US Markets- S&P 500 Futures -2.75 points

- US 10-Year Rate 2.585%

- Dollar Index 97.33

- Oil $65.97

- VIX 12.6

International Markets

S&P 500 (SPY)

The S&P 500 is pointing to a flattish opening, suggesting another day of stagnation at the start. But the patterns continue to suggest that a break out is imminent. A break out would push the index above 2,915 and towards 2,940 –the all-time highs.

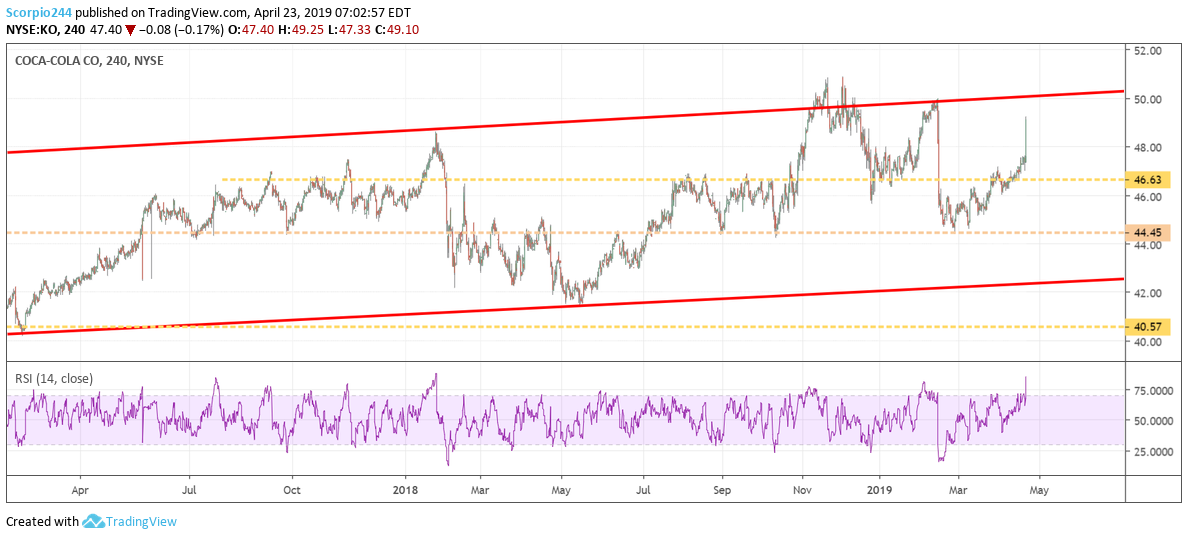

Coca-Cola (KO)

Coca-Cola Company (NYSE:KO) is rising this morning after beating on the top and bottom lines. The stock is popping to around $49.25. The stock is moving towards the upper end of what has been a long-term channel.

Twitter (TWTR)

Twitter Inc (NYSE:TWTR) is rising sharply after beating on the top and bottom lines. The stock is rising above a resistance level at $36.50, and that could set the stock up for a move towards $42.

Roku (ROKU)

Roku Inc (NASDAQ:ROKU) shares are rising this morning after the stock was initiated with an $80 price target at Susquehanna. The stock is trading right at resistance around $59.40. I had looked for a decline to around $52. So far that view appears to be wrong.

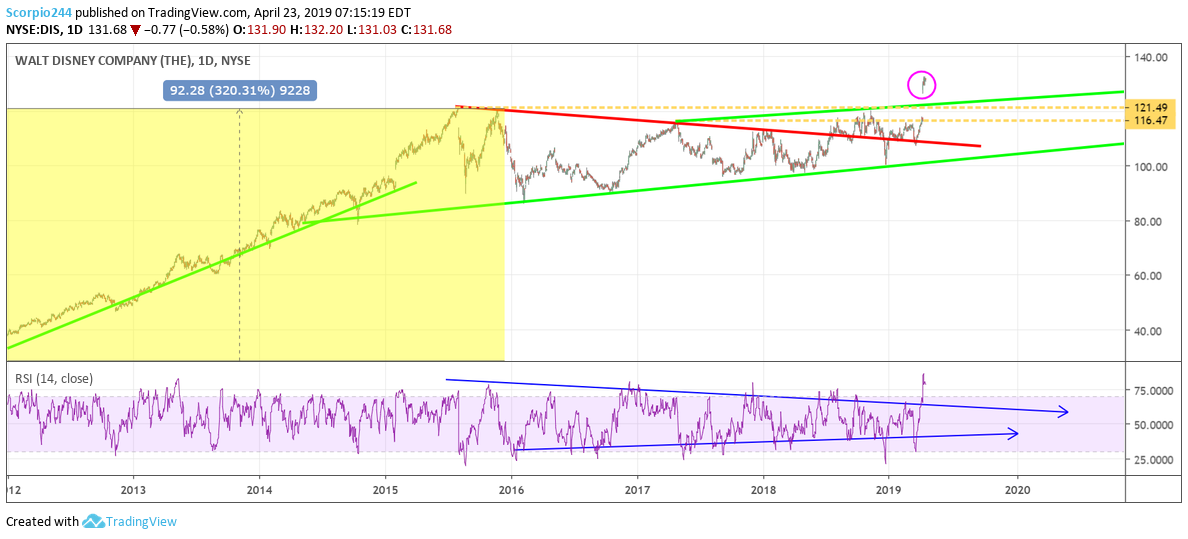

Disney (DIS)

Walt Disney Company (NYSE:DIS)’s price target was raised to $168 from $144 at Bank of America (NYSE:BAC) today. I outlined about two weeks ago why I thought the stock might rise to $175.

Netflix (NFLX)

Netflix Inc (NASDAQ:NFLX) will attempt to keep its bullish momentum today, as it needs a big break out at $378. It could send the shares higher towards $388.

Qualcomm (QCOM)

Qualcomm Incorporated (NASDAQ:QCOM) is also nearing a big break out with the potential for the stock to continue higher towards $88.

Verizon (VZ)

Verizon Communications Inc (NYSE:VZ) reported earnings that topped estimates, while revenue came in as expected. Additionally, the company raised its full-year guidance. The stock is rising this morning The $60 to $61 region continues to be the line in the sand for the stock.