With the giant reversal taking place today, let’s take a fresh look at some important indexes, in alphabetical order.

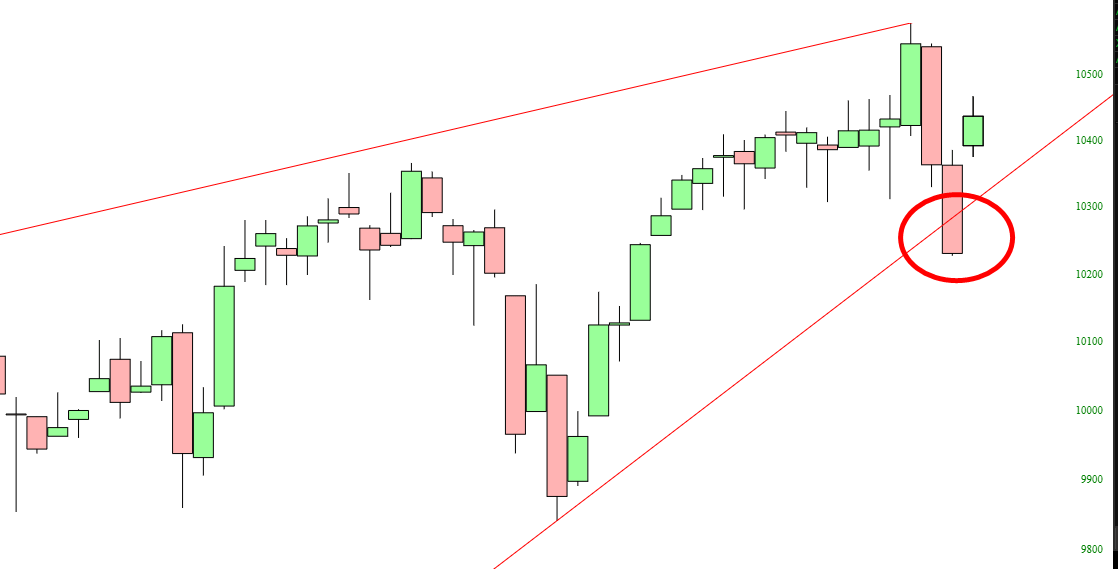

First is the Dow Jones Composite. This cracked through its trendline on Friday, but it has sprung right back above it. We’ll see if the damage done last week actually signals anything, or if this was just a one-day anomaly. My view is that the trendline break is meaningful.

The NASDAQ Composite hasn’t been quite as forgiving, since its trendline damage was much worse. It spent the entirety of last week below the broken trendline.

