(Bloomberg) -- U.S. stocks erased gains sparked by an emergency Federal Reserve rate cut as investors assessed whether easier monetary policy can effectively combat the economic impact of the coronavirus.

The S&P 500 turned lower after spiking as much as 1.50% following the central bank’s 50 basis point cut of its benchmark rate. The two-year Treasury yield tumbled to 0.78%, while the 10-year plunged below 1.08%. Banks led losses on benchmarks.

“Does a 50 basis point cut change things? That’s a tough one to answer,” said Subadra Rajappa, head of U.S. rates strategy at Societe Generale (PA:SOGN). “It could perhaps help the credit markets, especially primary markets that are currently somewhat frozen. But Fed cuts tend be less effective in situations like this when there is a supply and demand shock.”

Investors had piled out of risk assets last week as the spreading virus threatened to derail global growth, only to pour back in Monday in anticipation of concerted action from Group of Seven officials. Oil continued its rebound Tuesday, approaching $48 a barrel, while gold also rose. The yen was higher versus the dollar.

The OECD warned that growth will sink to levels not seen in more than a decade and ever more businesses are warning about the impact of the illness. President Donald Trump said on Tuesday the Federal Reserve “should ease and cut rate big.”

The governor of the Bank of England, Mark Carney, said it would take all necessary steps to help the economy. Australia lowered its benchmark by a quarter percentage point. Its currency rose, however, underscoring how traders’ expectations have rapidly shifted in recent days.

These are the main moves in markets:

Stocks

- The S&P 500 Index fell 0.1% as of 10:18 a.m. New York time.

- The Dow Jones Industrial Average rose 0.8%.

- The Stoxx Europe 600 Index surged 2.9%.

- The U.K.‘s FTSE 100 Index surged 2.2%.

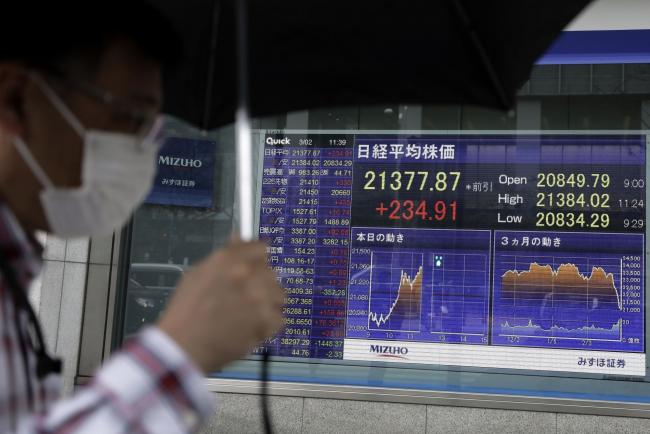

- The MSCI Asia Pacific Index gained 0.3%.

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%.

- The euro rose 0.3% to $1.1173.

- The British pound gained 0.6% to $1.2825.

- The Japanese yen strengthened 0.7% to 107.58 per dollar.

Bonds

- The yield on 10-year Treasuries decreased four basis points to 1.12%.

- The two-year rate lost 11 basis points to 0.79%.

- Germany’s 10-year yield gained two basis points to -0.60%.

Commodities

- Gold futures added 2.1% to $1,623.50 an ounce.

- West Texas Intermediate Crude gained 1.7% to $47.50 a barrel.