By Peter Nurse

Investing.com - European stock markets are set to open higher Tuesday, following Asia upwards, after the U.S. Federal Reserve’s latest attempt to calm the markets. However, these gains could be short-lived as evidence mounts of the devastation wrought on the global economy by the coronavirus pandemic.

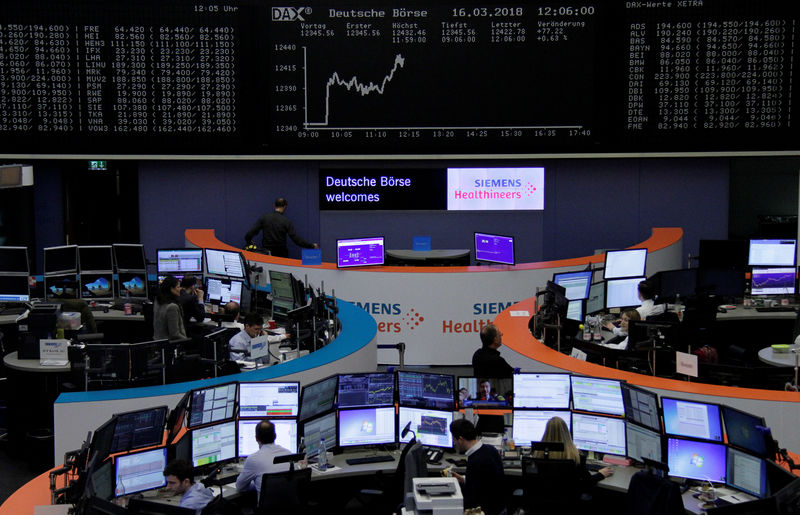

At 3:15 ET (0715 GMT), the DAX futures contract traded 4.0% higher. {{167|France's CACAC 40 futures were up 3.9%, while the FTSE 100 futures contract in the U.K. rose 4.4%.

The Federal Reserve announced Monday a sweeping extension of its plans to backstop businesses and consumers by increasing its asset purchases by any volume necessary. This followed the inability of Congress - for a second day - to agree on a $1 trillion-plus economic support package drafted by Senate Republicans.

The Fed's announcement was greeted with skepticism on Wall Street - all three major U.S. equity indices closed lower Monday - but Asian markets received it more favorably.

At 3:15 AM ET, the benchmark Shanghai index in China traded up 2.4%, the Hang Seng in Hong Kong up 4.5%, the KOSPI 50 in South Korea up 8.6%, while the Nikkei in Japan closed 7% higher and the S&P/ASX 200 in Australia ended up 4.2%.

However, the latest economic releases paint a grim picture about the damage being inflicted by the coronavirus pandemic as activity surveys for March from Australia and Japan showed record falls, and surveys in Europe and the United States are expected to be just as weak.

Purchasing Managers' Index surveys from Japan for March showed the services sector shrinking at its fastest pace on record and factory activity contracting at its quickest in a decade. In Australia, the CBA Services PMI fell to a record low.

Later on Tuesday, the eurozone composite PMI is expected to come in at the lowest since early 2009, at 5:00 AM ET (0900 GMT), while U.S. manufacturing and services PMIs are also expected at multi-year lows, at 9:45 AM ET.

Oil rallied Tuesday amid speculation of an alliance between the U.S. and Saudi Arabia, the two largest producers in the world, to stabilize prices, prompted by comments from U.S. Energy Secretary Dan Brouillette.

“At some point we will engage in a diplomatic effort down the road. But no decisions have been made on anything of that nature,” said Brouillette Monday.

At 3:00 AM ET, U.S. crude futures traded 5% higher at $24.52 a barrel. The international benchmark Brent contract rose 3.8% to $28.05.

Elsewhere, gold futures rose 1.9% to $1,597.55/oz, their highest in nearly two weeks, while EUR/USD traded at 1.0830, up 1% on the day as the dollar retreated from recent highs.