This does not serve my own selfish purposes of wanting people to hang out on the site all day long, but I must say, this market remains godawful boring. All the same, I feel some commentary is warranted.

So, below I present what I consider some important U.S. equity indexes, with the most bullish-behaving at the top and the most bearish at the bottom. I’ve put some remarks in the caption of each:

The Dow 30 Industrials hit yet another lifetime high on Monday in this dozen-year long bull market.

Its cousin, the Dow 20 Transports, also flew to prices never seen before.

The S&P 100 might be heading toward a breakout above resistance. It is extremely close to its own lifetime high.

Its bigger brother, the S&P 500, has a nearly identical setup.

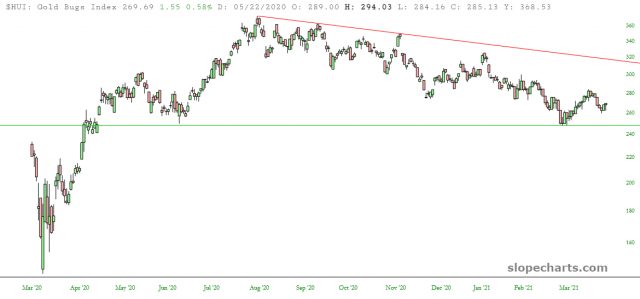

As I not-so-subtly implied with my “Gold is Garbage” post, anything to do with precious metals has been weak lately, and the gold bugs would fall hard if the HUI broke below that horizontal support.

The Oil and Gas sector was repelled by its horizontal line, and I believe new weakness will soon be afoot.

The NASDAQ Composite is about 85% done with the creation of what might be an important reversal pattern.

The NASDAQ 100 has an almost identical situation.

My favorite tech short remains the Semiconductor Index.

Small caps, via the Russell 2000, remained quite weak on Monday, and they are well below their own lifetime high.

If I am going to be bullish on any one thing, it is volatility. The VIX looks ready for a push higher, since it has been dead in the water for so long.