It’s a good day to be a forex trader. NFP Friday in the lead up to an anticipated Fed interest rate hike.

Honestly, it doesn’t get much better than this in terms of potential for trading opportunity on the back of markets re-pricing when reality doesn’t meet expectations.

But all that matters tonight is NFP:

USD Average Hourly Earnings m/m: 0.2% expected and 0.1% previously.

USD Non-Farm Employment Change: 171K expected and 151K previously.

USD Unemployment Rate: 4.9% expected and 4.9% previously.

If you look at the economic data for the past month, pretty much across the board it’s better.

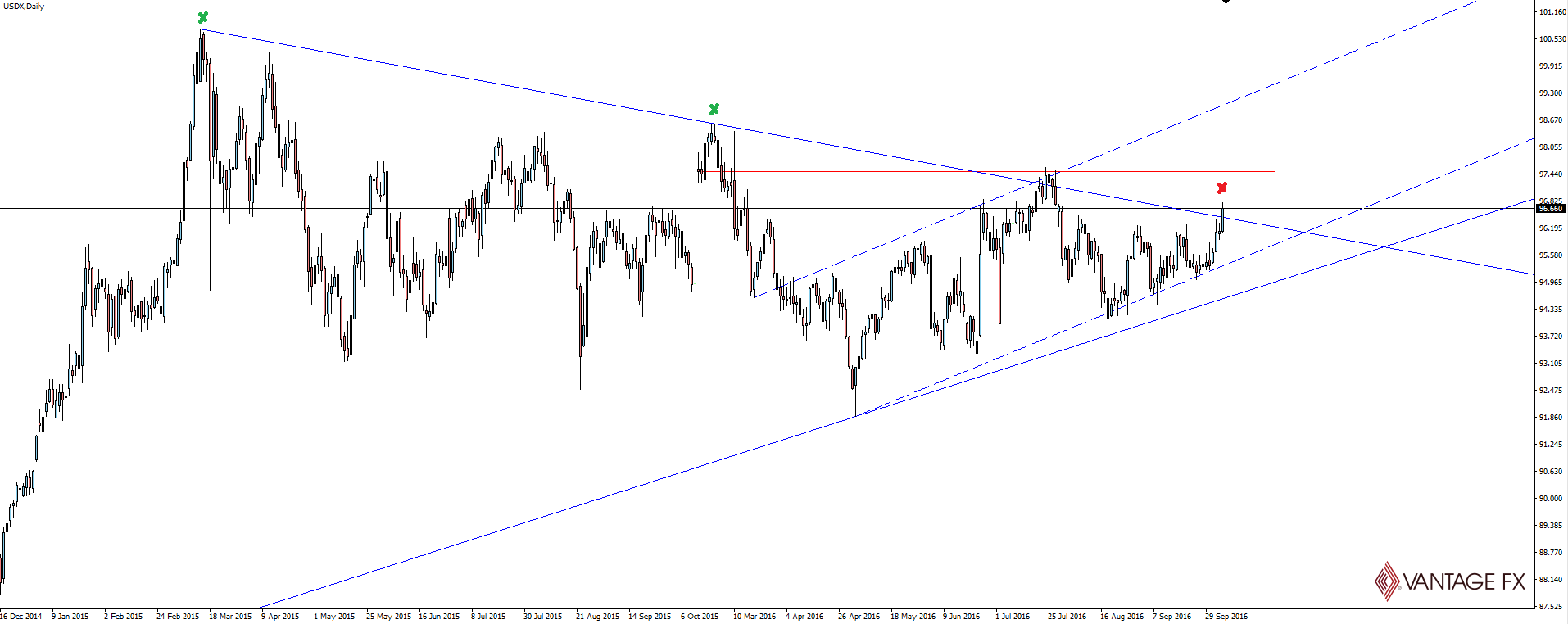

This is why the US dollar rallying off support in anticipation of further good news is no surprise:

USDX Daily:

