By Selena Li and Xie Yu

HONG KONG (Reuters) -Asia's top financial executives expect geopolitical tensions, the coming U.S election and Beijing's policy uncertainty to keep shaking investor confidence in China in 2024, as investors target other regional markets such as India for better returns.

China is attempting to use policy levers to boost investor sentiment and stabilise the plunging domestic stock market. It announced reserve ratio cuts for banks on Wednesday designed to unleash about 1 trillion yuan ($139.64 billion) of liquidity to support its wobbly economy and prop up ailing mainland and Hong Kong share prices.

But confidence is no easy fix, with more geopolitical headwinds expected in 2024, executives at exchange operators and asset managers said during panel discussions on Thursday at the Asian Financial Forum in Hong Kong.

"I will be honest - it's quite challenging to explain (things in China)," said Rene Buehlmann, global CEO of investments at UK asset manager Abrdn.

"We all know valuations are quite low and in our portfolios we hold fantastic companies," he said, adding the return of international capital will only happen when confidence is restored.

That will take a systemic change in Chinese government policy rather than a single measure, Buehlmann said.

Bridgewater Co-CIO Bob Prince said deflation, weak employment and geopolitical tensions are hampering the Chinese economy.

"The problem in China has been coming out of COVID, economy has been too weak," he said, adding deflation is making the debt problem worse while hurting corporate profitability.

Geopolitical issues have also caused some "pull back in capital" from China, Prince added, but noted that the current risk premium makes Chinese assets attractive.

China's benchmark CSI 300 Index is down 47% from its peak in February 2021.

In the past 12 months, Hong Kong's benchmark Hang Seng Index has tumbled 26%, the CSI 300 lost 22% and the wider Shanghai Composite index has slumped 15%. Over the same period, Japan's Nikkei index has gained 24% and the U.S. S&P 500 rose 27%.

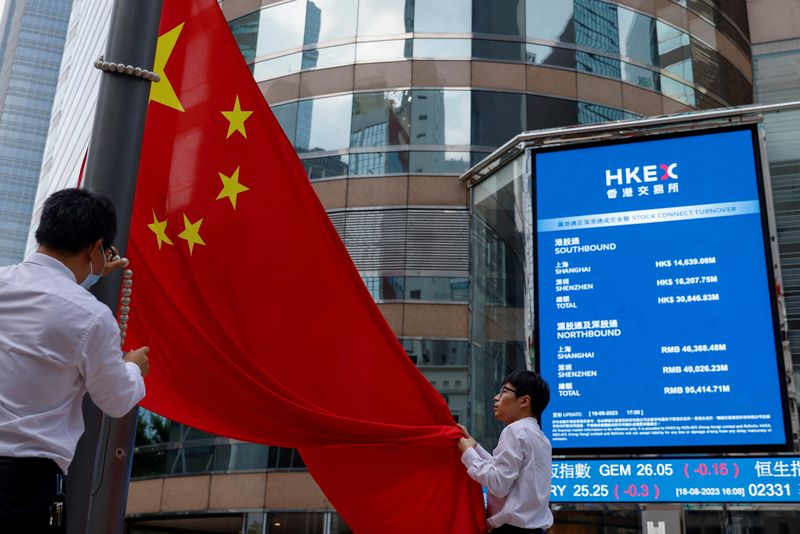

Hong Kong Exchange and Clearing's CEO Nicolas Aguzin said on Thursday that Hong Kong's stock market, trading near 15-month lows, had been affected by global geopolitical flashpoints and U.S.-China tensions.

Aguzin said the run-up to the U.S. presidential election in November would drive investor conviction in 2024.

He added proprietary investors and hedge funds have started shifting focus with new flows recently into the Hong Kong market, though he did not provide figures.

Min-Lan Tan, head of the chief investment office APAC at UBS, said investors had been looking for alternatives outside of China, making India "an essential part of the future".

"There is still scope for India to take it to a next level because right now what we see is a lot of public infrastructure, stable demographics, higher investment rates," she said.

"(The) U.S. presidential election is in November. Whether or not it creates more pressure on China is something that's important as well," she added.

($1 = 7.1612 Chinese yuan renminbi)