The “buy the dip” crowd were slapping each other on the backs and cracking open the champagne on Friday again, after the markets closed strongly higher, but this time they really look like they have overplayed their hand.

Let’s review what has just happened starting with the 6-month chart for the S&P 500 index. As you may recall, we were expecting a temporary cessation of the decline, because bullish looking candles appeared on the chart on Wednesday and Thursday on very heavy volume at a time when the market had become deeply oversold. On Friday the market rallied sharply, more than we had anticipated it is true, but it doesn’t change the picture. In retrospect the market was entitled to a sharp rebound because it had become so oversold that any piece of good news would be latched onto by the “buy the dip” crowd, and the moment a rally started it would quickly trigger a wave of short covering resulting in a sharp bounce. You will notice, looking at the chart, that the rally on Friday doesn’t look like such a big deal, especially as it closed well off its highs. There is substantial resistance approaching the 200-day moving average, which is rolling over, which is what caused the market to back before the close on Friday. As the market is still heavily oversold short-term, as made plain by its MACD indicator, it could chop sideways for a while before it heads lower again. The reasons we are expecting it to head lower again will become apparent as we review the longer-term charts.

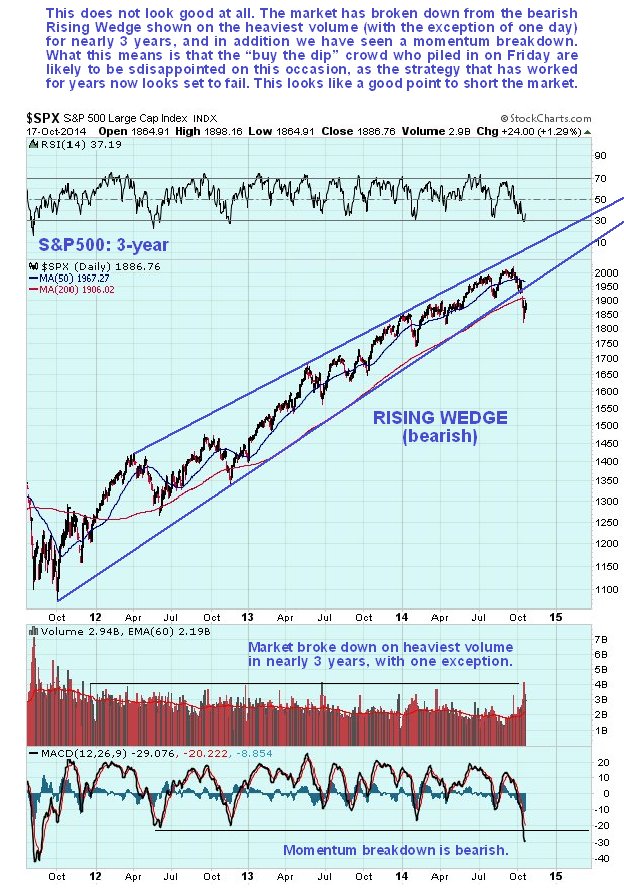

On the 3-year chart for the S&P 500 index, we can see how corrections got smaller and smaller as the market headed higher and higher, a sign of complacency and over-confidence, until this last drop, which bust it down from the long bearish Rising Wedge uptrend on heavy volume which was a bearish sign, especially as it was accompanied by a momentum breakdown. Despite the current oversold condition, this chart looks ominous.

The 7-year chart shows the entire bullmarket from the 2009 low and it reveals that the market has ascended in a larger bearish Rising Wedge than the one shown on the 3-year chart, which it has just broken down from for the 1st time. This chart makes plain that this bullmarket has been going on for a very long time, and since bullmarkets are known not to last forever, the probabilities of a bearmarket now setting in are high.

Finally, the very long-term chart going back to late 1992 reveals the cyclicality of the market. It is interesting to observe how the 2 prior major bullmarkets lasted 5 years, and the current one is over 5 years old and looking done. Both the earlier bull markets were followed by relatively short but severe bearmarkets lasting roughly 2 years. It is also fascinating to observe that the major peaks are separated by 7 years – and it is now 7 years from the last peak in 2007 to where we are now. Coincidence? – maybe, but do you want to risk betting against it??

Important corroborative evidence is provided by the London FTSE index (and other markets). The London FTSE shows a massive completed Triple Top, which it just broke down from over the last couple of weeks, a development we had expected for some time. This chart looks frightful and portends a serious decline, not just for this market, but for other European markets too, and beyond that other world markets, like the US. There is a school of thought which maintains that, because of all the troubles elsewhere in the world, vast amounts of capital will flood into the US and eventually drive its markets and the dollar through the roof. It’s a nice idea and longer-term might prove to be the case, but in the here and now US markets look set to be dragged down along with all the others, since major world markets tend to move like a flock of sheep, especially during major selloffs.

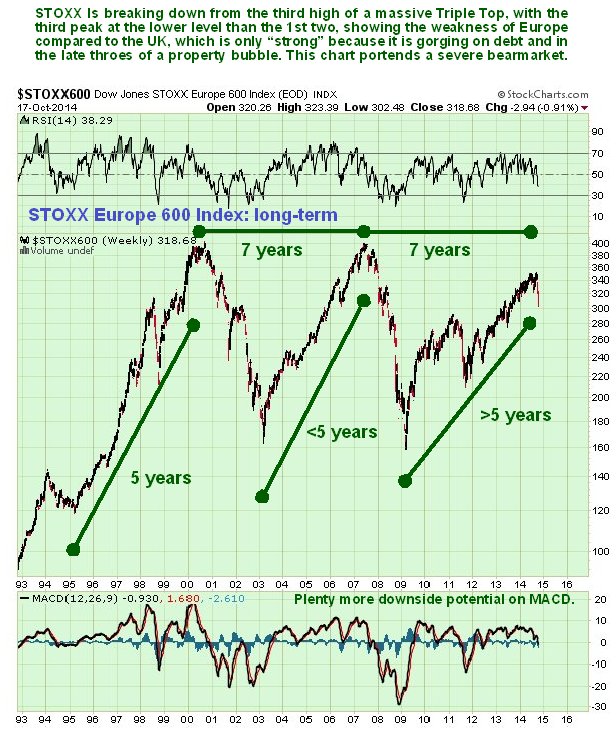

Meanwhile across the channel, in Europe, things look even worse. The Stoxx index didn’t even make it to its 2000 and 2007 before starting to crumble again…

