Another NFP down without any big shocks to turn the Fed away from a December rate hike:

USD Average Hourly Earnings m/m: 0.2% v 0.2% expected.

USD Non-Farm Employment Change: 156K v 171K expected.

USD Unemployment Rate: 5.0% v 4.9% expected.

The Fed has kept the overall hawkish tone with the disclaimer being ‘if the data warrants a move’. Well that set of numbers there, while red on the headline, wont be negatively significant enough for the Fed to change from this course.

Most importantly as Forex traders, the market’s perception of the number looks to have agreed with that statement as the already relatively high USD saw profit takers step in and end USDX and the majors basically unchanged on the day.

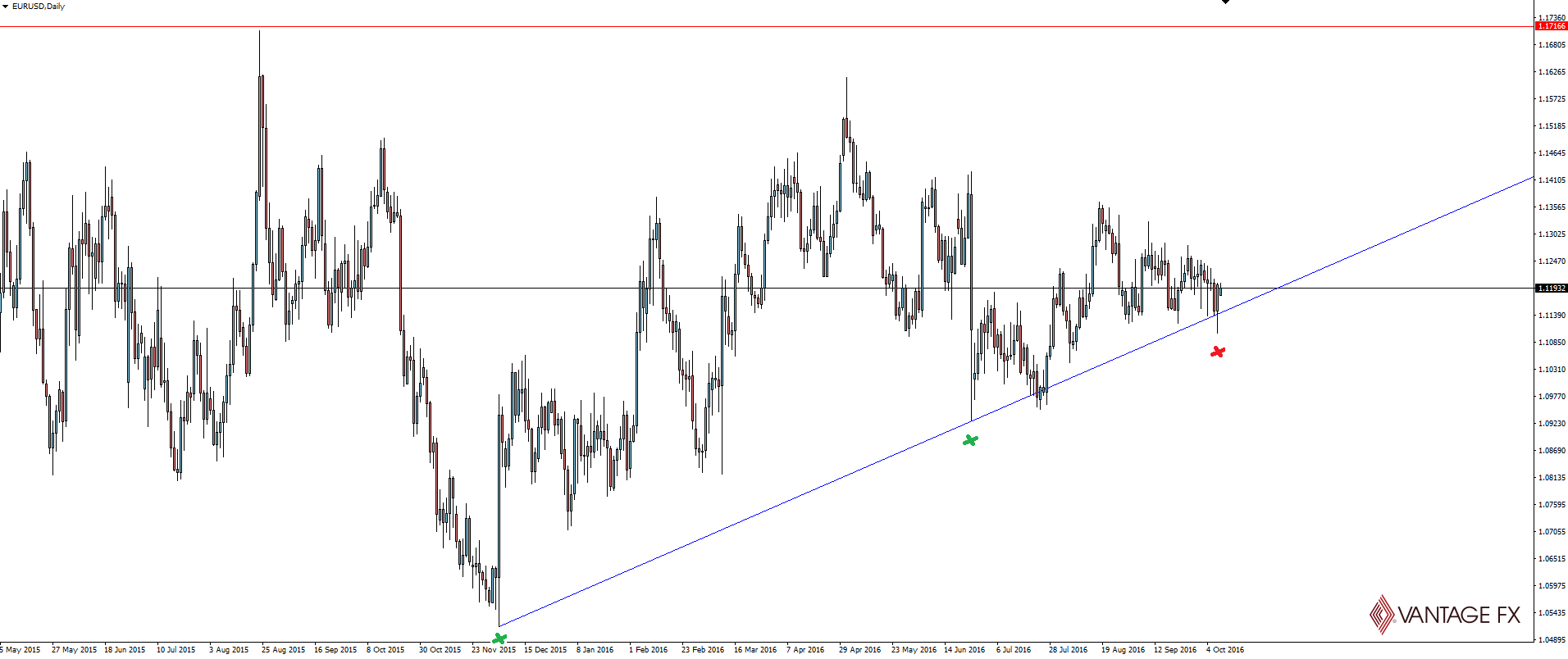

The Chart:

On Friday we were looking at this EUR/USD major trend line support and wondering if the pair was going to be obliterated by a positive NFP:

The potential for this support level to be absolutely obliterated heading into tonight if the number beats expectation is real!

Well taking a look at the post-NFP chart…

…we can see that when the numbers hit, price pushed down through the line but immediately found buyers lurking below. The number was more ‘not bad’ rather than ‘stellar good’, and the trap was set nicely to suck in anyone blindly selling the breakout as it happens.

As we spoke about above, the number won’t deviate the Fed away from their hawkish stance heading into December, but it wasn’t enough to destroy the huge EUR/USD technical level.