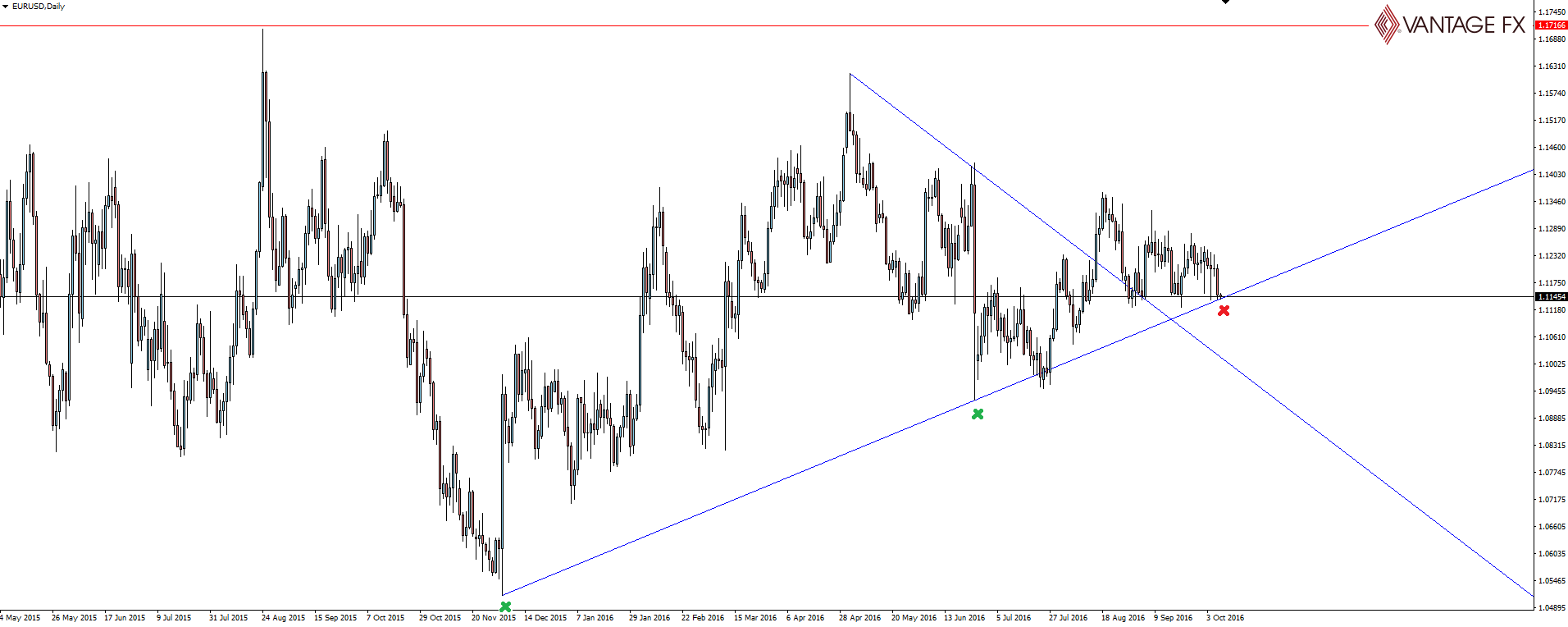

Looking for a chart we can look to trade this USD sentiment off of, brings us to EUR/USD.

On a parralel storyline, we have been speaking about the fact that Deutche Bank is in trouble. But as you can see in the charts from that post, the euro wasn’t reacting off the move.

Furthering this narrative, overnight International Monetary Fund managing director Christine Lagarde told Bloomberg TV that the sooner Deutsche Bank (DE:DBKGn) reaches a settlement with the US Department of Justice, the better it will be for all involved.

“A bad settlement is always better than a good trial.”

EUR/USD Daily:

So now a week later, EUR/USD has started to move. Euro weakness on the back of banking system uncertainty combined with US dollar strength thanks to huge market anticipation on data and the Fed.

The potential for this support level to be absolutely obliterated heading into tonight if the number beats expectation is real!

On the Calendar Friday

CNY: Bank Holiday

GBP: Manufacturing Production m/m

CAD: Employment Change

CAD: Unemployment Rate

USD: Average Hourly Earnings m/m

USD: Non-Farm Employment Change

USD: Unemployment Rate

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.