The week of May 13 may not live up to the hype of last week, but it doesn’t mean it won't be as entertaining. Trade tensions are likely to still be in the back of many investors' minds, but with no meetings planned between China and the US, it can at least begin to make its way out of the headlines. That being said we will need to focus on the Asian markets and how they perform. The markets that continue to be the main focus for me will be South Korea and Hong Kong.

KOSPI

The KOSPI chart is confusing, to say the least, with double tops and bottoms in at least three places. I want to predict the index rebounds and starts a push back to 2,220. The RSI has a longer-term uptrend, and that would suggest to me the index is not facing a further decline. It is positive for global growth.

Hong Kong

Hong Kong also finds itself in a tight spot resting on technical support around 28,160. It would be a bad sign if the index fell below support at that level because then the HSI would likely fall further to 27,345.

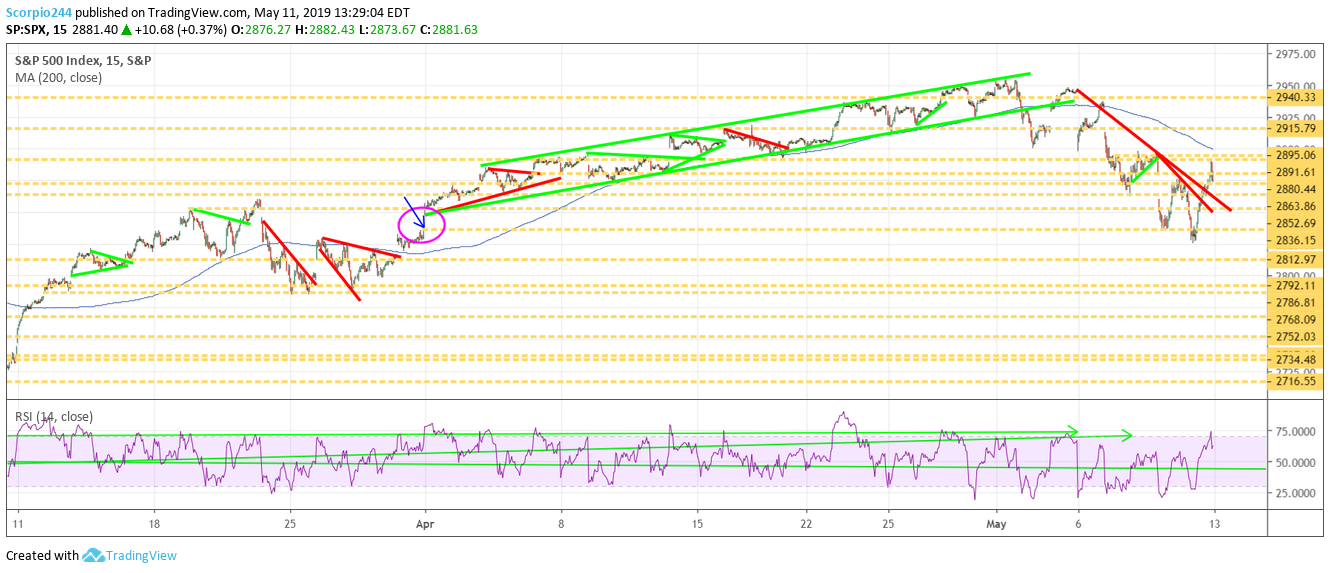

S&P 500

The S&P 500 had a big end of day rally on Friday. We can see that the S&P 500 had a nice retest of the lows on Thursday, and the only thing standing in the way of the index continuing to rally is resistance around 2895. Should resistance be broken, it sets up an increase to around 2,915.

NASDAQ

The NASDAQ was able to fill the same gap on its chart as the S&P 500, from April 1. The NASDAQ closed right at resistance at 7,917. The RSI is trending nicely higher and suggesting that the index continues to rise.

Apple (AAPL)

Apple (NASDAQ:AAPL) managed to survive the week holding both an uptrend and support at roughly $194.50. The big test comes Monday and if can manage to move back above $198. If that happens, it can help to push the stock higher towards $209.

Amazon (AMZN)

Amazon (NASDAQ:AMZN) held support around $1,850 this past week, and if it can move above $1,900 again, it has a chance to start trending higher back towards $2,000.

Netflix (NFLX)

Despite everything Netflix (NASDAQ:NFLX) has held up fairly well, and why shouldn’t it? It has nothing to do with anything remotely close to China. I still think it is trending towards $405. The RSI is still diverging, and that is something worth keeping a close eye on.

Facebook (FB)

Facebook (NASDAQ:FB) has held the uptrend and support at $186, and I think this continues to push higher towards $203.

Micron (MU)

Micron Technology Inc (NASDAQ:MU) may find itself in a tight spot with the trade worries I think this one continues to fall to around $36 before finding a bounce.

Alphabet (GOOGL)

Alphabet (NASDAQ:GOOGL) has found some support around the $1,150 to $1,170 region, and I think this one starts heading back to $1,200.

Disney (DIS)

It would seem that Walt Disney Company (NYSE:DIS) has a new floor to work higher off around $132. There is a good chance it heads back to $138.

Disclaimer: Michael Kramer and the clients of Mott Capital own Apple, Alphabet, Disney, Netflix.