For us traders, the only winner that matters is the one that the market decides. And yes, the market has spoken. Hillary Clinton has been pronounced the clear winner in the first presidential debate.

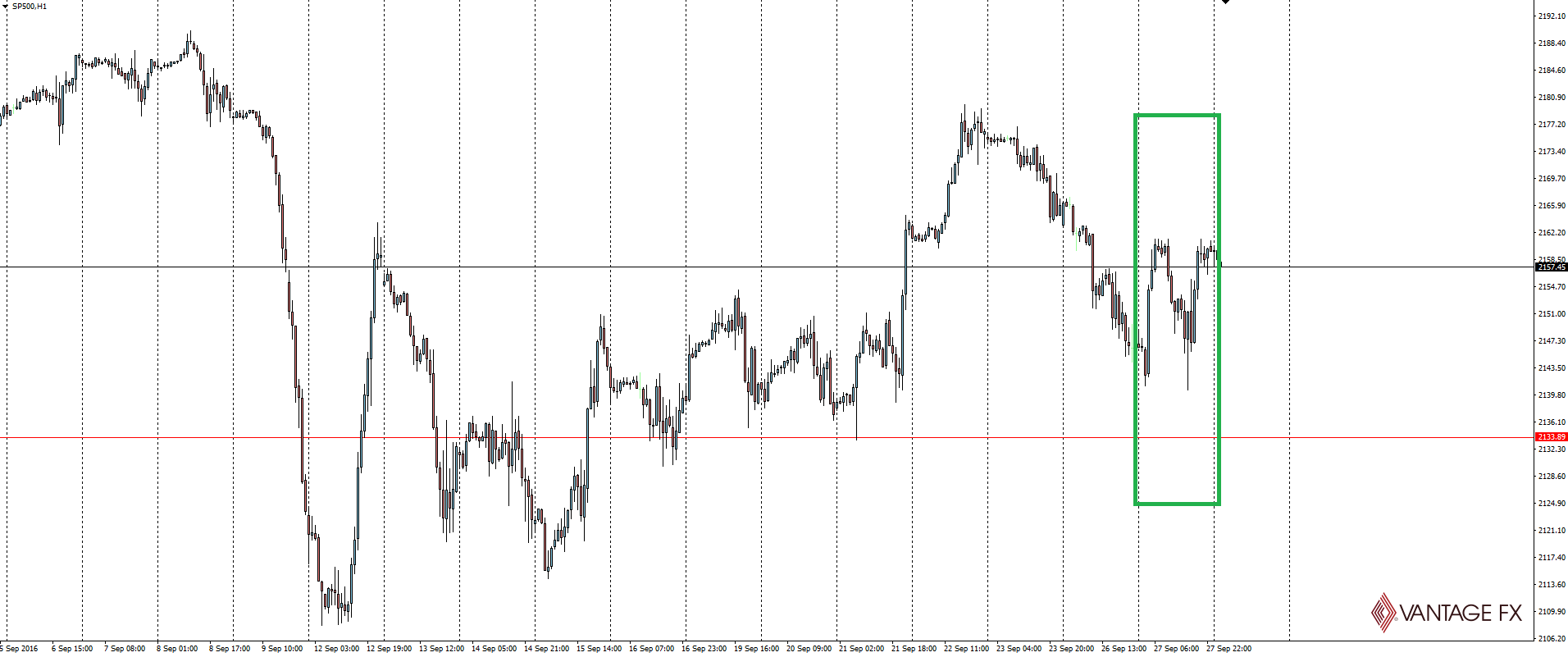

S&P 500 Hourly:

As you can see, the first SP500 rally is the emotional rally that the debate spurred the market into. But looking at the price action for the rest of the day, and especially how much bigger the daily session’s around it are, Hillary on top really didn’t give the market the emotional kick that, for example, a clear Donald Trump win would have given in the opposite direction.

Markets are always happier if the status quo continues, and more of the same is what a Hillary Clinton victory would offer.

This changes nothing in terms of how the market is possibly underpricing the shock of a Donald Trump presidency and as we said yesterday, the Trump risk is real.