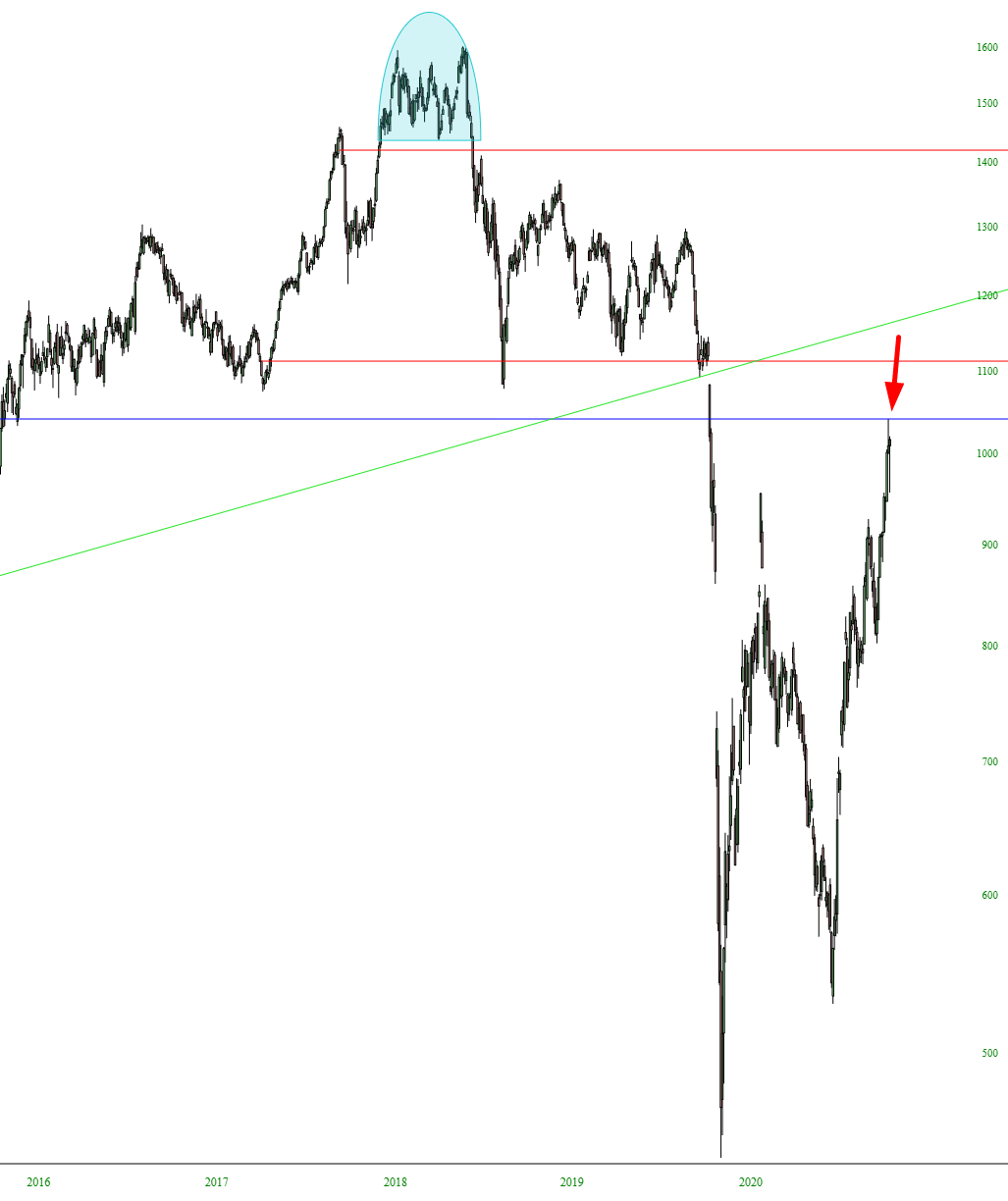

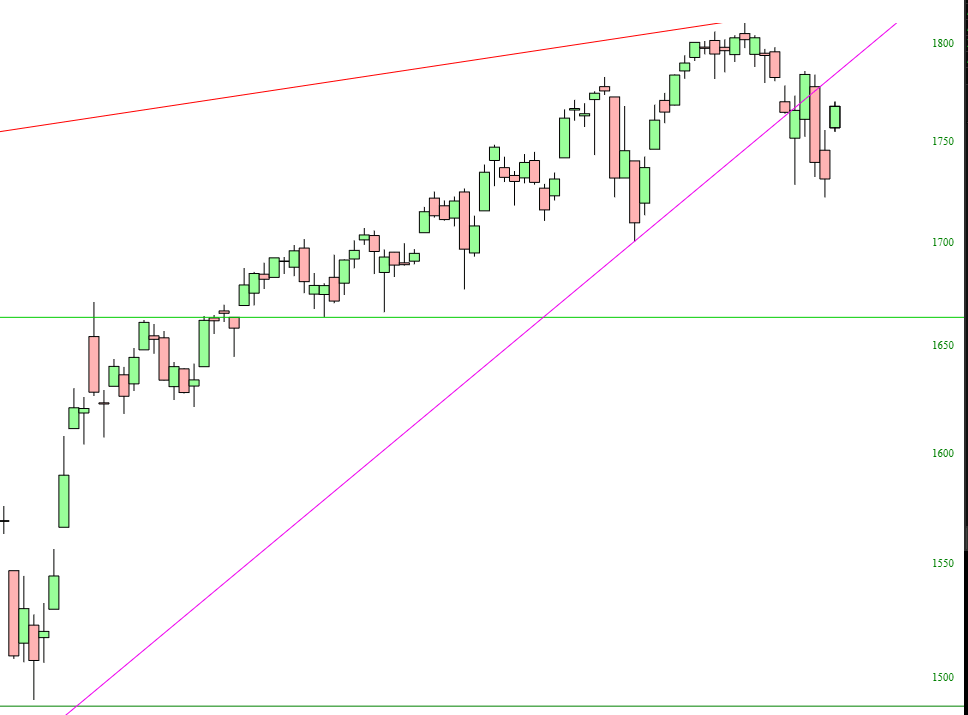

Ever since Aug. 6 of last year, precious metals have stunk out loud. We might get a bounce in the Gold Bugs Index, but I think that horizontal line will be the limit.

