Even the most level-headed investors may be wondering if their newsfeeds are glitching lately.

Amidst a pandemic, we have seen the stock market sore to record levels, despite high unemployment and economic retraction. The ever-widening drift between Main Street and Wall Street a troublesome sign of systemic problems.

Even though most investors will probably proceed with caution understanding that this most fragile of bubbles is propped up by excessive QE, the new-found volatility in the stock markets is catching the eye of those with a stomach for high-risk.

Just last week, the Shanghai Shenzhen CSI 300 Index reached its highest level in nearly a year. Even amid social unrest and uncertainty, the Hong Kong Hang Seng Index registered a new record since April and the NASDAQ… Well, I challenge any seasoned investor to explain what's going on there. A record high last week? Yet another record high before opening on Monday only to close notably lower.

The narrative is always the same: apparently it has to do with how confident investors are in a coronavirus vaccine or how afraid they are of a rise in cases. Either way, it's creating the type of volatility and sporadic gains (and losses) that cryptocurrency traders have long taken in their stride.

New Lows in Bitcoin Trading

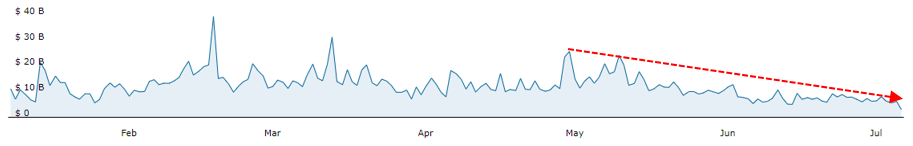

All these fireworks and record highs in stocks like Tesla (NASDAQ:TSLA), Apple (NASDAQ:AAPL), and Pfizer (NYSE: NYSE:PFE) are occurring at a time when Bitcoin is registering new lows in trading volume on exchanges in both spot and derivatives trading. If you examine the data from Cryptocompare, you'll see that spot trading volume is at its lowest in six months, showing a particularly marked decline since the start of May.

Spot Exchange Total Volume

Source: https://www.cryptocompare.com/

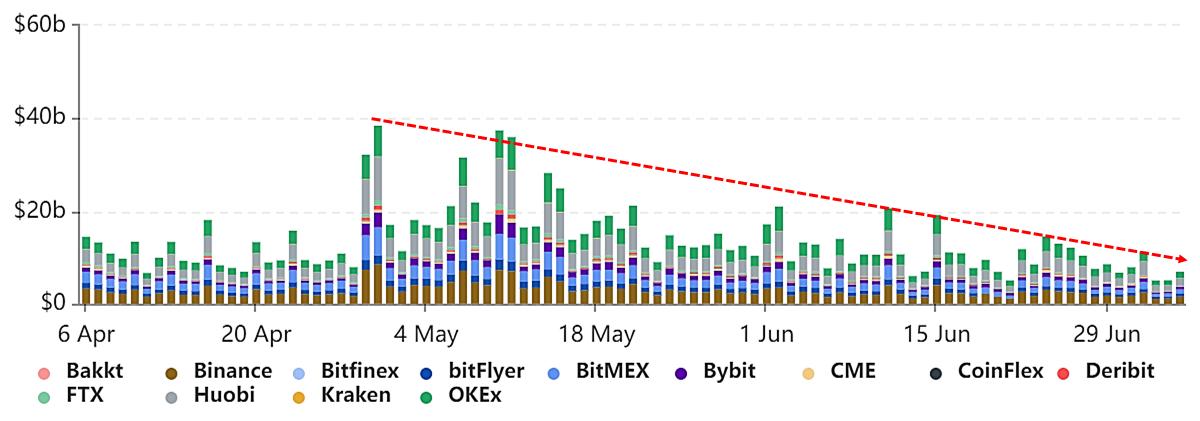

This is not only the case when it comes to spot trading volume. Data from Skew also shows that Bitcoin futures trading volume has been declining since May across the board.

BTC Futures – Aggregated Daily Volumes

Source:https://analytics.skew.com/

Time to Short Bitcoin and Start Playing the Stock Market?

With the drop in BTC trading and the wild activity in stocks, can we conclude that now is the time to short Bitcoin? It would be helpful to first understand what's driving the trading drop (and also to keep in mind that record highs in equities with so many global macro factors swirling to create the perfect storm can only be treated with caution).

On face value, one might be tempted to say that Bitcoin is indeed looking set to prepare for a crypto winter. But is this really the case? Let's remember that the real value behind Bitcoin derivatives is reflected in hedging market risks. This means that there is a strong demand during periods of high volatility.

