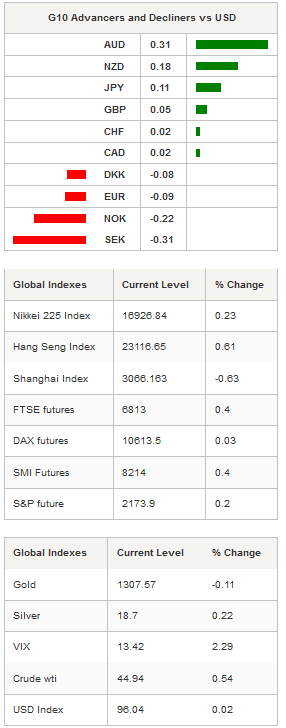

In the equity market, Asian equity returns were mixed on Thursday. Japan’s Nikkei and Topix indices were up 0.23% and 0.59% respectively, while in China the Shenzhen and Shanghai Composites were down 0.63% and 0.64% respectively. In Hong Kong, the Hang Seng was up 0.61% and in Taiwan the Taiex fell 0.75%. In Europe, futures are trading higher across the board with the FTSE 100 up 0.40% and the SMI rising 0.40%.

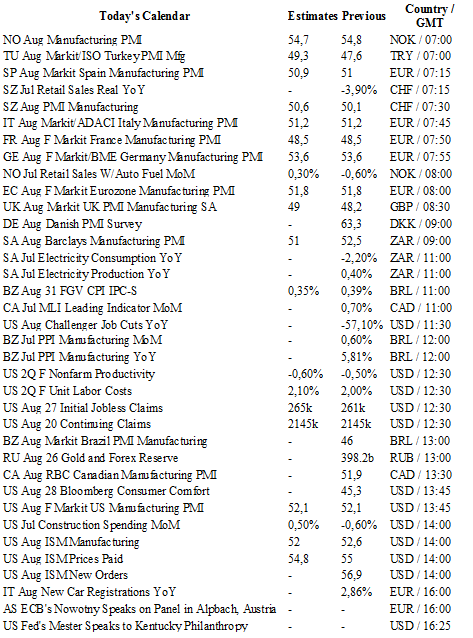

Today traders will be watching manufacturing PMI from Norway, Turkey, Spain, Italy, France, Germany, UK, Denmark and the euro zone; initial jobless claims, manufacturing PMI, ISM and construction spending from the US.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1145

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3534

R 1: 1.3372

CURRENT: 1.3153

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 105.63

CURRENT: 103.33

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9845

S 1: 0.9522

S 2: 0.9444