Investing.com -- Wells Fargo strategists believe that Chinese equities may be "running ahead of reality" following a sharp rally in the country’s stock market.

From September 9, 2024, to October 7, 2024, the MSCI China Index surged nearly 40%, driven by various economic and policy announcements. These moves have sparked investor optimism that the Chinese economy may be on the verge of a genuine recovery, despite its struggles with a prolonged property crisis that has weighed on both consumer and business sentiment.

However, Wells Fargo strategists remain unconvinced as they believe the recent recovery is “another false dawn.”

They cite several factors, including the “time it will likely take for consumers to rebuild their property-hampered balance sheets, a declining population, continued regulatory uncertainty, high levels of government debt, and a rise in global trade protectionism.”

Moreover, the upcoming US elections could act as a headwind, with both major political parties advocating for a tougher stance on China. Higher tariffs and stricter rules around technology transfers are likely to be among the first moves from a new administration.

Given these risks, Wells Fargo strategists suggest that investors use the recent bounce in Chinese equities as an opportunity to reduce exposure to China and Emerging Market Equities, areas they remain unfavorable toward.

Instead, they recommend focusing on US Large Cap Equities, as well as sectors like Energy, Communication Services, Financials, Industrials, and Materials, “for potential opportunities amidst any election-related volatility.”

Although the MSCI China Index remains in an uptrend, it is “incredibly overbought,” Wells Fargo notes.

In case of a pullback, support could be found at the 50-day moving average (58.85), followed by the 200-day moving average (57.05). Resistance is expected near the mid-2022 to early-2023 high of 76, the bank said.

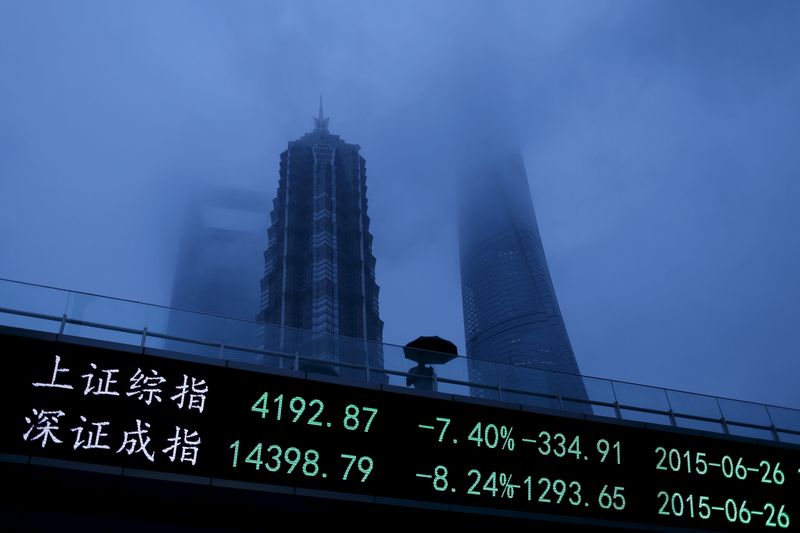

Hong Kong and Chinese stocks declined as disappointing economic data highlighted the need for Beijing to introduce fiscal measures to support growth.

The Hang Seng Index fell by 3.7% to 20,318.79, marking its second consecutive day of losses. The Hang Seng TECH Index saw an even steeper decline, dropping 4.7%. On the mainland, the Shanghai Shenzhen CSI 300 Index lost 2.7%, while the Shanghai Composite Index decreased by 2.5%.

China’s exports grew just 2.4% year-on-year in September, the slowest pace since May, based on customs data.

Furthermore, commercial banks issued 1.6 trillion yuan (US$226 billion) in new loans last month, missing a consensus forecast of 1.9 trillion yuan in a Bloomberg survey of economists.

Broader credit supply, as measured by aggregate finance, also slowed from the prior month, reflecting tepid domestic demand.