The strongest economy at the heart of Europe is Germany, which has until now has managed to “rise above it all”, but it won’t be able to hold out forever with other European countries around it going belly up. The German DAX index even managed to make new highs this year, but it is rather like the highest tower at the center of a castle under attack that is the last to fall – so we shouldn’t be fooled by the recent new highs, with other markets set to collapse, the German will be taken down too.

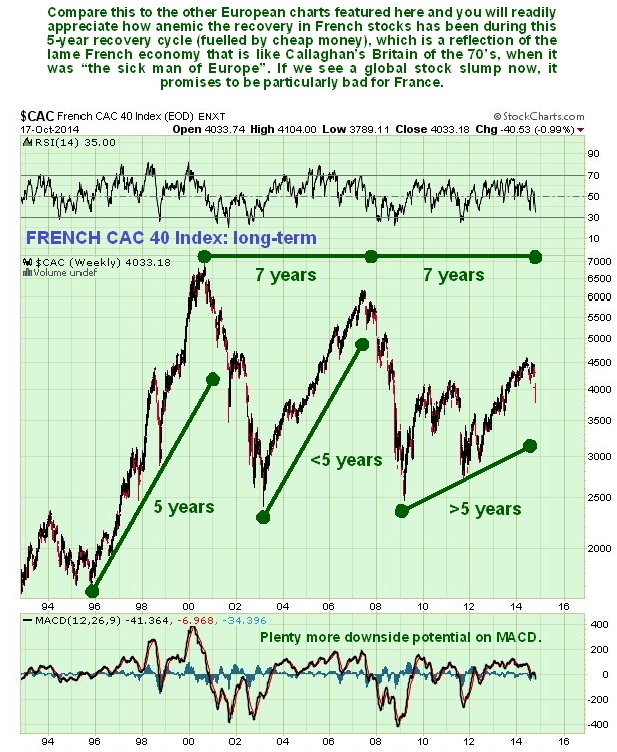

Now we come to a new “sick man of Europe”, France, an inglorious title that used to be held by Britain in the 70’s. If any of you have been to Paris in the recent past you will know that it is not the happy place it used to be – it is besieged by beggars, plastered in graffiti, expensive and the locals are often surly and discontented, and it is plagued by strikes. It’s always fun to watch a prominent public figure say what he really thinks, and then when the reaction is much greater than he expected, issue an insincere groveling apology. This is what happened recently with Andy Street, the boss of John Lewis after he called France “hopeless” and “finished”. Naturally we would have much more respect for him if he refused to apologize. The problems with France are twofold and emanate first from an over-liberal and politically correct approach to everything, which is why France’s football team could be mistaken for the team from Cameroon or the Ivory Coast, combined with a widespread “entitlement mentality”, all of which is dragging the country down and down. The problems engendered as a result of all this are the reason for the rise of the far right party of Le Pen – many people have had enough. This is why the French CAC stockmarket index looks so weak compared to other European indices, and especially compared to Germany. On its long-term chart we can see a series of descending tops that demonstrates its relative weakness . If the important support in the 2400 – 2500 area fails a savage decline will ensue – and it looks likely that it will fail.

Perhaps symbolic of France’s decline is the attack a few days ago on a modern art exhibit in a square in Paris. Enlightened American artist Paul McCarthy’s sincere attempt to fast track a staid 18th Century Parisian square into the 21st century, with his innocent looking giant green inflatable creation called “Tree” met with considerable scorn and hostility from some of the locals, who apparently thought it looked like something else. He was actually slapped in the face in the street and his work was the “butt” of numerous jokes. It culminated with it being vandalized one night last week, and the reason for mentioning this here are that the “before” and “after” photos of this work are an apt metaphor for what we can expect to happen to the French economy soon.

You might conclude from the above that the writer, who is English, is anti- French, but this is not true at all. France is a very beautiful and unique country, with the best cuisine in the world – they are right to be scornful of English food, which used to be awful – Roast Beef and Yorkshire Pudding and Fish & Chips and that’s about your lot, and now that the North Sea has been fished out even the latter is becoming more of a luxury. Pub grub has got a lot better in recent years though.

We don’t normally look at Far-East markets, but in view of the fragile look of many markets, especially in Europe, it is worth glancing at what is going on in the Far-East to see if markets there look similarly vulnerable – they do.

While the Hong Kong certainly looks better than many, thus far at least, it appears to have just attempted to break out upside from a Symmetrical Triangle, and failed, which make it vulnerable to a breakdown and sudden precipitous decline.

Meanwhile, after a strong run triggered by Father Christmas Abe’s “We’ll beat you all at money printing” policies, the Japan Nikkei appears to be topping out at a major trendline target, and looks set to go into reverse and drop hard too.

Although the Chinese market (Shanghai) has recently performed well, it looks like the uptrend is faltering and like it will soon break down from the converging uptrend channel shown on its 6-month chart.

So, to sum up, the bounce back on Friday from oversold is not viewed as changing anything. While markets could chop sideways for a while or even rally a little more to unwind the oversold condition, the prospect is for the decline to resume with a vengeance before long.