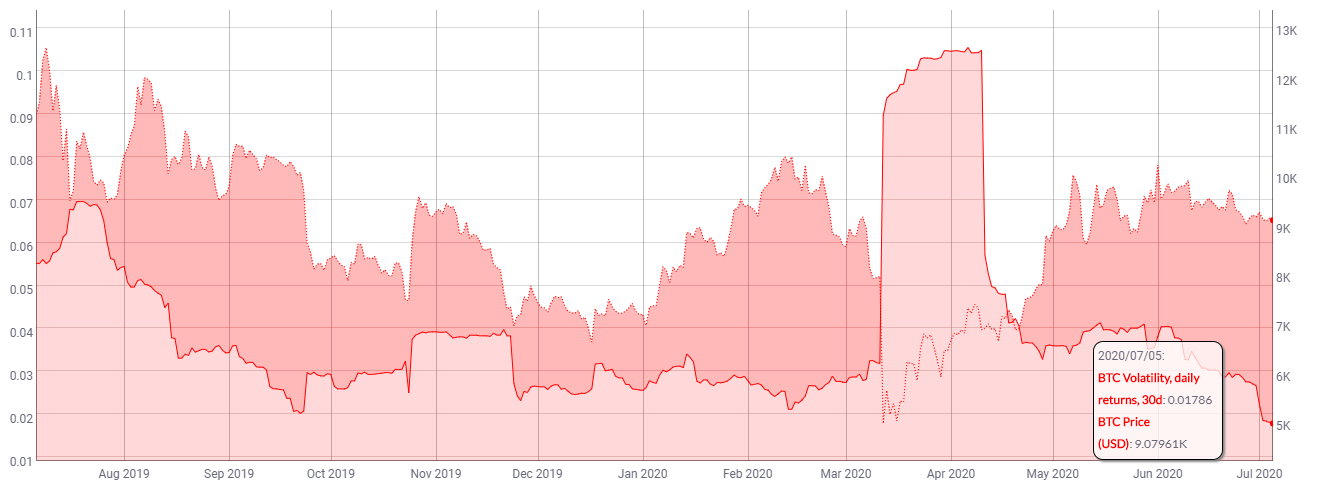

Therefore, it is of no coincidence that the drop in trading is also coinciding with Bitcoin's 30-day volatility reaching its lowest level in a whole year.

What's going on? Stocks seem to be the new Bitcoin and Bitcoin has lost its shine. Could that mean that it's maturing as an asset class by shedding volatility? And if so, shouldn't that be a good thing?

After all, the single main factor keeping institutions away from Bitcoin has always been its volatility. Yet, we're now seeing that in traditional markets - just look at crude oil, dropping by more than 300% in April. So before we decide to short BTC and long traditional markets, let's take a look at a little more data. Exchange trading data is not the only way of judging the health of Bitcoin.

Bitcoin 30d Volatility Vs Bitcoin Price

Source:https://coinmetrics.io/

Other Key Bitcoin Metrics Are Looking Strong

Beyond exchange trading volume (which has often been called into question for its veracity), OTC trading is an important indicator in the bitcoin market as OTC trading volume figures are more trustworthy. Looking at recent data from Coin.dance, we can see that trading volume on the two major peer-to-peer bitcoin market places has not seen a significant decrease. In fact, on Paxful, the pandemic has caused trading volume to increase significantly in many places particularly countries with a weak fiat currency.

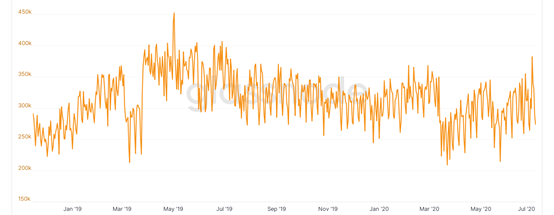

Another important factor which too many investors ignore is on-chain trading data. Unlike OTC and exchange trading data, on-chain usually represents larger more rational investors. You could say that on-chain data reflects the underlying support of Bitcoin prices. Glassnode tells us that Bitcoin on-chain transactions have kept an average level over the last year.

Bitcoin: Transaction Count

Source: https://glassnode.com/

This forces us to rethink the shape of Bitcoin and its overall health. Further, the Stablecoin Supply Ratio (SSR), essentially Bitcoin market cap vs Stablecoin market cap is low. In fact, data from Glassnode reveals that the SSR indicator has reached a minimum since this time last year. This is a positive sign because a low SSR indicates that the stable coin supply has more purchasing power to buy bitcoin.

Taking all these factors into account, we can see that Bitcoin's popularity has not only not decreased but the SSR is displaying its strongest upward momentum in 12 months. So, is it time to short Bitcoin? That is a decision each individual investor should make. Personally, I am extremely encouraged by these signs and believe that Bitcoin will soon be seen as a solid investment again, making going short potentially hazardous. As stocks continue to surge and flounder and liquidate those who fail to heed the warning, I believe that BTC will soon gain ground.