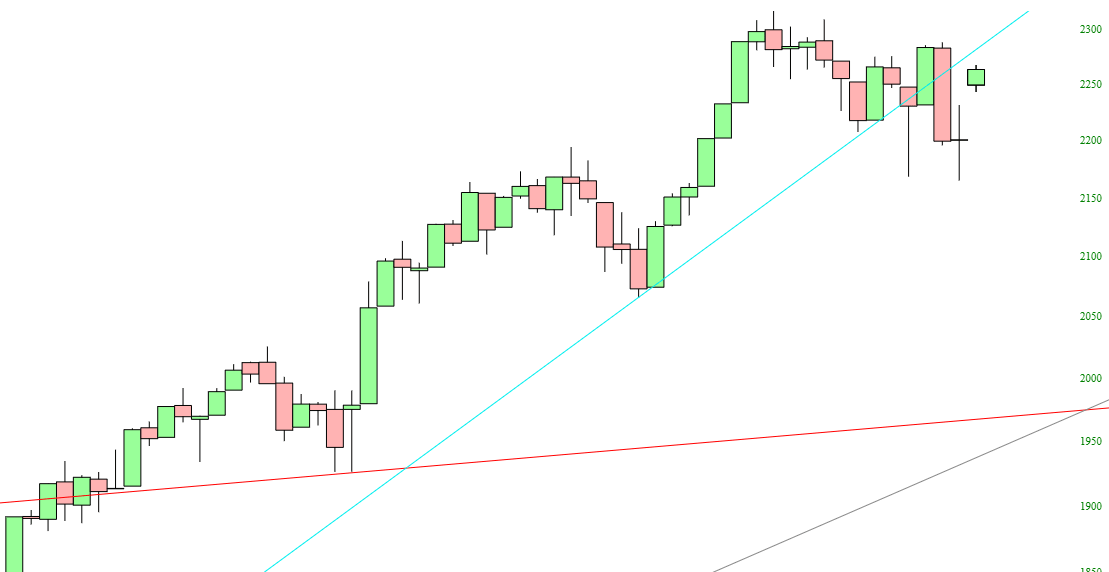

Similar to the $COMPQ, the NASDAQ 100, symbol Nasdaq 100, is quite plainly below broken support.

The S&P 100 remains below support as well, in spite of the very sizable rally this morning.

The same can be said of the Russell, since last Thursday’s drop was so substantial.

