Powell utterly, completely, and wholly capitulated to the will of the market. However, Powell’s surrender had exactly the desired effect and rocketed markets higher across the board. Even as I type this, the ES and NQ continue to creep higher and higher. In the span of just a few weeks, the Dow Industrials have gone from the 21-thousands to the 25-thousands. Most indexes have gone up 15% or more. Many stocks have gone up far more than that.

It would have been really smart for anyone to follow Trump’s advice and buy stocks back on December 26th. That was a winning move. I think that now, many thousands of points higher, it is not such a bright idea. And yet people are still piling in.

For the one or two of you left who think the bearish case has even a small prayer, allow me to say a few things:

- The strongest chart-based case for the bears is that the series of lower lows and lower highs is still intact, irrespective of the past five weeks;

- Just a glance at the persistent divergences in SocialTrade to have a peek at some reality;

- Getting the Fed out of the way was actually key, because as I said on my tastytrade show today, he can only surrender once. The “Powell Put” news is built into the market now.

Paradoxically, the best thing that could possibly happen for the bears at this point would be some kind of definitive, positive announcement on the US/China trade situation. That’s really the only “overhang” left. Get some big splashy announcement from that, and the market will quickly tell you what its peak price is. It is irksome that this uncertainty still remains, because getting it done would actually be beneficial to the bears, not, as most people believe, the bulls.

Let’s take a fresh look at some big cash indexes, with a few words beneath each:

The Dow Jones Composite still has a clear series of lower highs. However, its clean topping pattern (defined above the blue line) was pierced badly already.

The NASDAQ Composite likewise has its lower highs in place, although its strength has pushed it above an intermediate-term trendline, shown in blue

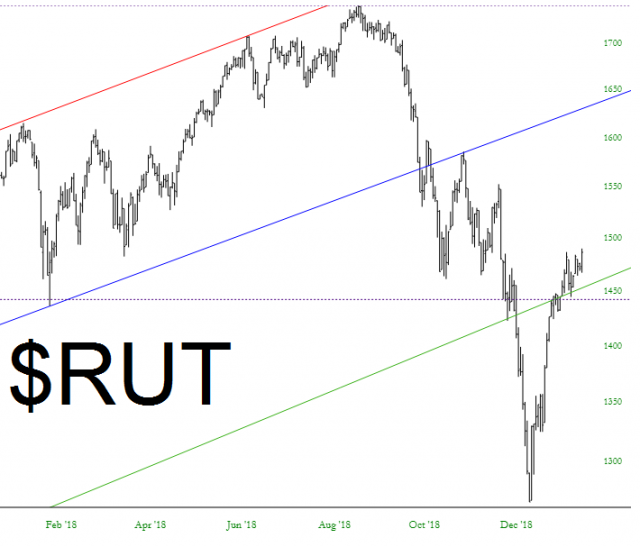

The Russell 2000 has also pushed above its trendline (green) and has also powered its way above the Fibonacci retracement (dotted line). The lower highs remain intact, however.

The broker/dealer index remains the most bear-friendly, actually managing to close down today and persistently respecting its descending trendline (red).

Finally, the S&P 500 is probably a good place to close with some focus. In the bulls’ favor is, frankly, the past five weeks. “Buy the Dip” has been proved right for the eight-thousandth time in the past decade. The Powell Put has been set in stone. There is almost certainly bound to be some kind of positive announcement – – even if it’s just a pledge for future talks – – with respect to China.

I still see a ton of fantastic short setups, which indicates to me the bears still have a chance. The most important “Please Do Not Cross This” level for me is marked below in green. Reaching such a level and then retreating would be a powerful reversal, not only because that green trendline goes back an entire decade, but also because it would be the 4th instance where the S&P got about to 2800 and then started plunging.

Barring some surprise, the next Big Event is going to be the AMZN earnings Thursday after the close. I won’t have any direction position, but I’ll certainly be watching with intense interest, because AMZN and its price gap always has an outsized effect on the rest of the market.