By Chibuike Oguh

NEW YORK (Reuters) -Global stocks edged lower after paring early gains while U.S. bond yields dropped on Tuesday as markets awaited economic data and a plethora of corporate earnings, moving past U.S. President Joe Biden's decision to end his reelection bid.

Alphabet (NASDAQ:GOOGL) reported better-than-expected results after the closing bell, while Tesla (NASDAQ:TSLA) saw its profit sink 45% on waning electric vehicle demand. Their results kicked off quarterly earnings season for the so-called Magnificent Seven technology megacaps that have driven recent market gains.

The U.S core personal consumption expenditures index, the Federal Reserve's preferred inflation measure, will be released on Friday. The yield on benchmark U.S. 10-year notes fell 0.9 basis points to 4.251%.

"The market is in the show-me-the-money stage where it's about the earnings being delivered," said Wasif Latif, chief investment officer at Sarmaya Partners.

MSCI's gauge of stocks across the globe fell 0.06% to 816.37. On Wall Street, all three major indexes pared early sessions gains and finished lower, dragged down by energy and utilities stocks.

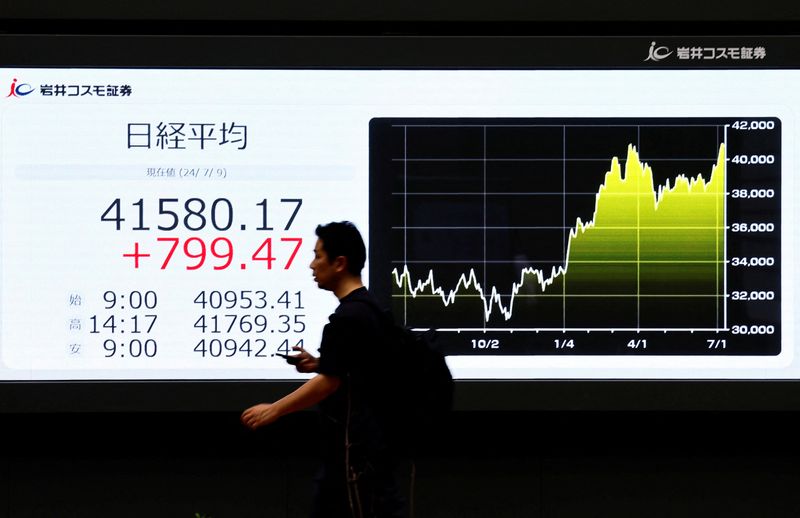

The pan-European STOXX 600 index gained 0.13%, helped by a technology-related rally. Overnight in Asia, MSCI's broadest index of Asia-Pacific shares outside Japan closed 0.30% higher at 566.92.

"We've had a strong run-up so far this year and a lot of the good news up until now is baked in, whether it's earnings related or rate-cut related," Latif added.

U.S. Vice President Kamala Harris will campaign in the battleground state of Wisconsin on Tuesday after securing support from a majority of delegates to the Democratic National Convention, making her the party's presumptive nominee.

The Dow Jones Industrial Average fell 0.14% to 40,358.09, the S&P 500 lost 0.16% to 5,555.74 and the Nasdaq Composite lost 0.06% to 17,997.35.

The dollar strengthened overall, while the yen rose for a second straight day against the greenback.

The dollar index, which measures the greenback against a basket of currencies, gained 0.14% at 104.45, with the euro down 0.37% at $1.0849. The yen strengthened 0.9% against the greenback at 155.63 per dollar.

Crude oil prices fell about 2% to a six-week low on rising expectations of a ceasefire in Gaza and growing concerns about demand in China.

Brent futures 1.7% to settle at $81.01 a barrel, while U.S. West Texas Intermediate crude (WTI) closed 1.8% lower at $76.96.

Gold prices edged up, with spot gold added 0.43% to $2,407.87 an ounce. U.S. gold futures gained 0.43% to $2,402.40 an ounce.

Bitcoin, which had risen on bets that a potential Trump administration would take a light-touch approach to cryptocurrency regulation, fell 3.60% at $65,698. Ethereum declined 0.48% at $3,473.