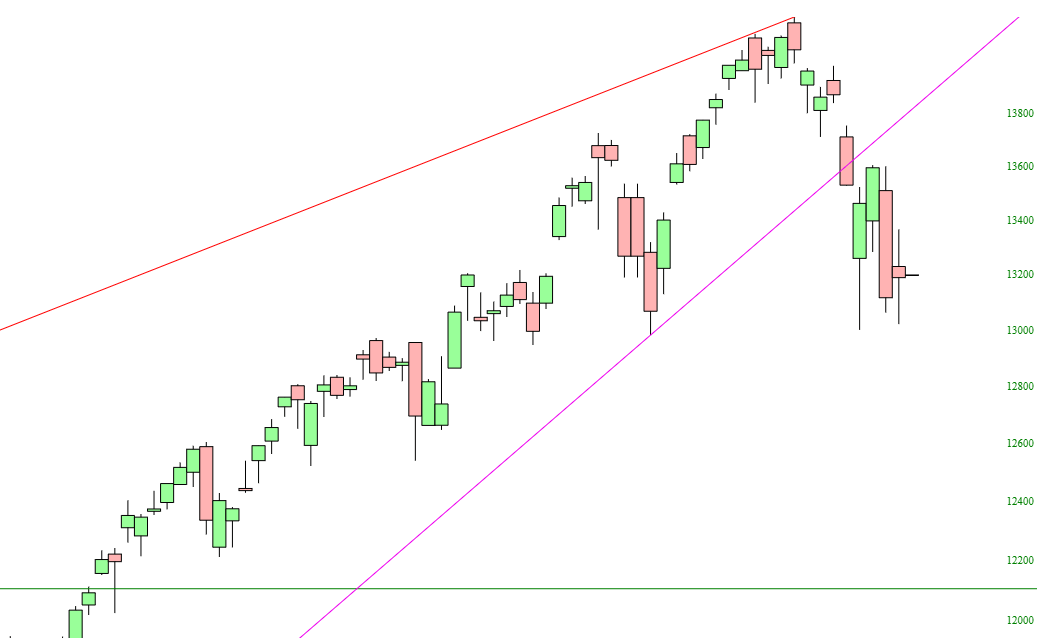

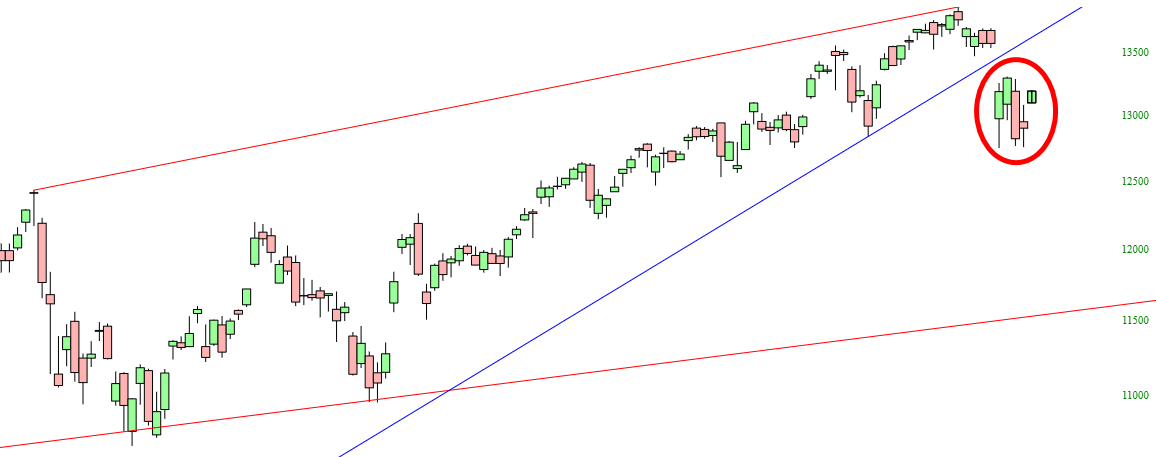

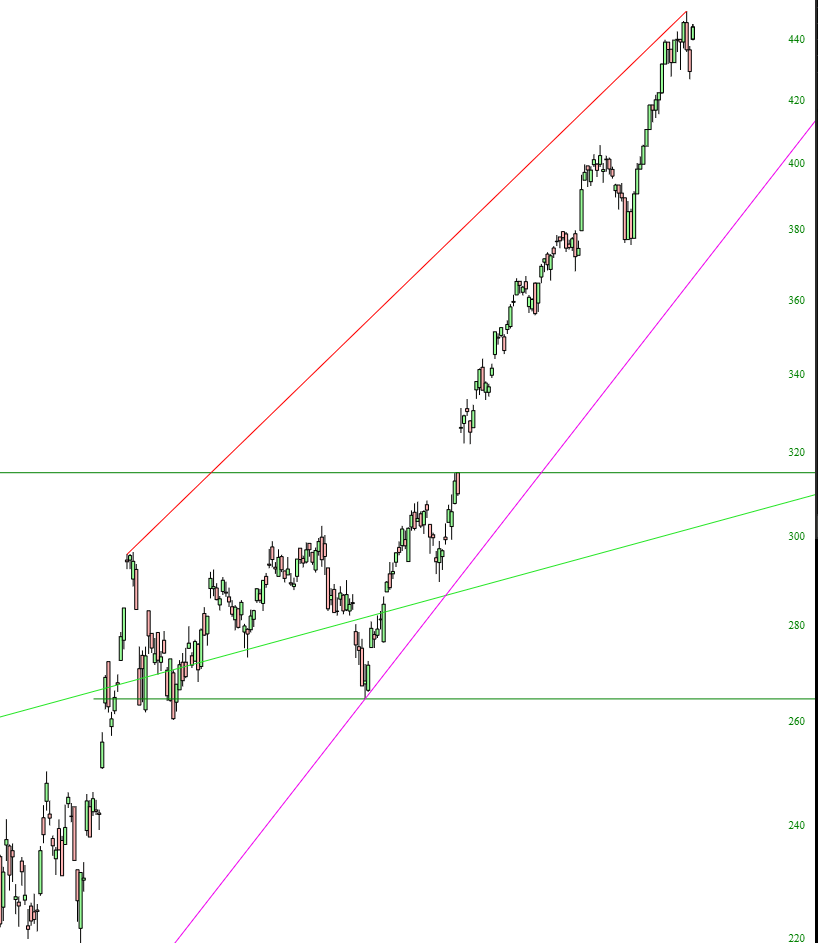

One area of resolute strength for the bulls is the semiconductor index, Philadelphia Semiconductor Index, which has been safely within its channel for going on a year now.

