By Caroline Valetkevitch

NEW YORK (Reuters) -Global stock indexes mostly eased on Wednesday along with energy shares, while U.S. Treasury yields rose as investors stuck to the view that the Federal Reserve will be able to create a soft landing for the U.S. economy.

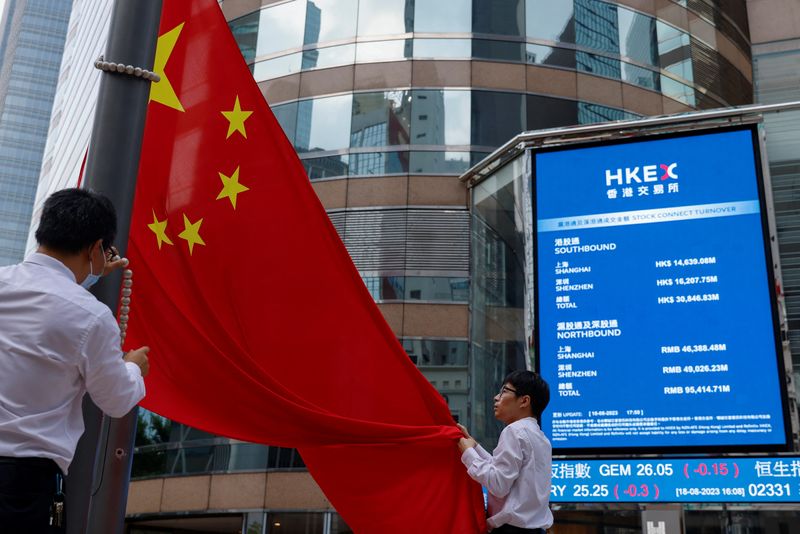

China's yuan gave back earlier gains a day after China's central bank unveiled its biggest stimulus since the pandemic to pull the economy out of its deflationary funk and back towards the government's growth target.

In the U.S., Wednesday's data showing new home sales falling in August had little impact on markets. Data on Tuesday showing U.S. consumer confidence dropped by the most in three years in September added to worries about the labor market.

The U.S. central bank last week began an anticipated series of interest rate cuts with a large half-percentage-point reduction.

Traders are now pricing in 59% odds of a 50-basis point cut at the Fed’s Nov. 7 meeting, up from 37% a week ago, and a 41% chance of a 25 basis point reduction, according to the CME Group’s FedWatch Tool.

"We're seeing yields trend broadly higher, which is a little counter-intuitive at the start of the Fed cutting cycle," said Chip Hughey, managing director of fixed income at Truist Advisory Services in Richmond, Virginia.

Investors will be watching this week for U.S. weekly jobless claims, due on Thursday, and the personal consumption expenditures price index, due on Friday.

On Wall Street, the Dow and S&P 500 ended lower, while Nasdaq was flat.

Energy led declines among S&P 500 sectors, falling 1.9% on the day, with oil prices also ending lower.

The Dow Jones Industrial Average fell 293.47 points, or 0.70%, to 41,914.75, the S&P 500 fell 10.67 points, or 0.19%, to 5,722.26 and the Nasdaq Composite rose 7.68 points, or 0.04%, to 18,082.21.

MSCI's gauge of stocks across the globe fell 0.95 points, or 0.11%, to 843.61. The STOXX 600 index fell 0.11%

The dollar bounced off a 14-month low against the euro in choppy trading.

The euro was last down 0.41% at $1.1134 after earlier reaching $1.1214, the highest since July 2023. The dollar index rose 0.68% to 100.91. It earlier fell to 100.21, matching a low from Sept. 18, which was the weakest since July 2023.

The greenback gained 1.03% to 144.68 Japanese yen and reached 144.75, the highest since Sept. 3.

The dollar was last up 0.33% at 7.033 yuan in offshore trading. The Chinese currency earlier reached 6.9952, the strongest since May 2023.

In Treasuries, U.S. 10-year yields last traded up 4.9 basis points at 3.784%. Since the Sept. 18 rate cut, 10-year yields have risen about 3 bps.

Oil prices declined as supply disruptions concerns in Libya eased. U.S. crude fell $1.87 to settle at $69.69 a barrel and Brent fell to $73.46 per barrel, down $1.71 on the day.

In other commodities, gold rose to a record high as expectations for another big rate cut by the Fed helped bullion's rally. Spot gold gained 0.2% to $2,662.00 per ounce by 1750 GMT after hitting an all-time high of $2,670.43 earlier.