By Caroline Valetkevitch

NEW YORK (Reuters) - Global stock indexes edged lower on Friday, reversing early gains as investors absorbed data that showed U.S. inflation was flat in May but in line with expectations, while Treasury yields turned higher.

Uncertainty around the U.S. presidential election and the imminent French legislative elections helped to offset the early reaction in the bond market to the U.S. inflation data.

The Fed's preferred inflation measure, the personal consumption expenditures (PCE) index, showed that annual growth in prices was 2.6% in May, as economists had expected, down from 2.7% in April.

While the data fueled some investor optimism the Federal Reserve could begin cutting interest rates in September, the early rally in stocks faded.

The MSCI world stock index, S&P 500 and Nasdaq all hit record highs in early trading before retreating.

"The Fed will see in this data what it wants to see and that’s going to keep everyone guessing as to when the next cut will be," said Brian Jacobsen, chief economist at Annex Wealth Management in Menomonee Falls, Wisconsin.

Investors were still digesting comments made during the U.S. presidential debate late Thursday between Democratic President Joe Biden and Republican rival Donald Trump ahead of the November election. The debate left some of America's allies bracing for a Trump return to office as president.

Trump Media & Technology Group shares rose early but were last down more than 11%.

The yield on benchmark U.S. 10-year notes was last up 4.9 basis points at 4.337% versus 4.288% late on Thursday.

The Dow Jones Industrial Average fell 122.54 points, or 0.31%, to 39,041.52, the S&P 500 lost 8.53 points, or 0.15%, to 5,474.59 and the Nasdaq Composite lost 28.70 points, or 0.15%, to 17,831.74.

MSCI's gauge of stocks across the globe fell 0.49 points, or 0.06%, to 803.26. The STOXX 600 index fell 0.23%.

The dollar index, which measures the greenback against a basket of currencies, was down 0.07% at 105.82 following the PCE data.

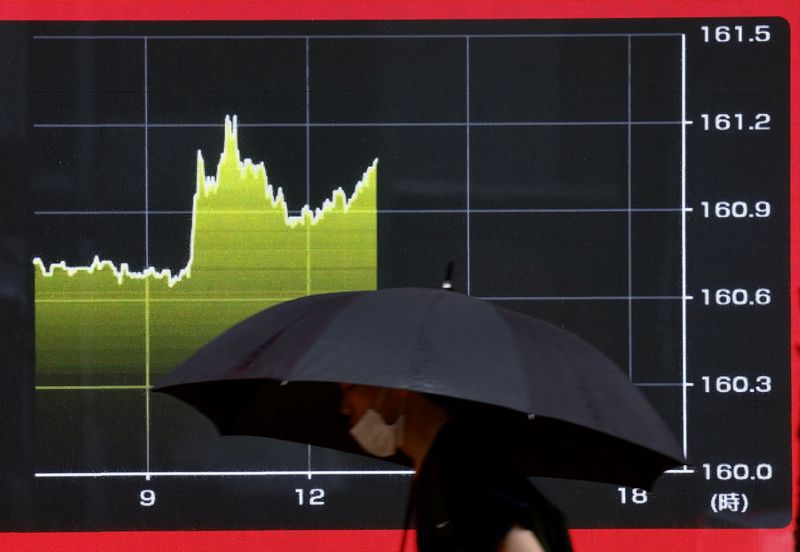

Against the Japanese yen, the dollar was nearly unchanged at 160.71.

The yen's slide to a 38-year low has fueled expectations of intervention by the Japanese authorities to stem the currency's weakness.

The euro was up 0.12% at $1.0714, with investors awaiting France's elections.

Worries about the outcome of the two-stage French parliamentary elections that start on Sunday pushed the risk premium on French government bonds over German bonds to its widest since the euro zone debt crisis in 2012.

U.S. West Texas Intermediate (WTI) crude futures fell 20 cents, or 0.24%, to settle at $81.54 a barrel.