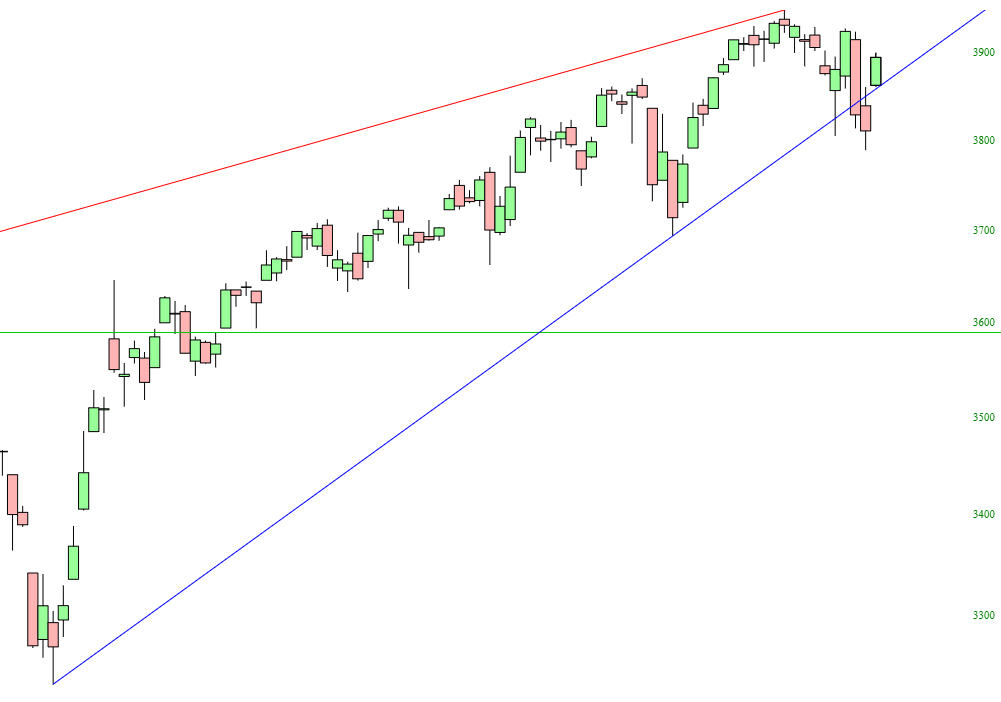

The S&P 500 teased us all a bit late last week with a trendline break, but it has clamored back above it. We are still below lifetime highs, and I think the ecstasy over the $1.9 trillion in free money that’s about to be distributed will be transitory.