If you’re a reader of the blog, you know that I like to preach either setting your position up early and playing for a future break-out, (a strategy that doesn’t always come off, but sets you up for a huge move if you can predict correctly), or my bread and butter of waiting for confirmation that higher time frame support/resistance has held and then taking a position on the first re-test offering you excellent risk:reward.

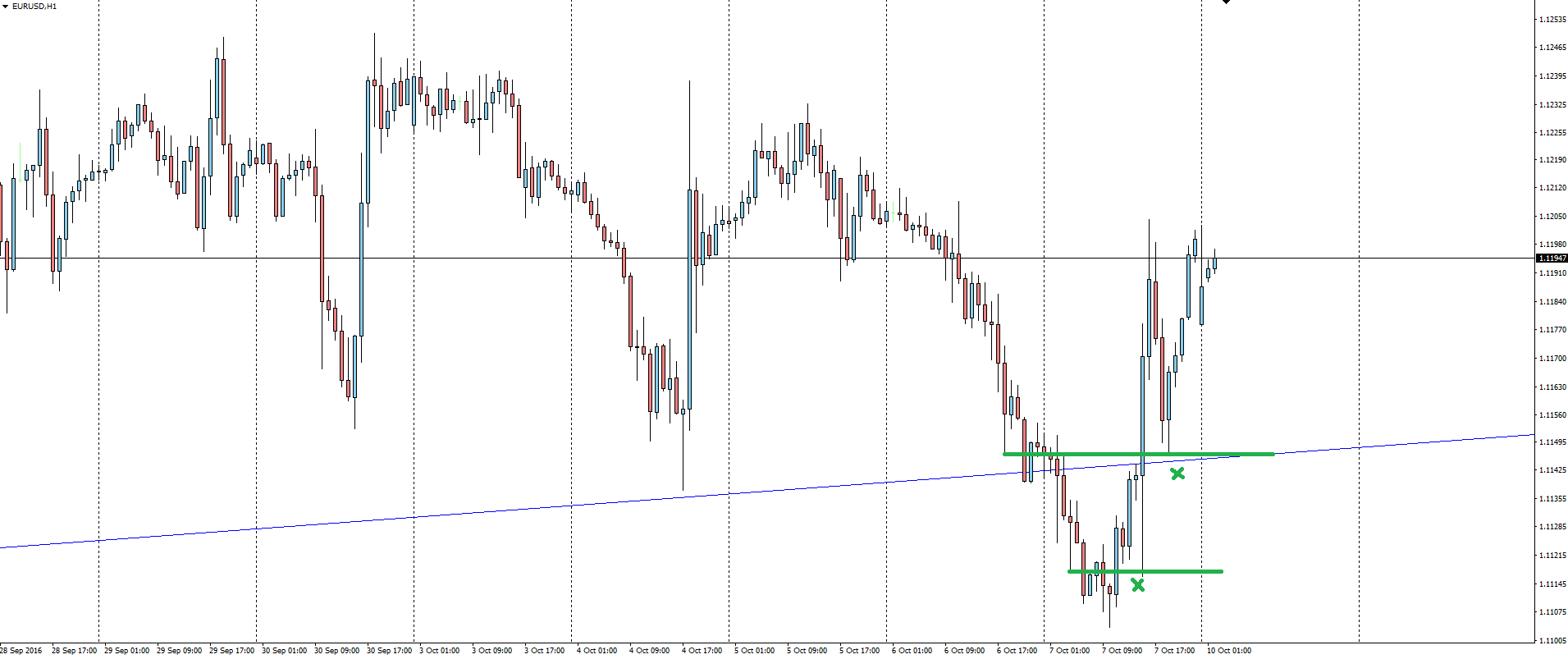

EUR/USD Hourly:

Looking at the charts in hindsight, these are the sorts of re-tests I’m talking about when the higher time frame trend line support has held. At Monday’s open, we’re still only 40 pips above that 2nd re-test, which is today’s key level heading into the debate if you’re playing from the long side.

The Second US Presidential Debate:

With a plethora of bank holidays across multiple Forex trading sessions, attention again will focus around the Asian session with the second US presidential debate.

Following the first debate, the market obviously awarded Clinton the winner, sending the US dollar soaring as the status quo means interest rate normalisation remains full steam ahead.

Always trying to look for where the biggest chance of a market re-pricing might be if expectations don’t match reality, I cannot express enough how almost none of the very real Trump risk has been priced in.

On the Calendar Monday:

JPY Bank Holiday (Japanese banks will be closed in observance of Health-Sports Day)

CAD Bank Holiday (Canadian banks will be closed in observance of Thanksgiving Day)

USD Bank Holiday (US banks will be closed in observance of Columbus Day)

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.