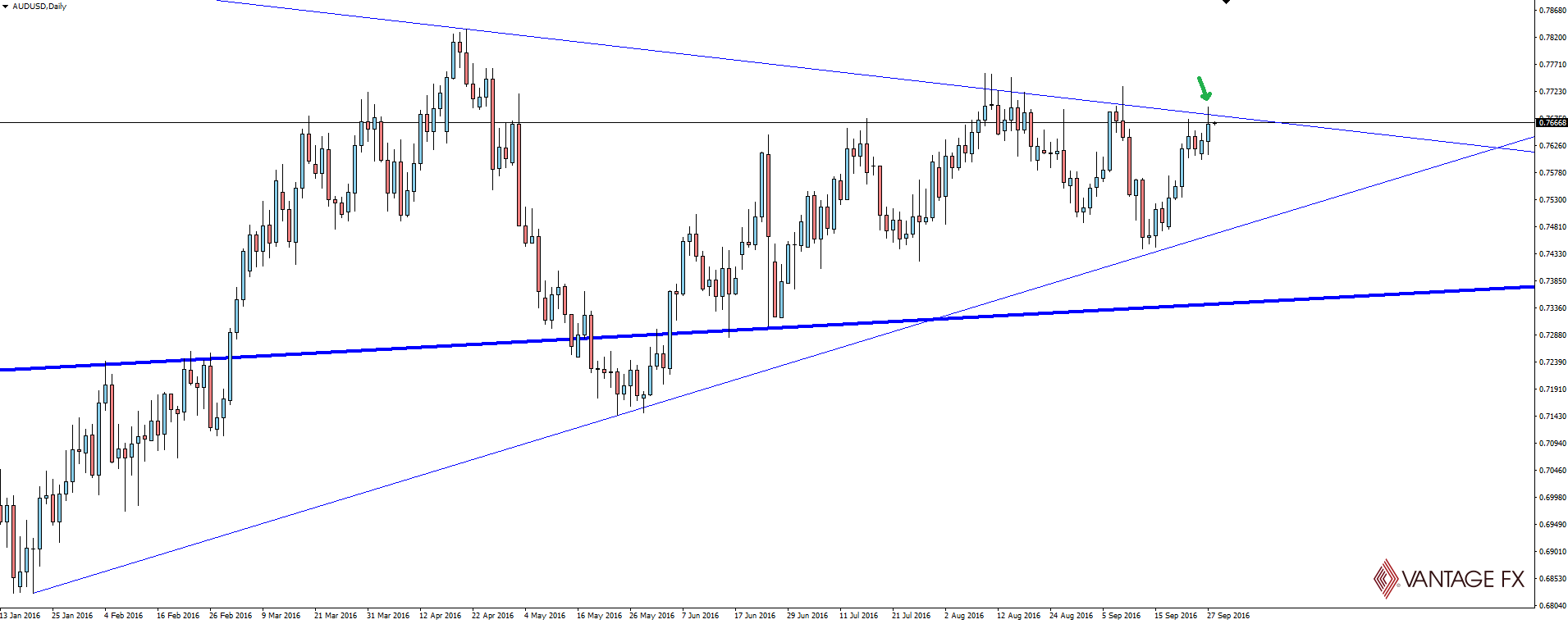

Looking at today’s aussie dollar chart of the day:

The AUD/USD scenario that we spoke about last week is starting to play out nicely with price testing higher time frame trend line resistance overnight for at least the SEVENTH time just this calendar year.

If you looked at getting long anywhere near the marked level to manage your risk around and held onto the trade, the drawdown was a minimal 20 pips from the line and you’re now sitting with a free trade that could get a whole lot better if the breakout comes.

All about putting yourselves in these positions to profit from the big moves when the do happen. Don’t be the trader chasing the last few pips of a breakout…

On the Calendar Wednesday:

USD Core Durable Goods Orders m/m

USD Fed Chair Yellen Testifies

EUR ECB President Draghi Speaks

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.