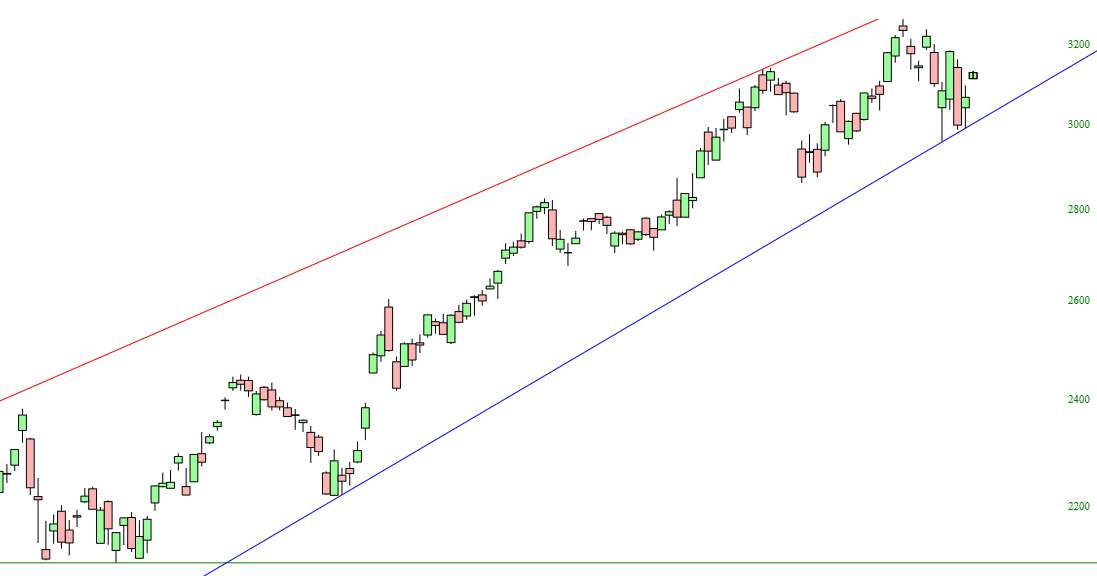

Just as the semiconductor space has been unbroken, so, too, has the Broker/Dealer Index (symbol ARCA Major Markets). We are sky-high on this.

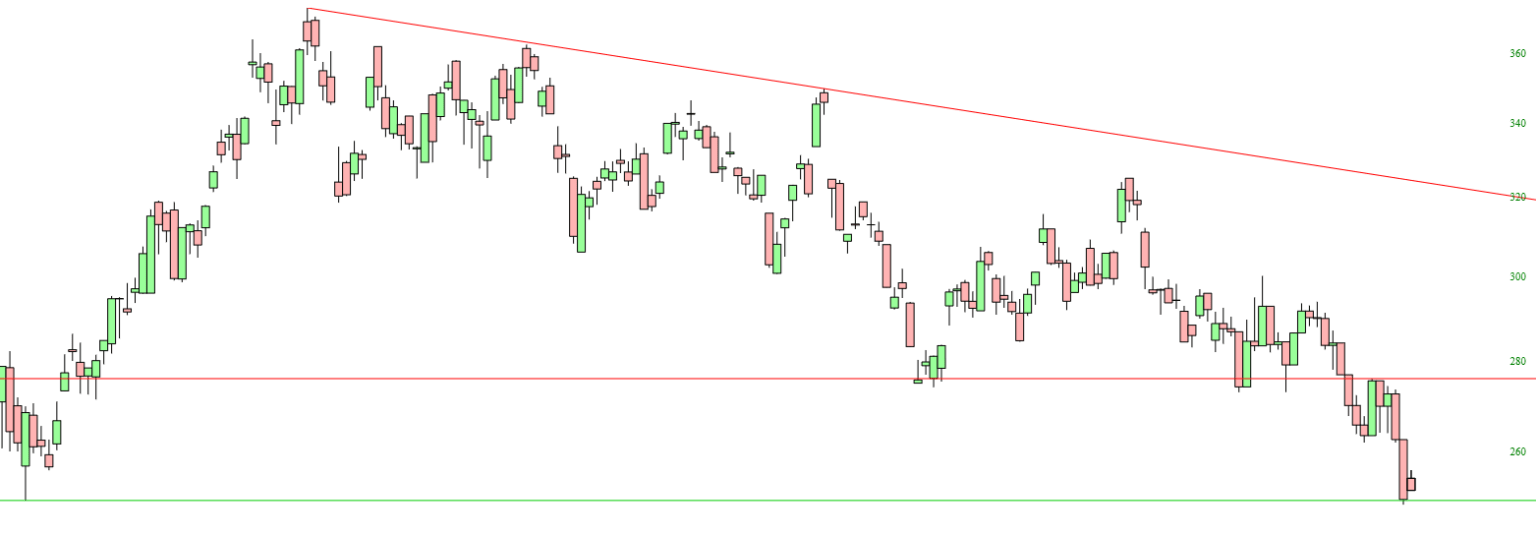

Lastly, the most vulnerable sector, in spite of all the breathless enthusiasm about crude oil, is the Oil & Gas sector (ARCA Oil). The run-up has been sensational, but that is a massive and powerful top.